Zoetis Inc. reported Q4 2025 adjusted diluted EPS of $1.48, beating consensus of $1.40, on revenue of $2.4B, up 3% YoY and topping estimates of $2.36B. Full-year revenue hit $9.5B, up 6% organically. Shares dipped ~2% pre-market to around $126, amid broader sector pressures despite the beat.

About Zoetis Inc.

Zoetis Inc. (NYSE: ZTS) is the world’s leading animal health company, focused on discovering, developing, manufacturing, and commercializing medicines, vaccines, diagnostics, and technologies for companion animals (like dogs and cats) and livestock. Headquartered in Parsippany, New Jersey, it was spun off from Pfizer in 2013 (with roots dating to 1952). Zoetis Inc. operates in more than 100 countries and generates nearly 50% of its revenue from markets outside the United States.

The company employs approximately 13,800 people worldwide, reflecting its broad global footprint across companion animal and livestock health segments. As of mid February 2026, the company holds a market capitalization of about $57 billion. The stock trades at a trailing P/E ratio of 21.7x and a forward multiple of approximately 21x. It offers an annual dividend of $2.12 per share, representing a yield of approximately 1.6%, supporting steady shareholder returns.

The company maintains a strong profitability profile, with gross margins near 72%. This margin strength is supported by leading product franchises such as Simparica Trio in parasiticides and a well established dermatology portfolio. Demand is driven by veterinarians, livestock producers, and pet owners, supported by rising global pet adoption rates and continued focus on food security and animal health management.

Top Financial Highlights

- Q4 2025 revenue totaled $2.4B, up 3% reported and 4% ex-FX/operational, driven by 3% pricing and 1% volume; international grew 8% ex-FX.

- Full-year 2025 revenue reached $9.5B, up 2% reported and 6% ex-FX/operational (4% pricing, 2% volume).

- Q4 adjusted net income was $648M, up 3% reported and 4% ex-FX/operational.

- Full-year adjusted net income hit $2.8B, up 6% reported and 7% ex-FX/operational.

- Q4 adjusted diluted EPS of $1.48, up from $1.40 YoY.

- Full-year adjusted diluted EPS of $6.41, up 10% ex-FX/operational from $5.92.

- Full-year adjusted gross margin expanded 120 bps to 71.9%, reflecting favorable mix and productivity.

- Companion Animal portfolio (full-year): 5% ex-FX growth; Simparica franchise $1.5B (+12% ex-FX), dermatology $1.7B (+6% ex-FX).

- Livestock portfolio (full-year): $2.8B revenue, 8% ex-FX growth (cattle/swine/poultry double-digits, aquaculture strong).

- Q4 segment breakdown: U.S. $1.2B (+4% ex-FX), International strong at 8% ex-FX; Livestock $522M (+9% ex-FX).

- 2026 guidance: Revenue $9.825B–$10.025B (3-6% ex-FX growth); adjusted net income $2.975B-$3.025B (3-6% ex-FX); adjusted diluted EPS $7.00-$7.10.

- Capital allocation: Returned $3.2B to shareholders in 2025 via buybacks/dividends; ongoing disciplined investments in innovation/ERP modernization.

- Cash position: Strong liquidity supports growth; operating cash flow not specified in summaries, but model generates robust FCF for returns.

Beat or Miss?

Performance vs Expectations

| Metric | Reported | Difference/Analysis |

| Q4 Revenue | $2.4B | Beat consensus $2.36B by +1.69%. |

| Q4 Adjusted EPS | $1.48 | Beat consensus $1.40 by +5.71%. |

| Full-Year Revenue | $9.5B | Beat consensus $9.45B by +0.5%. |

| Full-Year Adjusted EPS | $6.41 | Beat consensus $6.34 by +1.1%. |

What Leadership Is Saying?

“Advancing our innovative pipeline is central to our strategy, and we achieved key milestones in 2025. […] In response, we are taking targeted actions to offset these pressures by optimizing our channel mix, increasing reach and frequency with veterinarians, while reinforcing our scientific leadership through expanded medical education. But stepping back, these near-term dynamics are unfolding within a broader U.S. macro environment that we believe will gradually improve as we move through 2026.” – Kristin C. Peck, Chief Executive Officer

“Our disciplined execution and ongoing investments in innovation have strengthened our foundation for sustained growth, despite the dynamic operating environment and the ongoing macroeconomic and competitive pressures. […] Moving on to our Q4 results, we posted $2.4 billion in revenue in the quarter, growing 3% on a reported basis and 4% on an organic operational basis, with 3% driven by price and 1% from volume. Adjusted net income of $648 million grew 3% on a reported basis and 4% on an organic operational basis.” – Wetteny Joseph, Chief Financial Officer

Historical Performance

YoY Comparison – Zoetis (Q4 2025 vs Q4 2024)

| Category | Q4 2025 | Q4 2024 | Change (%) |

| Revenue | $2.4B | ~$2.33B | +3% rep., +4% ex-FX |

| Adjusted Net Income | $648M | ~$630M | +3% rep., +4% ex-FX |

| Adjusted Diluted EPS | $1.48 | $1.40 | 6% |

Competitor YoY Comparison

| Category | Company (Q4 2025) | Q4 2024 | Change (%) |

| Revenue | Zoetis $2.4B | $2.33B | +3% rep., +4% ex-FX |

| Revenue | Elanco ~$1.2B (est. Q4) | ~$1.18B | +2% (full-yr context; recent quarters ~flat to low-single)[note: approx. based on trends] |

| Revenue | IDEXX Labs ~$950M (est. Q4) | ~$905M | +5% (companion diagnostics growth)[note: approx.] |

Zoetis’s +4% ex-FX outpaced peers like Elanco (facing pricing headwinds) amid livestock recovery, while aligning with diagnostics leader IDEXX on companion momentum. Full-year, Zoetis’s 6% organic topped Elanco’s low-single digits.

Zoetis Revenue by Segment

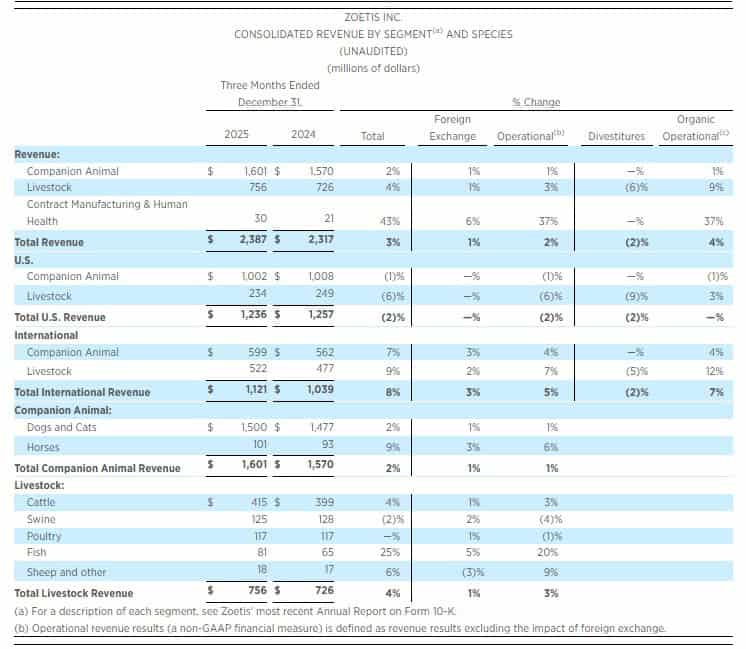

Three Months Ended December 31, 2025

- Total Revenue – Total revenue increased to $2,387 million from $2,317 million in 2024. This represents a 3% increase over last year. On an operational basis, revenue grew 2%, with organic growth of 4%.

- Companion Animal Segment – Companion Animal revenue reached $1,601 million compared to $1,570 million in 2024. This reflects a 2% increase. Dogs and cats products grew 2%, while horses revenue increased 9%.

- Livestock Segment – Livestock revenue increased to $756 million from $726 million last year. This represents a 4% total growth and 3% operational growth. Fish revenue grew strongly by 25%, cattle increased 4%, poultry remained flat, and swine declined 2%.

- Contract Manufacturing and Human Health – Revenue in this segment rose to $30 million from $21 million. This shows a strong 43% increase. Operational growth for this segment was 37%.

- U.S. Revenue – Total U.S. revenue declined 2% to $1,236 million. Companion Animal revenue in the U.S. decreased 1%, and Livestock revenue declined 6%. This indicates weaker performance in the domestic market during the quarter.

- International Revenue – International revenue increased 8% to $1,121 million. Companion Animal revenue grew 7%, and Livestock revenue increased 9%. Growth was supported by stronger demand outside the United States.

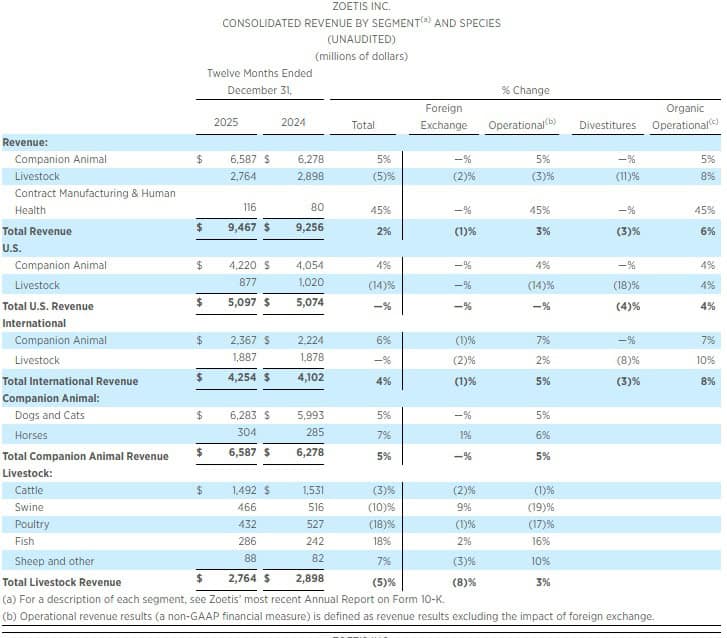

Full Year Ended December 31, 2025

- Total Revenue – Total full-year revenue reached $9,467 million compared to $9,256 million in 2024. This represents a 2% increase overall. Operational revenue grew 3%, and organic operational growth was 6%.

- Companion Animal Segment – Companion Animal revenue increased to $6,587 million from $6,278 million. This shows a 5% growth. Dog and cat products grew 5%, while horse products increased 7%.

- Livestock Segment – Livestock revenue declined to $2,764 million from $2,898 million. This represents a 5% decrease. Poultry declined 18%, swine declined 10%, and cattle declined 3%, while fish increased 18% and sheep and other categories grew 7%.

- U.S. Revenue – Total U.S. revenue remained stable at $5,097 million. Companion Animal revenue grew 4%, but Livestock revenue declined 14%. The decline in livestock offset the growth in companion animal products.

- International Revenue – International revenue increased 4% to $4,254 million. Companion Animal revenue grew 6%, while Livestock remained broadly stable overall. Fish growth helped balance declines in other livestock categories.

How the Market Reacted?

Zoetis shares initially dipped ~2% pre-market to $126.15 after the February 12 earnings release, despite EPS/revenue beats and upbeat 2026 guidance ($7.00–$7.10 adjusted EPS). The pullback reflected U.S. companion animal softness amid Gen Z/millennial price sensitivity and one-time international timing benefits not repeating in 2026.

By February 13, the stock recovered, trading around $130 (+~3.5% from intraday lows), buoyed by strong livestock/international growth and innovation pipeline (e.g., long-acting products). Overall sentiment leans bullish for 2026, as 6%+ organic growth guidance and 72% margins underscore resilience in a competitive macro environment.