Introduction

VK Statistics: The current social media landscape is undergoing rapid transformation, with VK remaining the most important platform for Russian-speaking internet users. VK operates as the parent company of VKontakte, which provides multiple online platforms and digital products to users. VK has served as a digital identity platform for Russian users since its launch, which established the service as the main tool for experts studying online user behavior and tracking the development of digital marketing methods and multimedia content trends.

VK enters its most critical period in 2025. The company experiences significant financial losses while facing intense competition from international platforms such as Instagram and Telegram.

The article analyzes important metrics that determine VK statistics in 2025 through user interaction metrics, revenue data, advertising metrics, platform usage metrics, and business unit performance data that is current.

Editor’s Choice

- VK’s total revenue reached RUB 1113 billion during 9M 2025, representing a 10% year-over-year increase, attributable to improved revenue generation from existing operations.

- Adjusted EBITDA rose to RUB 155 billion, and the profit margin increased by 14 percentage points to 14% due to effective business operations.

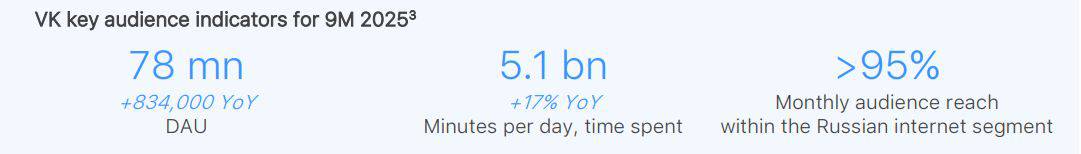

- VK users spent an average of 5.1 billion minutes per day on the platform, a 17% increase from the previous year, indicating strong user commitment to VK activities.

- VK achieved an exceptional 97% monthly reach of Russia’s internet audience in 9M 2025.

- The platform established itself as the dominant market player, with 78 million daily active users, an increase of 834,000 during the period.

- The Social Platforms and Media Content segment generated RUB 77 billion, up 6% YoY, while EBITDA jumped 4× to RUB 15.6 billion.

- VKontakte had 918 million monthly users in Q3 2025, representing 89% of all internet users in Russia.

- VK Video recorded a 19% year-over-year increase, bringing its daily average views to 3.2 billion, while total watch time increased 3.2-fold compared to the previous year.

- The daily viewing numbers for VK Video on Smart TVs increased 4-fold compared with the previous year, indicating that people now use Smart TVs more frequently to watch videos.

- VK Clips generated 2.7 billion daily views, and the creator base grew by 89% compared with the previous year.

- VK Music reached 46.5 million monthly users worldwide, and its subscriber base grew by 13% compared with the previous year.

- VK Dating experienced an 8% annual increase in audience size, whereas revenue growth was 42%, indicating greater revenue generation.

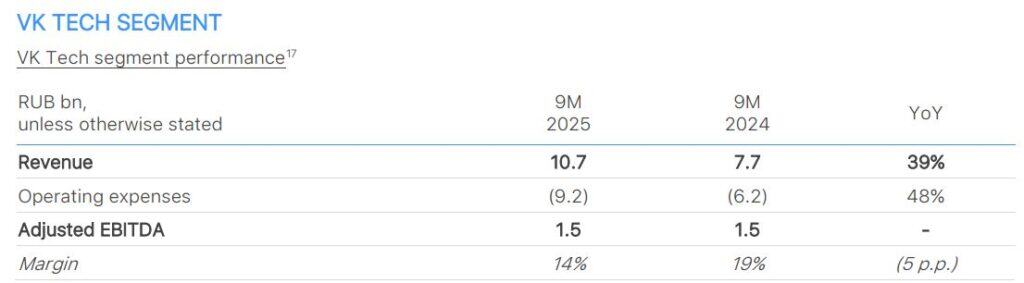

- VK Tech reported a 39% increase in revenue, bringing total earnings to RUB 10.7 billion, while the EBITDA margin reached 14%.

- VK Tech generated more than 75% of its total revenue from recurring sources, thereby improving the accuracy of its cash flow forecasts.

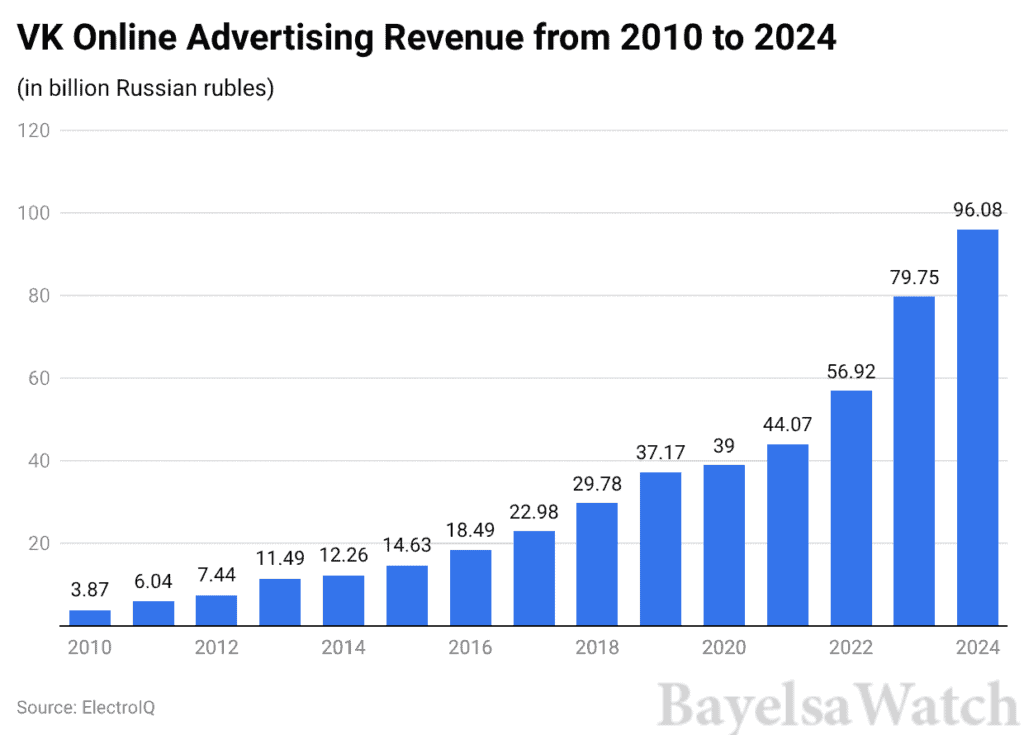

- VK’s online advertising revenue reached RUB 96.1 billion in 2024, representing approximately 20% growth over the previous year.

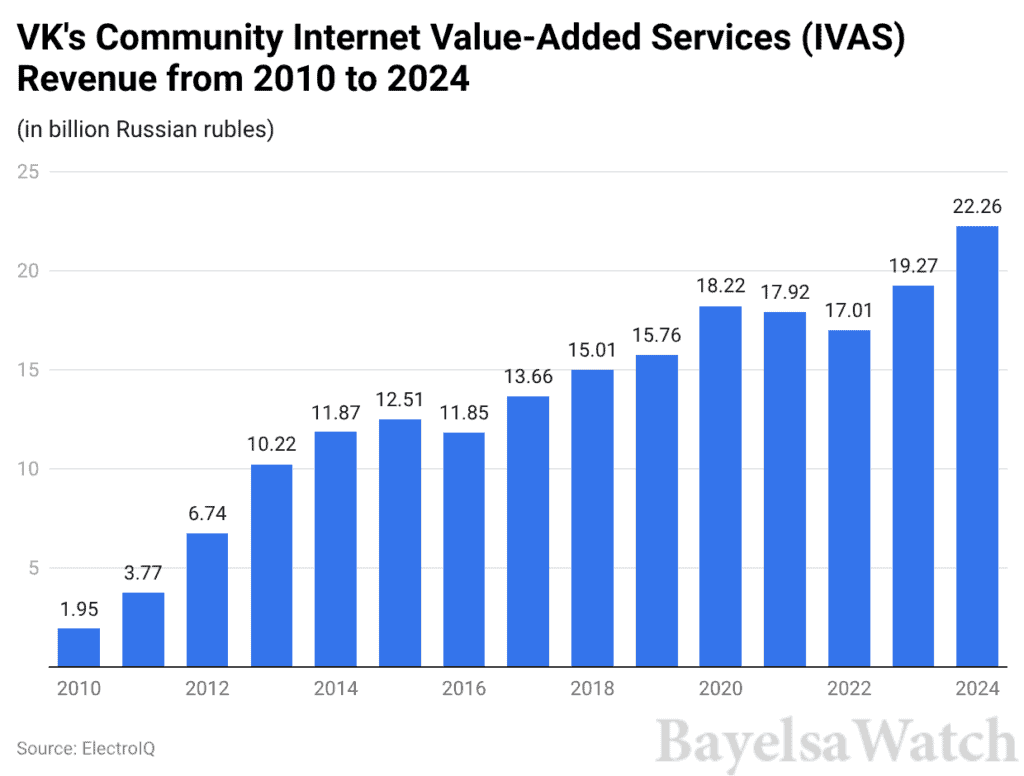

- IVAS revenue increased to RUB 22.3 billion, up 15.5% from the previous year.

VK Financial Performance

(Source: vkcdn.ru)

- The company reported revenue of RUB 111.3 billion, a 10% increase from the previous year, reflecting strong customer interest in VK’s full digital product range.

- The company achieved revenue growth through better monetization methods, which produced results that showed the technology platform was developing into a mature state.

- The company’s adjusted EBITDA increased by RUB 15.3 billion to RUB 15.5 billion compared with the previous year, attributable to improved operational efficiency.

- The company achieved a 14% EBITDA margin, a 14 percentage point increase from the previous year, driven by successful expense management and rising sales of higher-profit items.

- The company achieved margin expansion, which indicates that its operations have shifted from pursuing immediate growth to generating long-term value.

- The combination of rising EBITDA and double-digit revenue growth indicates that the platform has optimized its operations and improved its advertising revenue and subscription business performance.

- VK’s financial statistics indicate that the company is in a stronger financial position, as its profitability growth now exceeds revenue growth, which will enhance investor confidence over time.

VK Audienuce

(Source: vkcdn.ru)

- VK’s audience results for 9M 2025 indicate that the platform operates as the most established digital ecosystem in the Russian internet market.

- VK services users spent an average of 5.1 billion minutes per day on the platform, which shows a 17% increase from the previous year.

- The engagement level indicates two things about users who are at their highest level of platform activity. User behavior data further strengthens this view.

- Users of VK spend their time on two VK products daily and at least one hour in the VK ecosystem.

- Users who engage with multiple products are more likely to remain with the service and generate revenue.

- The use of multiple services by users reduces the time they spend on any particular VK service, thereby increasing network effects across the platform.

- VK reached an average of 97% of Russian internet users during 9M 202,5, making it a nearly universal platform.

- The number of daily active users increased by 834,000, bringing the total to 78 million.

- The VK statistics indicate that the platform provides unmatched audience access, while users demonstrate increasing operational involvement, which creates a strong basis for future revenue growth.

VK Technology Growth

- The recent technology upgrades by VK show that the company intends to create an AI-driven digital ecosystem through complete system integration.

- The company uses advanced personalization technology as its main operational framework.

- VK developed a multimodal content model that decomposes content into semantic components, enabling its system to track video, text, and audio.

- The system enables precise search capabilities, task completion, and analysis functionalities which enhance user content discovery and relevant content presentation.

- VK launched a multimodal language model that enables users to convert multimedia content into formats that are accessible to large language models.

- The platform uses this system to anticipate users’ responses while constructing in-depth profiles of users.

- The second wave of artificial intelligence development is equally important as the first. Developers can now access VK’s Diona language model system, which was trained on 1.2 billion data points.

- The model enhances internal operations and develops new applications of generative artificial intelligence.

- The organization has started using artificial intelligence technology, which produces actual business results because AI systems handle 66% of customer support requests. The RuStore system uses AI technology to perform review analysis.

- 20% of Mail users who rely on AI tools use AI features to assist their work. The VK data indicate that actual efficiency improvements have been achieved through improved operational execution.

- The development of advertising technology provides extra support for companies to enhance their revenue streams.

- AI systems, which handle ad targeting and creative content creation, led to a 35% increase in click-through rates for text banners and a 55% increase in click-through rates for website ads, both used by small and medium-sized enterprises.

- The system now enables ad delivery to take less than 90 seconds from data collection to campaign activation. This improvement yields better campaign outcomes and higher return on investment for advertisers.

- The company established its VK SIEM system as a central security solutioninn which processes 65% more events than before.

- The VK Security Gate system now tracks more than 40000 software repositories and 1 billion lines of code, which demonstrates its ability to protect enterprise systems.

- The VK statistics indicate that the platform allocates considerable resources to developing scalable intelligence systems, optimising business operations, and establishing secure foundations for future expansion.

VK’s National Messenger Max

- VK’s national messenger MAX achieves platform sovereignty through its ecosystem expansion.

- MAX has reached 55 million registered users since its launch, with over 22.1 million users per day.

- Users of the system demonstrate strong commitment, having completed more than 1 billion calls, sent 4.4 billion messages, and created over 43 million circle video messages.

- MAX ranks among the most popular communication platforms in the region according to VK’s overall user statistics.

- Digital ID demonstrates full development through its partnership with Gosuslugi, which is creating a new digital identity system for MAX.

- MAX serves as a digital identity solution by verifying age and student status and confirming large-family membership.

- The system demonstrates practical value because it operates across 5,000 retail locations, including Magnit, X5, and VkusVill.

- The system uses the Gosklyuch electronic signature service to provide digital signature capabilities, enabling MAX to handle official digital contracts for verification and compliance.

- MAX Partner Platform enables businesses to achieve commercial growth by providing comprehensive solutions for product sales, payment acceptance, booking management, and customer service via a messenger platform.

- MAX functions as a super-app, as its recent platform expansion supports this point, according to new VK user statistics.

- MAX extends its network effects beyond Russia by delivering calls and messages to users across nine countries of the Commonwealth of Independent States.

- More than 16000 verified A+ creators participated in open testing for MAX channels, which increased content engagement through creator tools. MAX launched its Safety Center to demonstrate VK’s dedication to user moderation and trust development.

VK Operations By Segment

(Source: vkcdn.ru)

- The 9M 2025 segment results show that VK has successfully established new growth pathways while boosting its profit margins.

- The Social Platforms and Media Content segment generated RUB 77 billion in revenue, up 6% from the previous year, and reported adjusted EBITDA of RUB 15.6 billion, up 4x.

- The company achieved higher profit margins by implementing more effective revenue-generation and operational strategies.

- VKontakte reported 10% annual revenue growth as its users consumed more video, music, and social-discovery content.

- Video and short-form content showed a strong increase in audience engagement, which led to business growth.

- VK Video viewing time increased three times from the previous year by the end of Q3 2025, while VK Clips daily views increased 51% during the first nine months of 2025.

- VK Dating gained 31% more users per month, while VK Music achieved 13% annual subscriber growth, which strengthened the ecosystem’s ability to retain users.

- VK Video has maintained the top position in Russia since July 2025, owing to its highest monthly audience, a key indicator of VK’s market dominance.

- The EdTech segment generated RUB 5.4 billion in revenue, which increased 20% from the previous year, while its adjusted EBITDA reached RUB 0.5 billion due to rising demand for children’s education and new online learning options.

- The VK Tech segment reported revenue of RUB 10.7 billion, up 39% from the previous year, and adjusted EBITDA of RUB 1.5 billion.

- Business applications recorded annual growth of 95%, while VKWorkspace experienced a 63% revenue increase, attributable to a major platform upgrade in October 2025.

- The VK statistics indicate that the company is shifting away from reliance on advertising and developing its business through more profitable revenue streams, which will enable it to achieve its 2025 adjusted EBITDA target of RUB 20 billion.

VK Social Media Segmented Performance

(Source: vkcdn.ru)

- The Social Platforms and Media Content segment reported its strongest results for the nine months ended September 2025.

- Revenue increased 6% YoY to RUB 77 billion, but the real story lies below the top line.

- The company achieved a fourfold increase in adjusted EBITDA because its operating expenses decreased by 11% YoY to RUB 61.4 billion.

- The EBITDA margin increased by 15 % points, from 5% to 20%, indicating VK’s operational efficiency and cost management, according to its recent performance data.

- VKontakte had an average monthly audience of 91.8 million users in Q3 2025, representing a 4% year-on-year increase of 3.7 million users.

- VKontakte remains one of the most widely used digital platforms in Russia, with 89% monthly reach and 55% daily reach among the country’s internet users.

- The high levels of user engagement create strong support for advertising and commerce activities and creator monetization, which represent the main areas of VK statistics in 2025.

- The launch of VKontakte Shops represented a strategic move that enabled the company to enter the social commerce market.

- VK created a direct transaction process that enables users to purchase products via social media content, using product cards and purchase links in posts and videos.

- The monetization results from the two-month testing period showed strong performance because creators earned more than RUB 500 million through the referral program, which started with Ozon as its initial partner.

- The data demonstrate that businesses can create substantial revenue opportunities by combining their content and creators with commercial activities to reach large audiences.

VK Content Services

(Source: vkcdn.ru)

- The performance of VK during Q3 2025 demonstrates that its content-based platforms create an effective engagement system that benefits from its scale, product enhancements, and various customer revenue streams.

- VK Video emerged as a standout growth engine, with average daily views rising 19% YoY to 3.2 billion, and a record peak of 3.5 billion daily views.

- The total watch time increased 3.2× YoY, indicating deeper consumption rather than passive traffic.

- Smart TV usage surged, with daily views via Smart TV apps growing fourfold, while VK Video app installations surpassed 91 million by the end of Q3 2025—key VK statistics pointing to living-room adoption and long-session viewing behavior.

- The new seasons of the flagship show, together with exclusive digital rights to all VTB United League basketball matches for the 2025–2026 season, which VTB United League secured, expanded VK Video’s professional content inventory.

- The introduction of VK Donut support tools created extra monetization options for creators, which now provide shared monetization benefits to all platform users.

- VK Clips maintained average daily views of 2.7 billion, which represented a 9% YoY increase, while content supply expanded rapidly: published clips increased 2.2× YoY, time spent grew 31%, and the number of creators jumped 89%.

- The VK statistics show that creators actively participate in the economy, which shows growth as content consumption increases.

- VK Music reached a global monthly audience of 46.5 million users, with access to its music service worldwide.

- Russian users comprised 42.8 million of this total audience. The company experienced a 13% annual growth rate in its subscriber base.

- Product enhancements played a major role: a new children’s section expanded family usage, while improved recommendations drove a 105% YoY increase in listening time for VK Mix tracks.

- The introduction of multi-settings and genre-based discovery features for personalization upgrades resulted in increased user engagement.

- VK Dating achieved successful monetization through its business operations. Its average monthly global audience grew 8% YoY to 4.1 million users, yet revenue surged 42%, reflecting improved conversion mechanics.

- The new features enabled users to view incoming superlikes without a Premium membership and reduced friction for making paid interactions through bundled offers, which they could access via VKontakte.

VK Tech Segment Performance

(Source: vkcdn.ru)

- The financial results for VK Tech for the first three quarters of 2025 indicate that the company has transitioned from a period of high growth to profitable operations.

- The segment achieved 39% annual revenue growth, resulting in RUB 10.7 billion in revenue, which outpaced the growth rates of most regional enterprise IT competitors despite a period of corporate spending restraint.

- The company reported an adjusted EBITDA of RUB 1.5 billion, yielding a 14% margin, indicating that operating efficiency improved as the company gained more clients.

- The most surprising change in VK statistics indicates how many new customers the company has acquired.

- VK Tech experienced a fourfold increase in clients during the year, bringing its total to 26,800 clients from various business sectors, including large enterprises, SMEs, and fast-growing digital companies operating in telecom, retail finance, and oil and gas.

- The company experienced year-over-year revenue growth that was more than twice its previous total, driven by a multiple-fold expansion of the On-Cloud client base and by additional revenue from On-Premise technical support services.

- The total recurrent revenue base reached 75% of total revenue after we removed seasonal effects from On-Premise revenue, representing a significant achievement that improves cash flow stability and company value security.

- The high proportion of recurring revenue at VK Tech enables the company to adhere to global software-as-a-service standards, as reflected in its overall VK performance metrics.

- VK Tech released the updated VK WorkSpace super-app in October 2025, which added offline capabilities, enhanced security features, and a global email delivery system.

- The platform operates across all subscription plans and supports organisations of various sizes, thereby simplifying customer adoption while increasing the potential for cross-selling.

- The development of proprietary products, including the SIEM system and VK Security Gate, enables VK Tech to meet the increasing demand for domestic cybersecurity solutions by integrating them into VK Cloud.

User Demographics

- VK’s current user base indicates that women account for 54.7% of users, while men account for 45.3%.

- The platform’s core strength lies in the 25–34 age group, which alone accounts for 25.7% of total traffic, underscoring VK’s relevance among young working professionals.

- The platform maintains a youthful user base, with only 5% of users older than 55.

- Students are an essential driver of VK’s growth: 5 million students in Russia use VK daily, accounting for 12.8% of monthly user traffic.

- Urban dominance is striking, with 88% of users living in cities.

- Russia accounts for 82.4% of the user base, while Ukraine and Belarus account for nearly 8%.

- The VK statistics confirm VK’s role as a regionally concentrated yet commercially attractive digital platform.

VK Advertising Revenue

(Reference: statista.com)

- VK’s online advertising performance in 2024 demonstrates strong revenue growth attributable to effective monetisation efforts, despite market fluctuations in the digital advertising sector.

- The company generated RUB 96.1 billion in online advertising revenue, which shows a 20% increase from the previous year, and this growth rate exceeds the overall market expansion of Russia’s internet economy.

- The increase reflects improved ad inventory management, increased user interaction on VK’s social and video services, and higher domestic advertising demand.

- Advertising serves as VK’s primary revenue source, enabling the company to translate business growth into financial success.

- The VK statistics demonstrate two things: the company achieves sustainable growth, and its ability to charge higher prices for its services has grown.

VK Platform Usage

- According to Thrive My Way, VK distinguishes itself from standard social networks through its extensive digital ecosystem, which serves as its primary competitive advantage.

- The VK statistics indicate that 66% of its members use multiple VK digital products, confirming that VK functions as a comprehensive digital platform rather than a dedicated social network.

- Approximately 70% of businesses use VK for branding through public pages and targeted advertising. VK Ads provides businesses with direct access to Russian and Eastern European audiences, which is particularly valuable because Facebook advertising is not available on the platform.

- The commercial power of VK directly affects revenue generation, as the platform accounts for 15% of Russia’s B2C online sales.

- Users are also relatively ad-tolerant: about 54% are willing to accept advertising in exchange for free content, supporting long-term monetization stability.

- The organization of VK provides both information services and educational resources to people who need access to knowledge.

- Russian users prefer VK as their primary news platform, making it the third most popular channel for online school advertising that aligns with digital learning patterns.

- The platform uses messaging services, including VK Messenger, which ranks third in the country for calling and messaging, behind WhatsApp and Viber, as its primary communication feature.

- Russian people exhibit a 46% engagement rate, driven by daily sharing of more than one billion likes to discuss movies and TV shows.

- The content development team should use Monday as its primary content publishing day because it serves as the most active day for users.

- VK has 11.2 million users who rely on it as their sole social media platform, indicating strong platform loyalty, according to VK’s user statistics.

- VK maintains its position as a relevant social media platform, with widespread yet dedicated use worldwide.

- The social network, which has been blocked in Ukraine, remains the seventh most popular platform there, whereas it was previously the ninth most popular in South America.

- The platform provides access to 85 languages, whichincludes rare Russian dialects and historical Russian language forms, to enhance its user accessibility.

- VK has established itself as Russia’s leading digital platform through its vast content library and commercial activities, as evidenced by its user statistics, although its UK usage remains under 0.1%.

VK Community Internet Value-Added Services (IVAS) Revenue

(Reference: statista.com)

- VK’s internet value-added services (IVAS) business experienced sustained, high-quality growth throughout the 2024 fiscal year.

- The segment generated RUB 22.3 billion in revenue, representing a 15.5% increase over the previous year.

- The user base of Community IVAS, which offers messaging and social features, has grown, driven by deeper ecosystem integration and sustained product usage.

- IVAS generates consistent revenue for VK, which helps to stabilize their income during periods when advertising revenue experiences fluctuations.

- VK demonstrates its ability to generate revenue through non-advertising methods, enabling the company to achieve sustained business growth across its operations.

VK Ecosystem Services Drive Diversified Growth

- The VK Ecosystem services and other business lines segment established itself as a vital strategic growth force during the first nine months of 2025.

- The segment generated revenue that increased by 21% from the previous year to RUB 20.4 billion, driven by broader adoption of its services beyond advertising and social media.

- The segment reached its financial turning point when adjusted EBITDA became positive at RUB 0.5 billion,n indicating a significant operational improvement following prior losses during the 2024 fiscal year.

- The domestic distribution of apps through RuStore experienced a 3.9-fold revenue increase, which indicates growing user adoption of the platform during its localization development.

- The monthly audience of RuStore increased by 1.5-fold over the year to 65.5 million users, who accessed more than 85000 apps and games. The strategic initiatives that support regional developers and mobile game accelerators create a foundation for sustainable supply-side growth.

- VK Play had 58.6 million registered accounts in the gaming industry, while maintaining an average of 12.8 million global users per month, indicating the depth of VK’s consumer ecosystem.

VK Corporate Developments

- The key corporate changes VK made during Q3 2025 create a path for the company to achieve capital-market readiness while establishing structural resilience. VK Tech completed its transition to a public joint-stock company in July 2025.

- The company also registered a securities prospectus, an important IPO preparatory step that will proceed contingent on market conditions and internal approvals.

- The organization executes this plan to enhance project transparency while maintaining funding flexibility, which aligns withVK’s goals for segment growth and EBITDA growth.

- VK executed active balance sheet optimization by redeeming ZO25 Russian bonds worth USD 29.2 million in October 2025, which replaced old Eurobond debt and decreased its need for foreign currency debt.

- The Annual General Meeting held via absentee voting further underscores governance continuity and shareholder engagement.

- The actions of the organization establish financial discipline while protecting against risks and providing strategic options, which become more apparent through recent VK performance indicators.

VK Challenges and Competitive Dynamics

- VK continues to experience strong user and revenue growth, yet faces several significant market and operational challenges.

- The company’s excessive financial investments in original content production, creator monetization initiatives, platform enhancements, and infrastructure development resulted in expanded financial losses during 2024, which drove total profitability further into negative territory despite reaching record revenue achievements.

- VK currently faces heightened competition from various platforms, including Telegram and Instagram, and international short-form video services.

- The competitors have been especially successful in capturing younger audiences, raising concerns about VK’s ability to maintain its appeal and cultural significance among Gen Z and emerging digital-first audiences.

- The organization encounters additional challenges through its existing regulatory framework and privacy-related operational requirements.

- Government-led initiatives focused on domestic messaging platforms and digital sovereignty—such as the expansion of services like MAX—have created a more constrained operating environment.

- The initiatives may enhance local ecosystem control, yet they create user data privacy and platform independence concerns, which make it harder for VK to establish its strategic direction in a digital environment that prioritizes privacy protection.

Conclusion

VK Statistics: VK’s 2025 results demonstrate its transformation from expansion through greater size into the creation of lasting business value. VK possesses a strong competitive advantage because its core business operations generate high customer engagement and achieve near-complete market coverage in Russia, while its ongoing AI technology development sustains this advantage. The financial indicators of rising EBITDA margin, along with increasing revenue streams and multiple revenue sources, indicate improving earnings quality, as assessed by financial performance, amid persistent market competition.

The ecosystem demonstrates strength through MAX’s rapid user adoption, combined with VK Tech’s leadership in video consumption and its ongoing market expansion. The company creates long-lasting business strength through its monetization method, product range, and strategic business approach despite facing competition and financial losses.

VK reported revenue of RUB 111.3 billion, which represented a 10% annual growth.

The adjusted EBITDA reached RUB 15.5 billion, which resulted in a 14% profit margin.

VK achieved 97% monthly reach of Russia’s internet population.

Users spent 5.1 billion minutes per day, which represented a 17% annual increase.

The number of daily active users reached 78 million during 9M 2025.