Introduction

Wealth Management and Robo Advisory Adoption Statistics: Wealth management is a financial program that helps people to invest wisely, build wealth over time, protect it, and pass it on to the next generation. In contrast, Robo-advisory is an online service that uses computer programs to recommend investments, build portfolios, and automatically rebalance them. In recent years, clients have come to expect prompt support, account updates, intuitive digital tools, and guidance that helps secure goals, reduce risk tolerance, and promote personal circumstances.

Thus, when robo-advisory is implemented in wealth management, it helps to measure risk, recommend suitable portfolios, and manage them with less manual effort. It also lowers costs, improves access, saves time, and limits emotional decisions. This article includes several current statistical analyses from different insights that will guide you in understanding the overall top effectively.

Editor’s Choice

- The global market size for Robo Advisory is projected to reach approximately USD 13.3 billion by 2025, up from USD 10.1 billion in 2024.

- According to Mordor Intelligence, in 2024, hybrid robo-advisory platforms held the largest market share at 60.7%.

- Fortune Business Insights stated that in 2024, more than 28% of Americans preferred robo-advisors for investing.

- Globally, robo-advisors are growing rapidly, with assets under management increasing from USD 186.9 billion in 2017 to USD 2,761 billion in 2023.

- Bankrate reports that robo-advisors typically charge 0.25% to 0.5% per year on managed assets.

- Betterment’s 2025 Retail Investor Survey also reports that 22% of investors use digital investing apps.

- In 2024, 20% of affluent investors use robo-advisors (higher than in 2023).

- A report published by ScienceDirect states that a major U.S. robo-adviser reduced the minimum from USD 5,000 to USD 500.

- Bank of America reported on January 10, 2025, that its Consumer Investments platform exceeded USD 500 billion in client assets.

- Independent fintech robo-advisors focus on scale and low entry barriers: Betterment reports AUM of USD 65 billion (as of 10/21/2025).

General Statistics On Wealth Management and Robo Advisory Adoption

- According to Fortune Business Insights, in 2024, more than 28% of Americans preferred robo-advisors for investing.

- This choice is most popular among millennials (41%), with Gen Z close behind (40%).

- The buy-and-hold remains the most common approach, used by 56% of Americans.

- At the same time, more Americans are exploring new investment options, such as fractional share investing (37%) and direct indexing (32%).

- They also show interest in socially responsible investing (31%), automated or robo-advisory investing (28%), and thematic investing (25%).

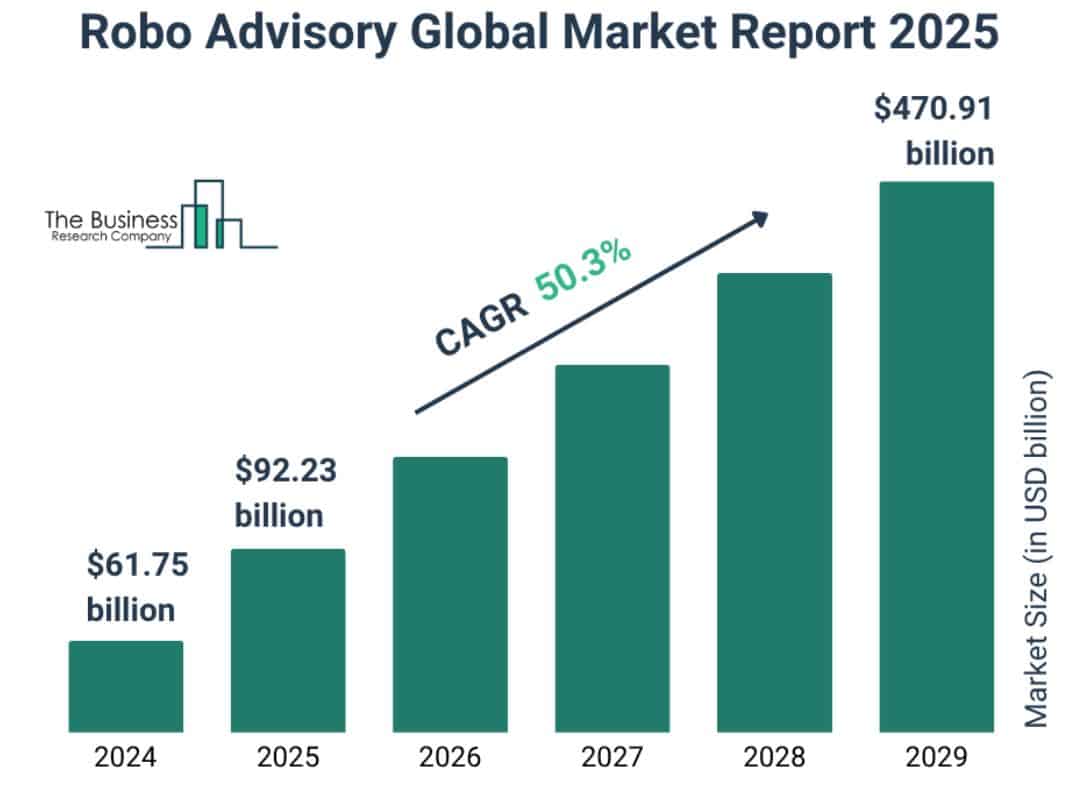

(Source: thebusinessresearchcompany.com)

- The Robo Advisory market size has reached USD 61.75 billion in 2024 and is projected to reach approximately USD 92.23 billion by 2025.

- Meanwhile, expected to grow up to USD 470.91 billion by 2029 at a compound annual growth rate (CAGR) of 50.3% from 2025 to 2029.

Comparison Analyses of Robo Advice Vs.Human Advisors

| Area | Digital advice (robo / hybrid) | Human advisors (traditional) |

| Scale | Global robo-advice is projected at USD 10.86 billion (2025). | Managed accounts total USD 13.7 trillion in Q1 2025, down 0.2%. |

| Fees & minimums | Typical robo-advisory management fees range from 0.20% to 0.30%. | Human advisors often charge 1% or more in fees on assets under management. |

| Digital experience | Virtual assistants appear in 60% of DIY apps and 54% of advised apps. | Complex requests still get escalated to a human agent/advisor. |

| Younger investors | Among under-40 investors, 42% are employed by fintech firms and 26% by banks. | Investors under 40 constitute only 11% of clients at traditional wealth firms. |

Robo Advisory Market Size

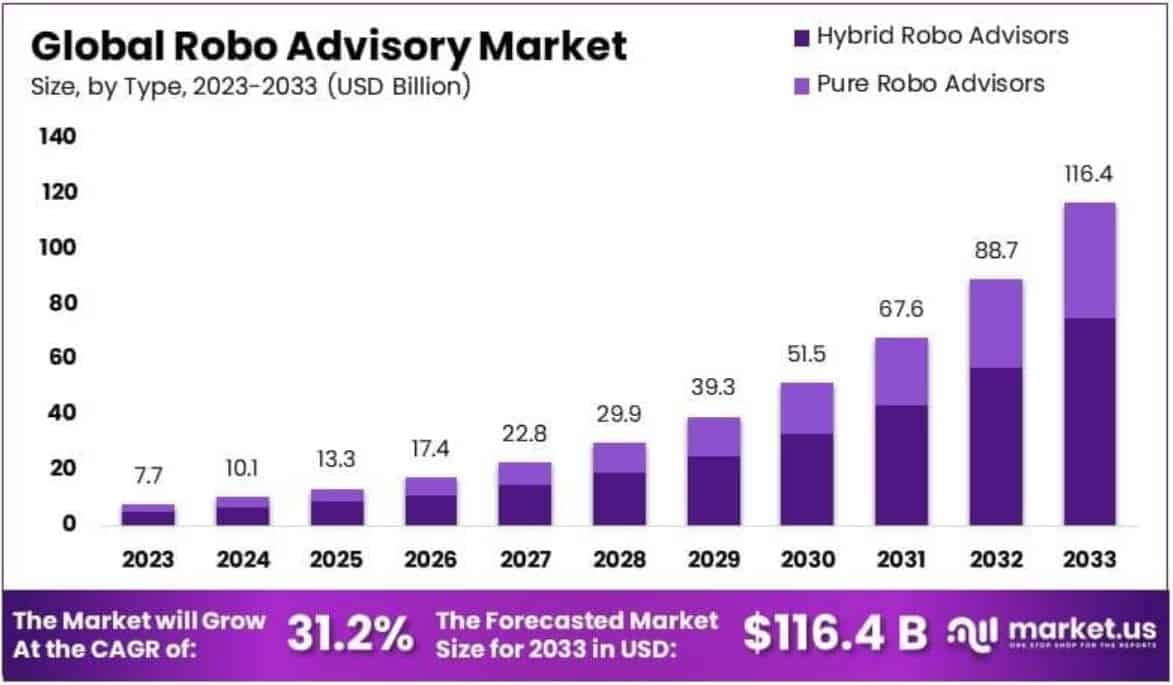

(Source: market.us)

- The global market size for Robo Advisory is projected to reach approximately USD 13.3 billion by 2025, up from USD 10.1 billion in 2024.

- The market is projected to grow at a CAGR of 31.2% from 2025 to 2033.

- In the coming year, the market size is estimated to reach USD 17.4 billion by 2026, USD 22.8 billion by 2027, USD 29.9 billion by 2028, USD 39.3 billion by 2029, USD 51.5 billion by 2030, USD 67.6 billion by 2031, USD 88.7 billion by 2032, and USD 116.4 billion by 2033.

- Robo-advisors appeal to smaller investors because fees can be as low as 0.25% per year, rather than 1-3%.

- In 2024, robo-investing averaged USD 69,174 in the U.S., USD 12,931 in Europe, and USD 7,552 in China.

Robo-Advisory Services Market Statistics By Segments

- According to Mordor Intelligence, in 2024, hybrid robo-advisory platforms held the largest market share at 60.7%.

- Meanwhile, pure-play models may grow at the fastest rate, with a 35.2% CAGR from 2025 to 2030.

| Segment | Market Share (2024) | Fastest Growth Rate (CAGR from 2025 to 2030) |

| Service type | Wealth-management functions: 38.7% | Tax-loss harvesting: 34.1% |

| Provider type | Fintech innovators: 52.3% | Banks & credit unions: 35.5% |

| End-user | High-net-worth clients: 55.3% | Retail segment: 34.2% |

| Geography | North America: 38.2% | Asia-Pacific: 33.8% |

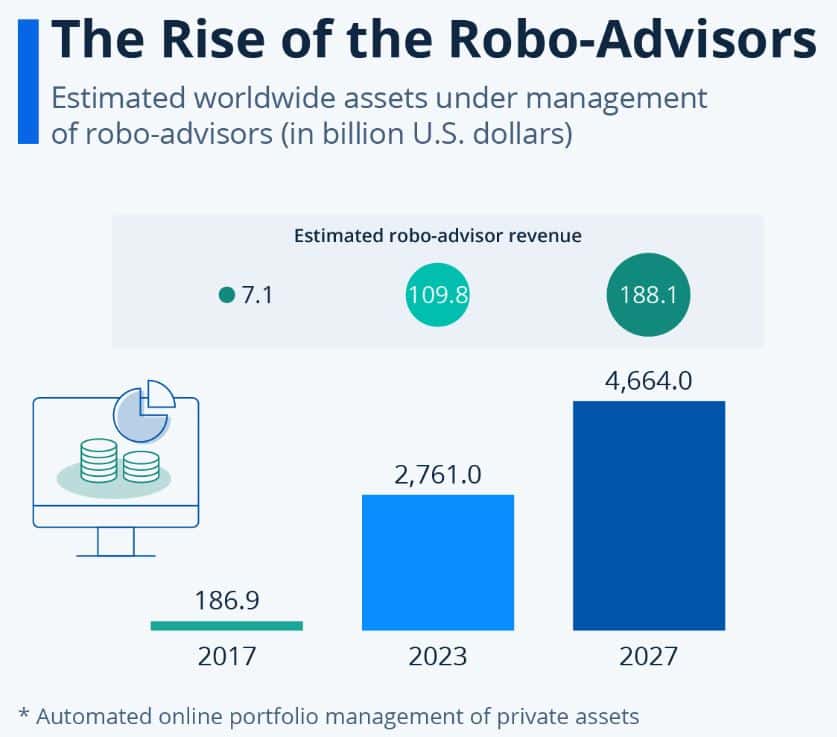

The Rise Of The Robo-Advisors

(Source: statcdn.com)

- Globally, robo-advisors are growing rapidly, with assets under management increasing from USD 186.9 billion in 2017 to USD 2,761 billion in 2023.

- Meanwhile, it is projected to reach 4,664.0 billion by 2027.

- The fortunebusinessinsights.com report further estimated that the global robo-advisory market will reach USD 10.86 billion by 2025 (up from USD 8.39 billion in 2024).

- ETFGI reported U.S. ETF assets reaching USD 13.08 trillion at the end of Oct 2025, with USD 1.14 trillion in year-to-date inflows (and USD 186.19 billion in October alone).

- mminst.org also claimed that managed account assets remained at USD 13.7 trillion.

- ICI also stated that money market fund assets were at USD 7.67 trillion for the six days ended Dec 23, 2025.

Robo-Advisor Cost Adoption Analyses

- Bankrate reports that robo-advisors typically charge 0.25% to 0.5% per year on managed assets.

- Meanwhile, around USD 10,000 is invested, and the investor pays approximately USD 25-50 in additional management fees annually.

- ETFs or mutual funds within the portfolio may also incur expense ratios, which are fund-level fees.

- Across the full portfolio, these expense ratios typically range from 0.05% to 0.25%.

- At those levels, every USD 10,000 invested generally incurs annual fund expenses of USD 5-25, in addition to the wealth management fee.

Users of Robo-Advisors Statistics

- An SEC filing by Wealthfront reports that, as of July 31, 2025, it had more than 1.3 million funded clients.

- Meanwhile, the average annual earnings amounted to USD 165,000.

- About 77% were born after 1980, and the average client age was roughly 38, with Gen Z accounting for a growing share.

- Betterment’s 2025 Retail Investor Survey also reports that 22% of investors use digital investing apps.

- Moreover, these users reported greater confidence in retirement planning (73% vs. 50%).

- According to Investopedia, only 20% of households earning less than USD 48,000 use a financial advisor, compared with 54% of households earning more than USD 90,000.

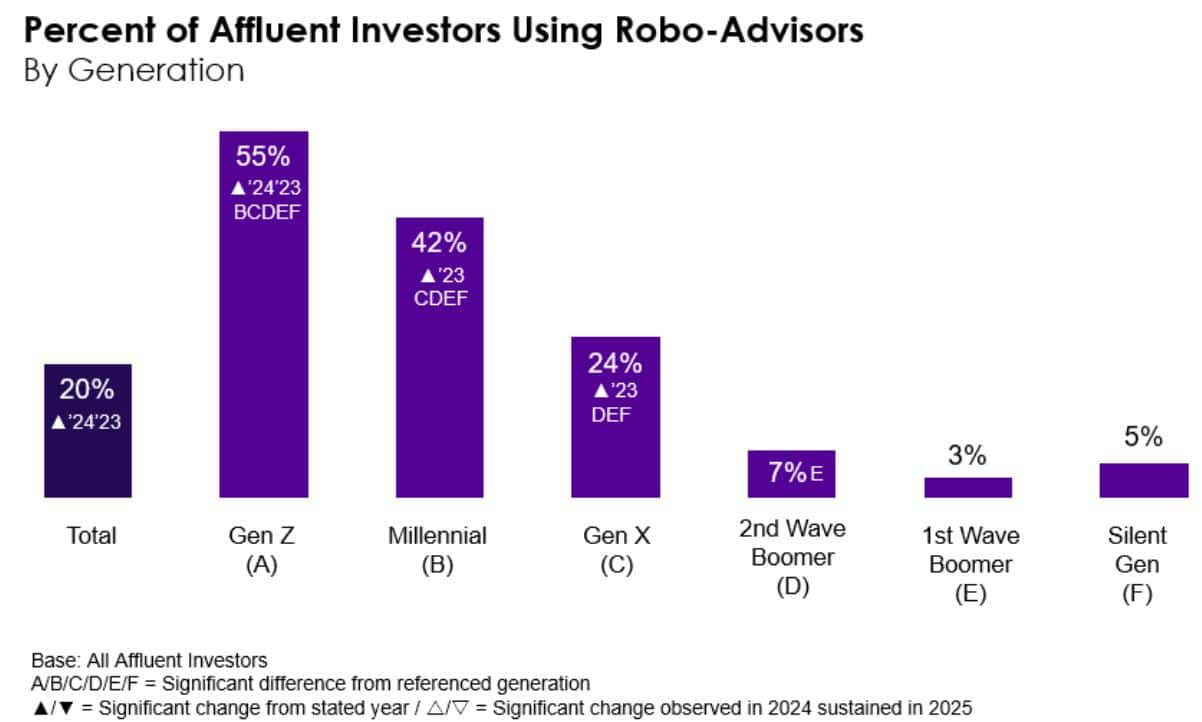

Investors Using Robo-Advisors Statistics By Generation

(Source: escalent.co)

- In 2024, 20% of affluent investors use robo-advisors (higher than in 2023).

- Gen Z shows the highest usage at 55% (also higher than in 2023), followed by Millennials at 42% (also higher than in 2023) and Gen X at 24% (also higher than in 2023).

- Adoption is much lower among older groups: 2nd Wave Boomers are at 7%, 1st Wave Boomers at 3%, and the Silent Generation at 5%.

How Lower Minimums Changed Robo-Advisor Use and Benefits

- A report published by ScienceDirect states that a major U.S. robo-adviser reduced the minimum from USD 5,000 to USD 500.

- After this drop, users became less wealthy overall, with no pre-trend before the change.

- Middle-class users (2nd and 3rd wealth quintiles) increased by 107% (16 pps), indicating a sharp increase in their counts.

- Meanwhile, the upper class (top 2 quintiles) showed no similar change, and the bottom quintile still did not increase participation.

- A DiD test finds that the middle class became 14 percentage points more likely to join after the cut than the upper class.

- Middle-class users (2nd and 3rd wealth quintiles) increased by 107% (16 pps).

- The model predicts an overall welfare gain of 0.8%.

- People aged 55+ gain more (1.7%) than those under 35 (0.6%).

Robo-Advisors In Banks Vs. Independent Fintech Platforms

- Bank of America reported on January 10, 2025, that its Consumer Investments platform exceeded USD 500 billion in client assets and had nearly 4 million client accounts across Merrill Edge Self-Directed and Merrill Guided Investing.

- Merrill Guided Investing charges a 0.45% annual program fee (or 0.85% with Advisor) and requires USD 1,000 (growth) or USD 50,000 (income).

- Wells Fargo further stated that Intuitive Investor has a minimum investment of USD 500 and charges an annual advisory fee of approximately 0.35%.

- Independent fintech robo-advisors focus on scale, and low entry barriers in Betterment reports AUM of USD 65 billion (as of 10/21/2025) and over 1 million customers (as of 8/19/2025).

- Wealthfront reported 1.3 million funded clients and about USD 88 billion in assets in 2025 disclosures.

- Robinhood Strategies surpassed USD 1 billion in AUM in just over 6 months, with over 180,000 funded accounts, charging a 0.25% annual fee and a USD 50 minimum.

Conclusion

After completing the article on Wealth Management and Robo Advisory Adoption Statistics, it is evident that Robo-advisory adoption is reshaping the wealth management platform by enabling faster, easier investments at lower costs. Robo-advisory service support in constructing portfolios, rebalancing, and goal tracking, thereby allowing firms to serve more clients efficiently.

However, trust in algorithms, data privacy concerns, and the need for personal guidance continue to affect the adoption of robo-advisory services. Moreover, they are not replacing traditional wealth managers; rather, they are improving how advice is delivered and helping the industry by meeting the expectations of modern clients.