Introduction

Wendy’s Statistics: The year 2025 marked a strategic turning point for Wendy’s, which operates as a fast-food chain serving square-shaped burgers. The company, which once received acclaim for its fresh, never-frozen beef and creative menu selections, now faces multiple challenges. The company encountered two major challenges, which included decreased sales from vital markets and increased competition from McDonald’s and Chick-fil-A, and the impact of rising inflation, which reduced consumer purchasing power.

Wendy’s company initiated major growth projects while maintaining their operational improvements to restore business expansion and create value for shareholders. The resulting year showed two opposing trends because global sales growth estimates remained low while same-store sales fell and stores closed, but new stores opened, and Wendy’s changed its financial goals as its long-term business plan progressed.

We examine Wendy’s statistics for 2025, which include revenue generation, restaurant count, and expansion activities and strategic business programs that operate under the current reported information.

Editor’s Choice

- Wendy’s total revenue declined to USD 5495 million in 2025, which represents a 3 decline from the previous year because the company optimized its product offerings without losing market demand.

- The systemwide revenues experienced a 23 decline, reaching 163 billion, while customers in the market environment faced difficulties.

- A rise in franchise royalty revenue to 1278 million, which demonstrated the strength of Wendy’s business model that generates high-profit recurring income streams.

- Operated sales reached 2332 million, which showed that customers maintained their regular shopping habits despite decreased store visitor numbers.

- In 2024, Wendy’s operated more than 7200 restaurants worldwide, which represented almost ten years of uninterrupted restaurant expansion.

- Franchised restaurants outnumber company-owned units by roughly 17:1, which enables the organization to grow its restaurant business through effective capital management.

- The financial records show net income at approximately USD 194 million for 2024.

- The operating profit reached approximately USD 371 million.

- The restaurant chain Wendy’s established 44 new dining locations worldwide during the second quarter of 2025, which included 23 locations that opened in 15 different nations.

- Established permanent contracts that will create 190 new international dining establishments, which include 170 locations that will open in Italy.

- Florida operates the most restaurants in the United States,s with 540 locations, while Texas follows with 408 dining establishments.

- Wendy’s employed 14500 workers during 2024, who created an efficient workforce through their work operations.

- Achieved free cash flow of approximately 1959 million dollars during 2025

- Wendy’s received an ACSI score of 76, which placed the company above McDonald’s yet below Chick-fil-A.

Wendy’s Revenue

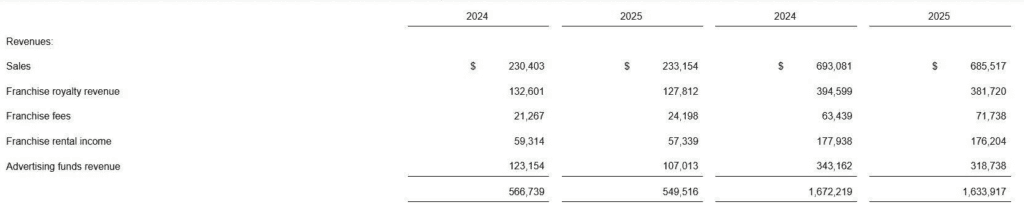

(Source: irwendys.com)

- Wendy’s statistics from irwendys.com show that its franchise-based system operates with strong protective elements that help maintain its operational stability.

- The business experienced a slight revenue drop in 2025 when its total revenues decreased to USD 549.5 million from USD 566.7 million in 2024 because the business executed successful portfolio management.

- The company-operated stores generated sales of USD 233.2 million, which demonstrated consistent performance in retail locations, while franchise royalties reached USD 127.8 million, which demonstrated the company’s ability to generate stable, high-profit revenues.

- The franchise fees increased to USD 24.2 million,n which demonstrated the company maintained its expansion operations despite the current economic conditions.

- The advertising funds generated revenue of USD 107.0 million,n which matched the company’s needs for its more focused marketing expenditures.

- The system-wide revenue showed a slight decrease,e which dropped from USD 1.67 billion to USD 1.63 billion, representing a decline of approximately 2.3 %.

- The financial data from Wendy’s demonstrates that the company earns stable income from its franchise business, which protects its revenue streams while enabling its profit margins to remain steady and its business operations to expand.

Wandy’s Net Income

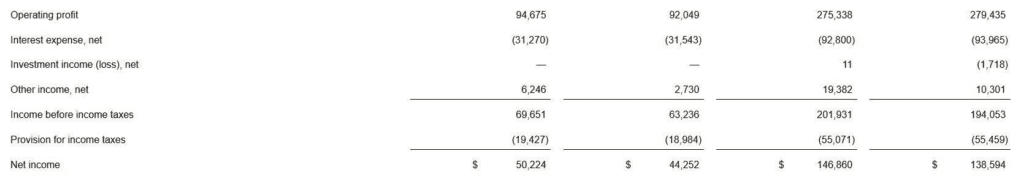

(Source: irwendys.com)

- According to the annual report, Wendy’s net income performance demonstrates that the company operates with a preference for maintaining profitability standards instead of pursuing unrestrained revenue growth.

- Wendy’s maintained its earnings protection while facing a slight revenue decline because its asset-light franchise system proved to be its most valuable resource.

- The company achieved stable net income results because of its high-margin royalty revenue streams, together with its controlled operating costs and its strategic capital management practices.

- Wendy’s statistics demonstrate that franchise royalties and fees create dependable cash streams that protect earnings from temporary declines in sales at company-operated locations.

- The company achieved operating margins between 15 and 20 % during the recent fiscal periods, which gave it a competitive advantage over most of its quick-service restaurant competitors.

- The company achieved stable profits through its implementation of cost efficiencies, menu price adjustments, and focused marketing expenses.

- Wendy’s sustained a strong earnings performance despite facing economic challenges from inflation and reduced customer traffic.

Distribution of Wendy’s In The United States by state

| State | Number of Coffee Shops |

| Florida | 540 |

| Texas | 408 |

| Ohio | 385 |

| Georgia | 301 |

| California | 297 |

(Source: xmap.ai)

- According to xmap.ai, the restaurant distribution across different regions shows important patterns of expansion that match Wendy’s restaurant location selection and customer distribution patterns.

- Florida leads decisively with 540 restaurants, strong quick-service consumption driven by tourism, urban density, and year-round foot traffic. This concentration leads to increased store performance and better brand recognition.

- Texas follows with 408 locations, where large metro areas and a diverse population create room for menu localization and digital engagement to lift average ticket size.

- Ohio (385) and Georgia (301) show established markets that experience steady growth through customer loyalty programs and better operational efficiencies instead of growing their business through new locations.

- California’s comparatively lower count, despite its massive population, shows white-space opportunities and a consumer base that prefers unique or high-end products.

- Wendy’s statistics show that intelligent state clustering leads to competitive market development, which generates sustainable profits, while the company expands into regions that need better market coverage.

Wendy’s Number of Employees

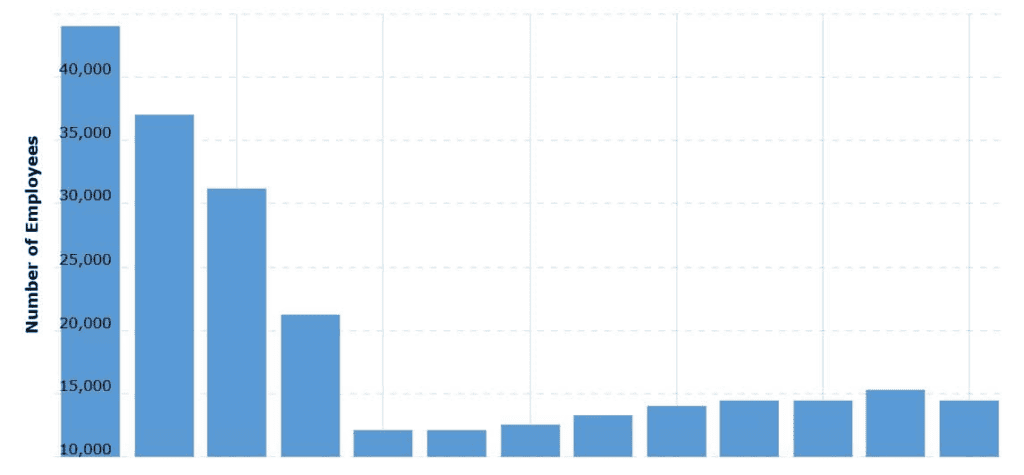

(Source: macrotrends.net)

- According to Micortreuds.net, Wendy’s long-term employee records show a planned transition to an operating system that focuses on asset-light operations through franchise partnerships.

- The company’s employee count reached its highest point of 44,000 workers during 2012 but dropped to 21,200 employees by 2015 after the company underwent major changes through refranchising its corporate-owned stores.

- The period after 2017 shows employee numbers that stay within the range of 12,100 to 15,300, which indicates that the company has achieved operational efficiency.

- Wendy’s employed 14,500 people in 202,4 which represents a 5% decrease from the previous year because the company maintained its cost control measures while increasing its productivity.

- The period from 2020 to the present shows that Wendy’s has established its ideal staffing level, which matches its revenue from royalty-based operations.

- Wendy’s presents evidence that its streamlined workforce generates better financial results through reduced operational expenses, which lead to more certain revenue streams.

- Wendy’s statistics show that refranchising has transformed the company into a business that can grow without needing extra capital while achieving better employee productivity.

Wendy’s International Expansion

- Wendy’s international momentum in 2025 reflects a clear pivot toward faster franchise-led global expansion.

- Wendy’s established 23 new restaurants in 15 different countries during the second quarter, which brought the worldwide restaurant count for that quarter to 44 new openings.

- The current execution pace demonstrates brand partner trust,t which has grown together with their operational abilities.

- The company generates steady cash flow through its strengthened presence in established markets like Canada, India, and the UK, while entering Romania represents its strategy for tapping into new market territories.

- The new development agreements for 170 restaurants in Italy over ten years and 20 in Armenia over five years add 190 committed future units, which create a multi-year growth runway. These agreements support predictable unit growth without heavy capital deployment.

- Overall, Wendy’s statistics point to a scalable international model driven by local partnerships, disciplined market selection, and strong brand transferability. Collectively, Wendy’s statistics reinforce a narrative of accelerating global reach with manageable execution risk.

Wendy’s Free Cash Flow

(Source: irwendys.com)

- Wendy’s free cash flow profile demonstrates effective financial management practice because the company experiences temporary cash flow variations.

- The company generated net cash from operating activities, which reached approximately USD 266.6 million in 2024 because of its strong earnings performance and effective working capital management.

- The free cash flow reached approximately USD 213.9 million after deducting capital expenses of USD 52.4 million and franchise development fund contributions and advertising fund impacts.

- Operating cash flow reached almost USD 275.3 million in 2025 because the company spent USD 64.0 million on capital projects and had higher franchise-related expenses, which caused free cash flow to decrease to about USD 195.9 million.

- Wendy’s data shows that its franchise-based business model generates cash,h which shareholders can access.

- Wendy’s data demonstrates that the company achieves both cash flow stability and dividend payments while maintaining debt obligations through its reinvestment strategy.

Wendy’s Brand Strength With Scale Constraints

- Wendy’s Brand Strength with Scale Constraints Wendy’s establishes a stable market position that already reaches its boundaries in the U.S. QSR market.

- In 2025, Wendy’s data showed that the brand achieved higher dining popularity than major competitors McDonald’s, Burger King, and Chick-fil-A while falling short of reaching the top 10 dining establishments across the country.

- Customer perception remains a relative strength because Wendy’s American Customer Satisfaction Index score of 76 out of 100 places the company ahead of McDonald’s but behind industry leader Chick-fil-A.

- The key point of distinction between the two parties resides in their operational scale.McDonald’s generated USD 25.9 billion in U.S. revenue in 2024, which exceeds Wendy’s revenue base and strengthens McDonald’s position in the market.

- Wendy’s reduced its sales forecast for 2025 because of declining customer visits and the existing economic conditions.

- The success of Wendy’s brand depends on its ability to control customer satisfaction while creating new menu items and maintaining affordable pricing.

Wendy’s Long-Term Performance

- Wendy’s success is best measured through its expanding global footprint rather than short-term earnings alone.

- The restaurant brand Wendy’s achieved worldwide expansion with more than 7200 active locations in 202,4 which represents almost 10 years of continuous growth.

- The company expands its business through a franchise model,l which enables its franchise locations to grow at a rate of 17 restaurants for every 1 company-owned restaurant.

- Wendy’s reported operating profit of USD 371 million and net income of USD 194 million for 2024, which represents a year-over-year decline because of macroeconomic pressure.

- The company has experienced earnings volatility throughout its history, which reached a peak of over USD 460 million in 2018 because of its one-time sale of Inspire Brands’ ownership.

- Wendy’s statistics demonstrate that the brand maintains consistent business operations through its strong franchising business model despite its need to improve earnings performance.

Wendy’s Long-Term Financial Targets

- Wendy’s financial framework for long-term operations supports its controlled business expansion, which includes established business development processes.

- The management of Wendy’s restaurants aims to achieve 3 to 4 % annual growth in net restaurant operations while maintaining 5 to 6 % growth in total system sales, which enables the company to expand its business operations without requiring excessive financial resources.

- The company maintains its focus on profitability because it expects adjusted EBITDA to increase between 7 and 8 % during each subsequent year,r which indicates better operational efficiency.

- Wendy’s plans to establish between 8100 and 8300 restaurants worldwide by 2028 while generating between 175 billion and 180 billion dollars in total system sales and achieving between 700 million and 850 million dollars in adjusted EBITDA, which demonstrates the financial advantages of its operational size.

- The company provides conservative 2025 financial guidance, which predicts 2 to 3% worldwide sales growth, between 0.98 and 1.02 dollars adjusted EPS, and between 100 million and 110 million dollars capital expenditures.

- Wendy’s statistics demonstrate that the company implements a balanced approach that combines predictable growth with margin improvements and controlled investment activities.

Conclusion

Wendy’s Statistics: The Wendy’s brand will experience more business transformation in 2025 through its operational adjustments than through business decline. The financial data shows a complex situation, which shows that revenue experiences slight declines while the business maintains stable profit margins and generates high free cash flow through its franchise system, which produces low risk and steady returns. Wendy’s statistics demonstrate that the business chooses to practice business discipline instead of pursuing fast results through its approach to optimizing restaurant locations, its strategy to invest cash, and its decision to expand into international markets where new opportunities exist.

Wendy’s customer relationship management system and its operational expenses create essential business challenges that prevent the company from expanding its customer base beyond its current market presence in the industry. The company’s system needs to manage its expansion through strategic resource allocation, which creates value for its stakeholders.

FAQ

The total revenue of Wendy’s for 2025 reached approximately 5495 million dollars.

Wendy’s operated over 7200 restaurants worldwide as of 2024.

Wendy’s employed about 14500 people in 2024.

The management team has established a growth target that requires 3 to 4% annual net unit expansion.

Wendy’s operates with mid-teen operating margins, which represent strong performance for the QSR industry.

The targets include 8100 to 8300 restaurants and systemwide sales between 17.5 billion and 18.0 billion dollars.