Introduction

Video Games Industry Statistics: The worldwide video game sector has transformed from its initial function as specialised entertainment for dedicated fans into a mainstream entertainment industry that competes with the combined revenues of the film, music, and streaming sectors. In 2025, video gaming was recognised as an essential form of entertainment and a key driver of economic development, as it influenced technological progress, consumer behaviour, and global cultural change. The industry operates at a substantial scale, as evidenced by its mobile games, AAA games, and esports ecosystems.

The article presents an extensive analysis of 2025 Video Games Industry statistics, including revenue data and player demographic information, platform usage patterns, and new technology developments, as well as research insights that show the current state of the video game industry and its future development path.

Editor’s Choice

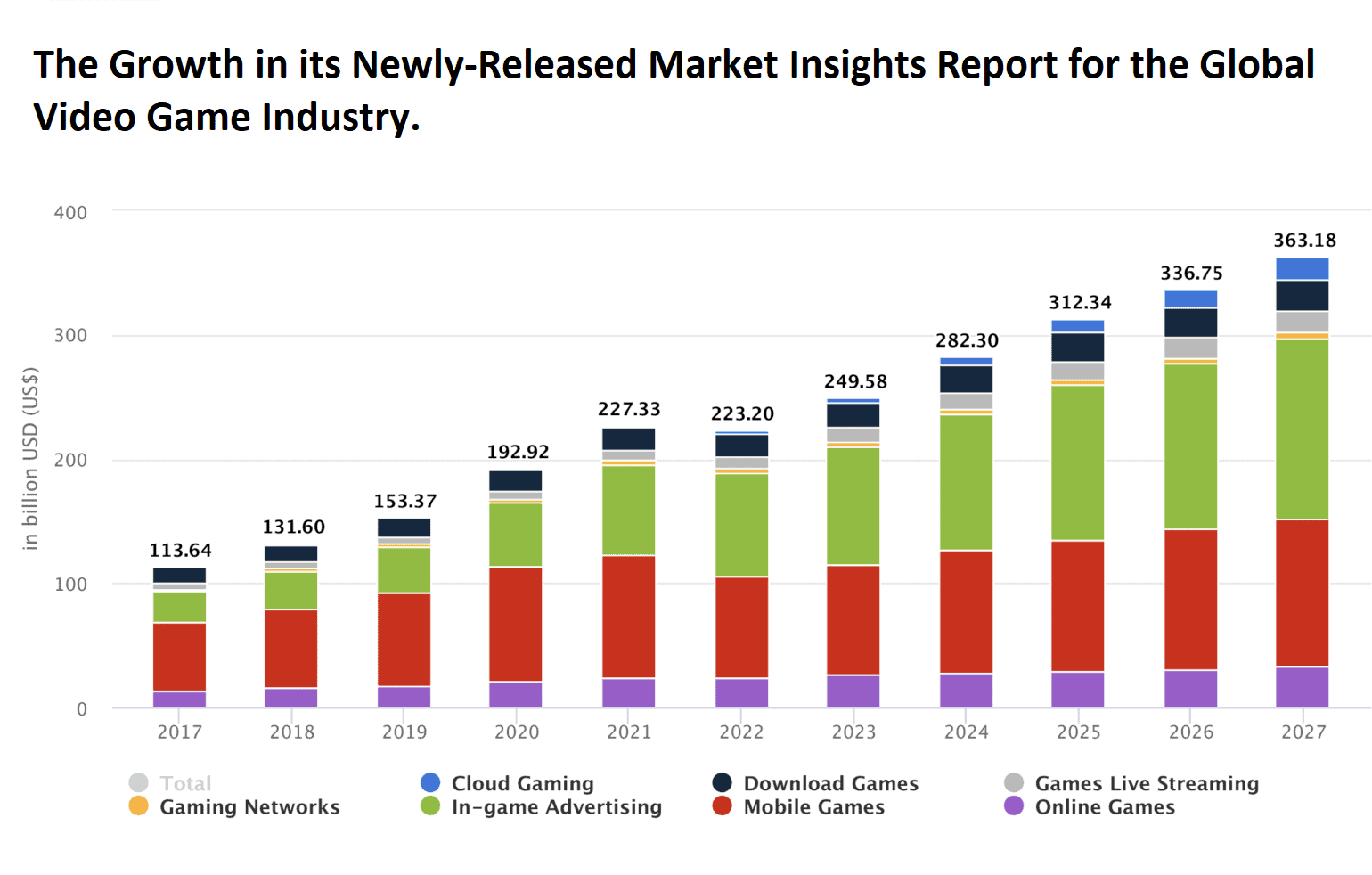

- Global video game industry revenue is projected to exceed USD 282.3 billion in 2024, making it more profitable than the combined revenues of the film and music industries.

- The market is expected to achieve an 8.76% CAGR, increasing its value to USD 363.2 billion by 2027 from 2024.

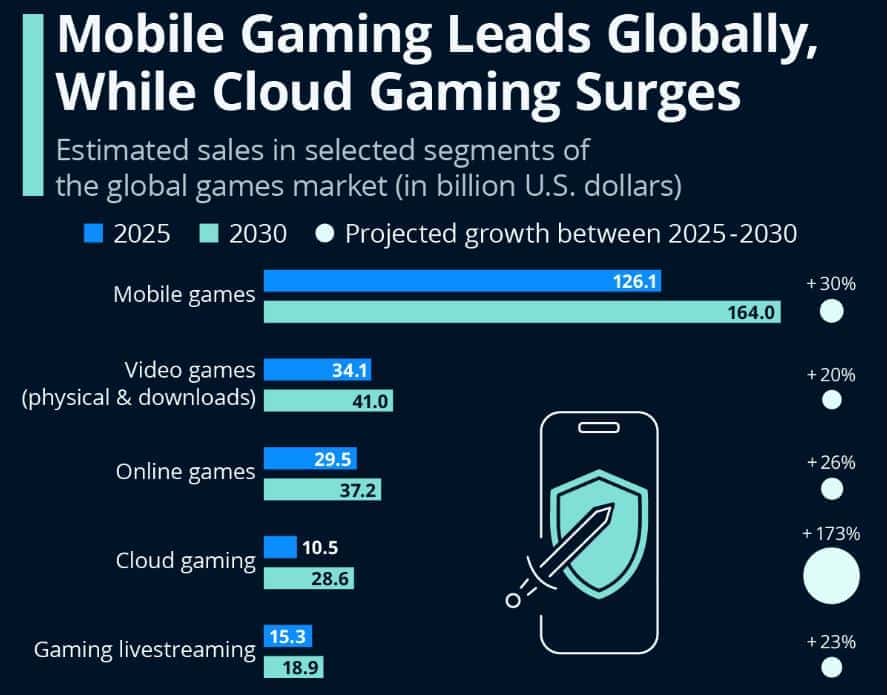

- The mobile gaming sector remains the leading segment, with growth from USD 126.1 billion in 2025 to USD 164.0 billion by 2030.

- The cloud gaming market is growing faster than any other part of the gaming industry. It is expected to grow from USD 10.5 billion to USD 28.6 billion by 2030, more than doubling in size.

- The online gaming industry is projected to grow by 26%, bringing its total revenue to USD 37.2 billion by 2030.

- The gaming livestreaming market will see its revenue increase by 23% because gaming has developed into a social form of entertainment.

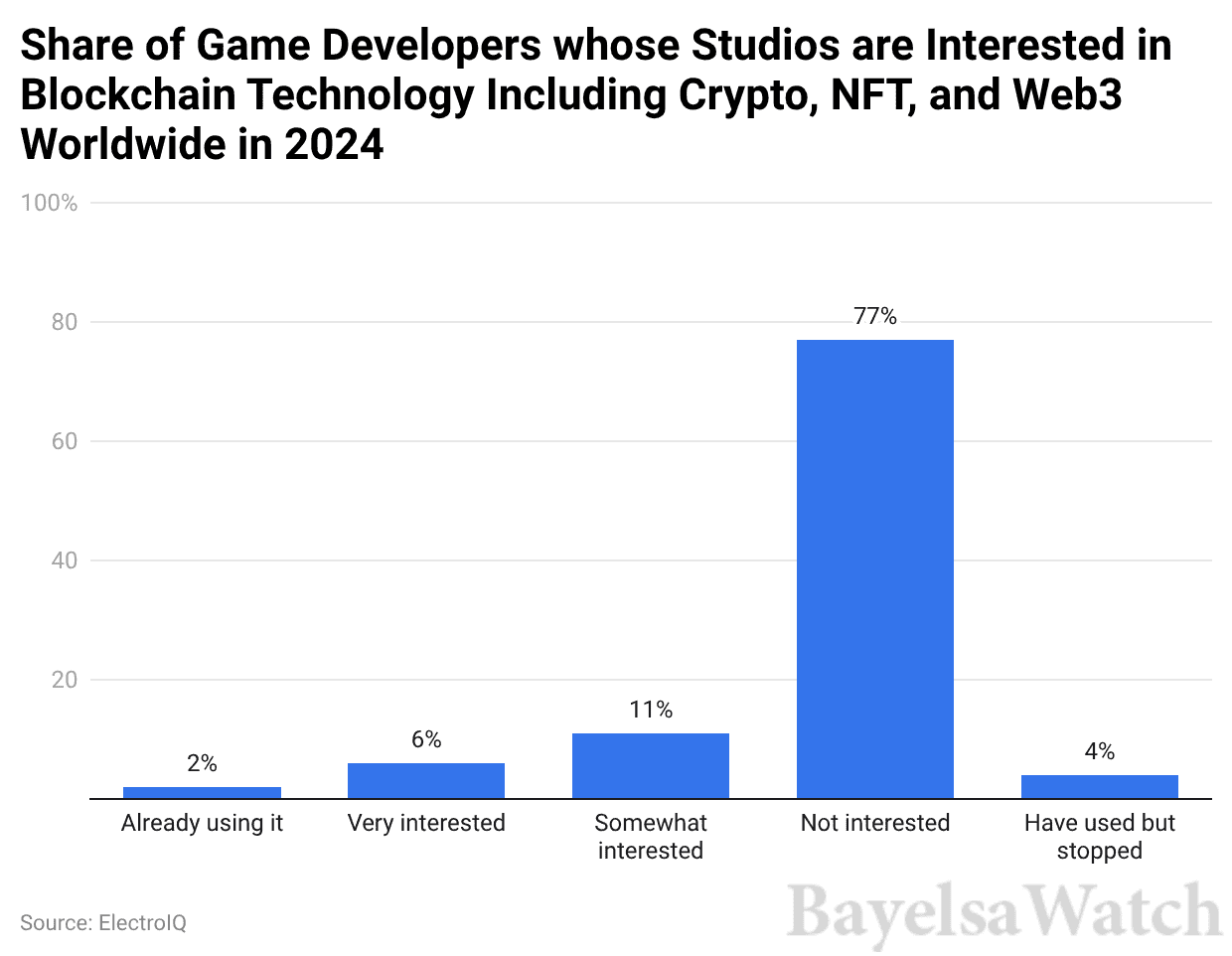

- 77% of game developers currently show no interest in implementing blockchain technology with NFTs and Web3 systems.

- Only 2% of studios currently use blockchain technology in their game development process.

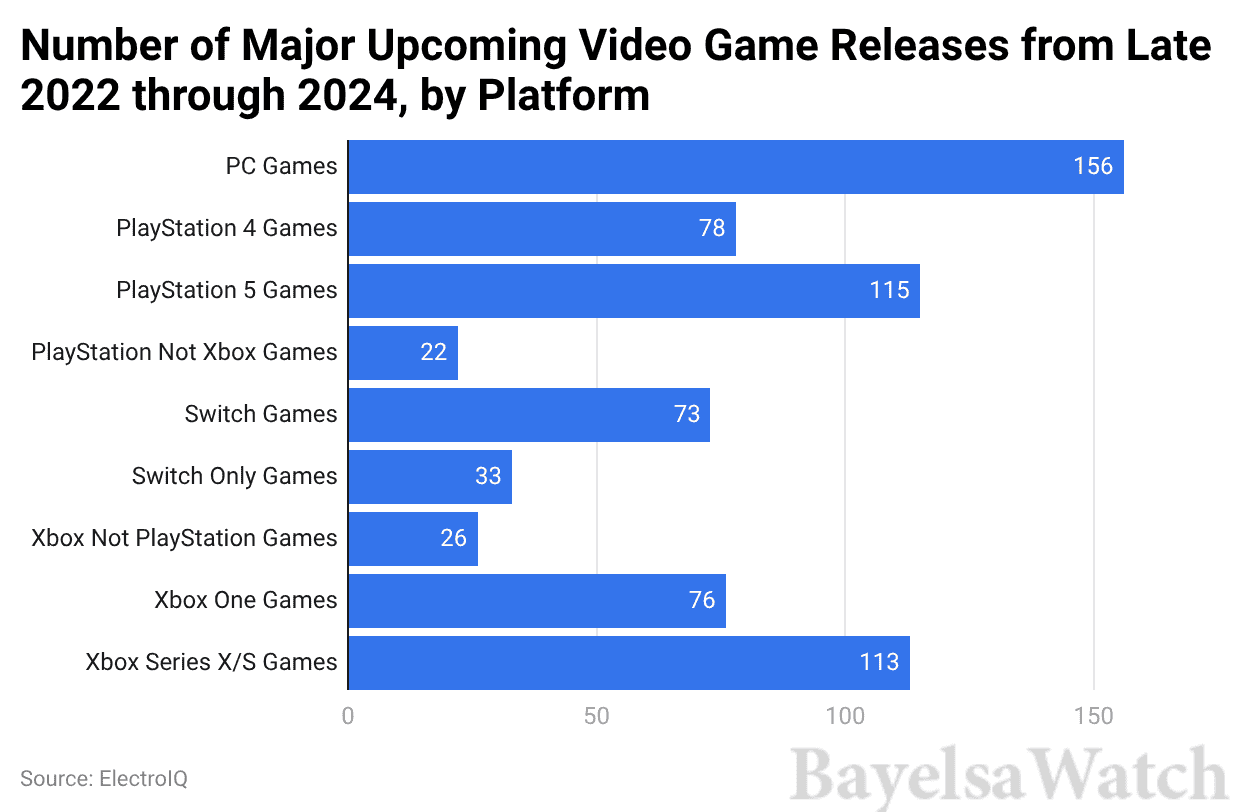

- The PC platform dominates game releases because developers have scheduled 156 of the 200 top upcoming games for launch on that platform.

- PlayStation 5 and Xbox Series X/S display comparable game availability, with 115 and 113 major titles, respectively.

- Global gaming IPOs reached their highest value of USD 109.4 billion in 2021 but declined sharply between 2022 and 2023.

Gaming Industry Revenue By Segments

(Source: ustimes.biz)

- The total number of video gamers worldwide will exceed 3.58 billion by 2025, with 83% of players using mobile devices.

- The video game industry now stands as the most powerful entity shaping the global entertainment industry.

- The video game industry now operates at the intersection of three industries, generating more revenue than both the film and music industries combined.

- Statista’s current market assessment indicates that global gaming revenues will exceed USD 282.3 billion in 2024, as mobile, console, and PC games continue to attract players.

- The 8.76% compound annual growth rate indicates that the period from 2024 to 2027 will produce permanent business growth rather than temporary economic expansion.

- Digital distribution and live-service models, along with increasing global user bases, will drive market volume growth, which is projected to reach USD 363.2 billion by 2027.

- The current growth trajectory of gaming establishes it as a sustainable business model that will continue to generate revenue throughout its operations.

Estimated Sales of the Global Video Game Market

(Source: statista.com)

- The current state of the global gaming market is reflected in its segment distribution, which indicates that video games have evolved into a broad digital market.

- Mobile games generate the highest revenue for the industry, with sales projected to increase from USD 126.1 billion in 2025 to USD 164.0 billion by 2030, reflecting nearly 30% growth driven by smartphone usage, in-app purchases, and the expansion of new markets.

- The market for traditional video games, which includes physical copies and digital downloads, has shown steady growth, increasing from USD 34.1 billion to USD 41.0 billion (20% increase), indicating that consoles and premium games continue to attract users.

- The online gaming market will increase from USD 29.5 billion to USD 37.2 billion, representing 26% growth, as live-service systems and multiplayer games foster stronger player connections.

- Cloud gaming has experienced tremendous growth, with the market reaching USD 28.6 billion after starting at USD 10.5 billion, representing a 173% increase, indicating that gamers now prefer hardware-free gaming.

- The gaming livestreaming market increased from USD 15.3 billion to USD 18.9 billion, representing a 23% rise, indicating that gaming now serves as both entertainment and a social media platform.

- The video game industry is shifting toward revenue models that support service-based growth, as the cloud and mobile segments will create new pathways for future expansion.

Global Game Developer Sentiment Toward Blockchain, NFTs, And Web3

(Reference: statista.com)

- The data establishes a cautious and skeptical attitude towards blockchain technologies, which the video game industry maintains throughout 2024.

- A dominant 77% of game developers report no interest at all in crypto, NFTs, or Web3 integration, highlighting strong resistance despite years of hype around decentralized gaming economies.

- Current technology usage indicates that 2% of studios actively use these technologies, 6% show strong interest, and 11% demonstrate moderate interest, suggesting that mainstream adoption will remain limited to experimental testing.

- The data show that 4% of developers used blockchain tools, which they later abandoned because their initial tests failed to yield usable benefits for players.

- Studios now avoid taking risks because they face rising development costs, regulatory uncertainty, volatile crypto markets, and permanent consumer resistance to NFTs.

- Many developers in the industry need to establish player trust because it helps them maintain player engagement.

- Developers need to find better methods of monetizing their content, which also need to reduce operational costs.

- The data show that video game industry innovation priorities continue to focus on established growth drivers, including live services, cloud gaming, and cross-platform play.

- The video game industry demonstrates a skeptical attitude toward blockchain technology, which will prevent mainstream adoption until there is clear evidence of consumer demand and a regulatory framework.

Major Video Game Releases By Platform

(Reference: statista.com)

- Data demonstrate that platform strategy has evolved to its current state in the video game industry.

- Upcoming game releases planned for late 2022 through 2024 indicate that PC leads with 156 titles.

- The console market remains competitive, with 115 upcoming games scheduled for PlayStation 5 and 113 for Xbox Series X/S, indicating comparable third-party support for both systems.

- The industry uses exclusivity to control markets because 22 PlayStation-only titles compete against 26 Xbox-only releases, which demonstrate companies’ efforts to attract customers to their platforms.

- The video game industry has evolved into a platform-agnostic market, preferring to generate revenue across multiple channels rather than relying on exclusive content.

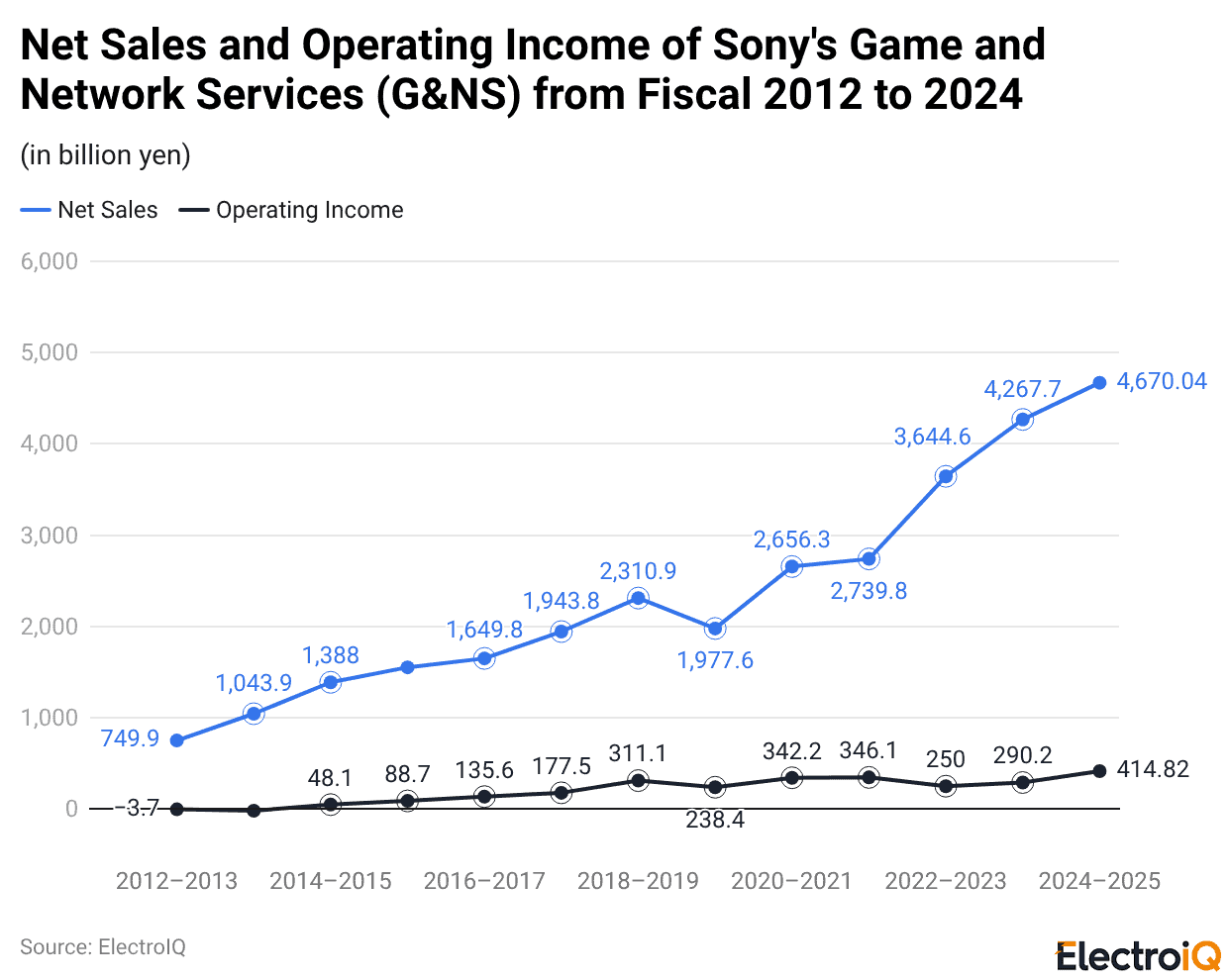

Sony’s Gaming Net Sales and Operating Income

(Reference: statista.com)

- Sony achieves market dominance in the video game industry through its fiscal year ending March 2025 net sales of 4.67 trillion yen from Game and Network Services.

- The business unit derives its operational success from diversified revenue streams, including PlayStation hardware sales, digital and physical game software, add-on content, and recurring network services.

- The company offers digital content and subscription services that generate consistent revenue growth, thereby reducing its dependence on seasonal console sales.

- Sony leverages its large corporate presence to generate revenue from both gaming hardware platforms and the extended time players spend with its products.

- Sony generates the highest revenue in the video game industry, according to these statistics, owing to its platform strength and extensive content library.

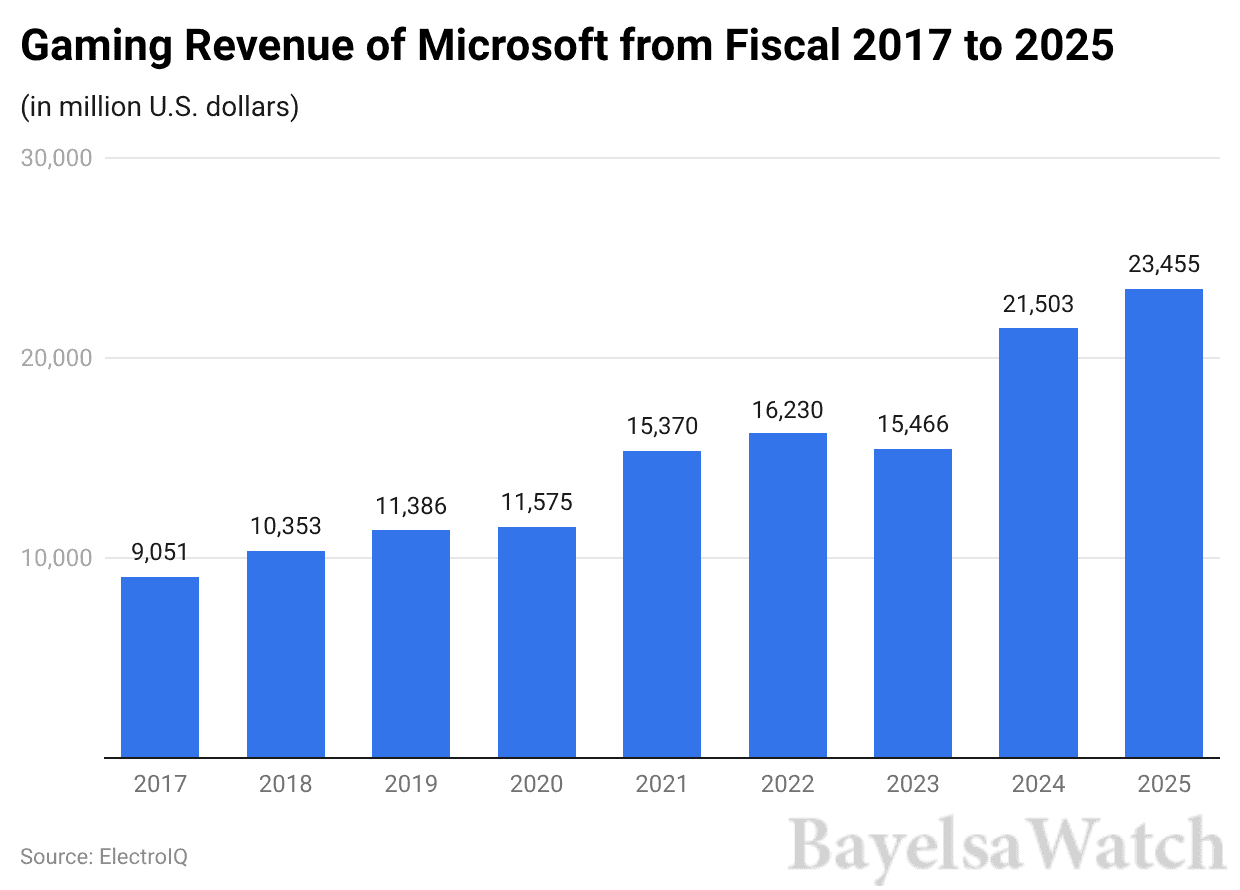

Microsoft Video Game Industry Revenue And Expansion

(Reference: statista.com)

- In fiscal year 2025, Microsoft reported gaming revenues of USD 23.5 billion, exceeding the previous year’s total of USD 21.5 billion, indicating that its video game industry market share increased.

- The company achieved this growth through its planned ecosystem expansion strategy, which focuses on generating recurring revenue and executing high-impact acquisitions.

- Microsoft establishes multiple monetization opportunities in its gaming division, which encompasses Xbox hardware and digital content, Xbox Game Pass subscriptions, cloud gaming, and third-party royalties and advertising revenue streams.

- The completion of the Activision Blizzard acquisition marks a major turning point for the company.

- Game industry revenue increased from USD 3.9 billion to USD 7.1 billion during October-December 2023, indicating that popular intellectual properties, including Call of Duty and Diablo, drove immediate revenue growth.

- The company reported revenue of USD 5.4 billion after the holiday season, exceeding last year’s total, indicating permanent revenue growth rather than temporary market expansion.

- Microsoft has created a long-term growth path in the video game industry by leveraging its platform strategy to provide access to premium franchises, thereby enhancing user retention and generating new revenue streams.

Major Console And PC Gaming Investments

| Company (date) | Date | Value in million USD | Company value in million USD | Stage | Company description | Country |

| Embracer Group | 5 Jul 2,023 | 184.6 | – | Other | Console/PC games developer/publisher | Sweden |

| The Believer Company | 7 Mar 2,023 | 55 | < 250 | Early | Console/PC games developer | USA |

| Starbreeze | 22 Jun 2,023 | 42 | – | Other | Console/PC games developer | Sweden |

| Strikerz | 12 Dec 2,023 | 40 | < 250 | Ealy | Console soccer games developer | Cyprus |

| People Can Fly | 22 Jun 2,023 | 31 | – | Other | Console/PC games developer | Poland |

| Mountaintop Studios | 21 Sep 2,023 | 21 | < 250 | Early | PC games developer | USA |

| G.TB International | 1 Feb 2,023 | 20 | – | Early | Console/PC and blockchain games developer | China |

| BLANK. Game Studios | 13 Nov 2,023 | 17 | <100 | Early | Console/PC games developer | Poland |

| Pahdo Labs | 11 Sep 2,023 | 15 | <100 | Early | AI-driven games developer and user-generated content platform provider | USA |

| Fuzzybot | 29 Sep 2,023 | 13 | – | Early | Console/PC games developer | USA |

| Riftweaver Game Studio | 19 Jan 2,023 | 12.1 | <100 | Early | PC/mobile TTRP game developer | USA |

| Noodle Cat Games | 20 Oct 2,023 | 12 | <50 | Early | PC games developer | USA |

| Farcana | 14 Dec 2,023 | 10 | <50 | Early | Blockchain PC games developer | UAE |

(Source: statista.com)

- The largest 2023 video game investments in console and PC gaming indicate which areas of the industry attract both trust and financial support.

- The Embracer Group established itself as the top company for deal value after spending USD 184.6 million to acquire content rights for its console and PC games.

- The Believer Company received USD 55 million, while Starbreeze obtained USD 42.2 million in funding, demonstrating that investors support studios that can develop expandable intellectual property and deliver ongoing services.

- Most deals during this period were classified as early-stage transactions, typically under USD 250 million. This trend indicates that investors now prioritise long-term value creation over short-term financial returns in mature companies.

- The international reach of the video game industry is evidenced by the presence of Sweden, the U.S., Poland, China, Cyprus, and the UAE.

- Startups such as Pahdo Labs, which develops AI-based games, and Farzana, along with GTB International, which creates blockchain-powered PC games, managed to attract investment despite the overall market downturn, indicating a pattern of acceptable losses.

Major Gaming Acquisitions

| Acquiree – Acquirer (date) | Segment | Upfront EV in mUSD | Total EV (incl. earn-out) in mUSD |

| Keyword Studios acquired by EQT (Oct 2024) | Outsourcing | 2,800 | 2,800 |

| Easybrain acquired by Miniclip (Nov 2024) | Mobile | 1,200 | 1,200 |

| Jagex acquired by CVC Capital (Feb 2024) | PC & Console | 1,100 | 1,100 |

| SuperPlay acquired by Playtika (Nov 2024) | Mobile | 700 | 2,000 |

| Plarium acquired by MTG (Nov 2024) | Mobile | 620 | 820 |

| Gearbox acquired by Take-Two Interactive (Jun 2024) | PC & Console | 460 | 460 |

| Landvault acquired by Infinite Reality (Jul 2024) | Tech | 450 | 450 |

| Saber acquired by Beacon Interactive (Mar 2024) | PC & Console | 247 | 341 |

| Data.ai acquired by Sensor Tower (Mar 2024) | Tech | n/d | n/d |

| Chartboost acquired by LoopMe (Dec 2024) | Tech | n/d | n/d |

(Source: statista.com)

- The largest acquisitions in 2024 indicate that the video game industry is entering a new period focused on controlled business growth through planned mergers rather than large-scale acquisitions.

- The most important transaction was EQT’s acquisition of Keywords Studios for USD 2.8 billion in October 2024, as investors now prioritise gaming services infrastructure over ownership of pure content.

- The development, localization, QA, and live operations functions of Keywords make it essential for publishers who want to achieve operational efficiency through Automated publishing, and Lab scaling, and testing.

- The total value of 2024 deals shows a significant decline compared with the exceptional market growth in 2022, which altered perceptions of the video game industry.

- Take-Two Interactive made its first mobile gaming acquisition in January 2022, when it purchased Zynga, but Microsoft followed eight days later with the largest gaming deal to date, buying Activision Blizzard for USD 69 billion.

- The period marked an economic peak, driven by low interest rates, platform competition, and content development races.

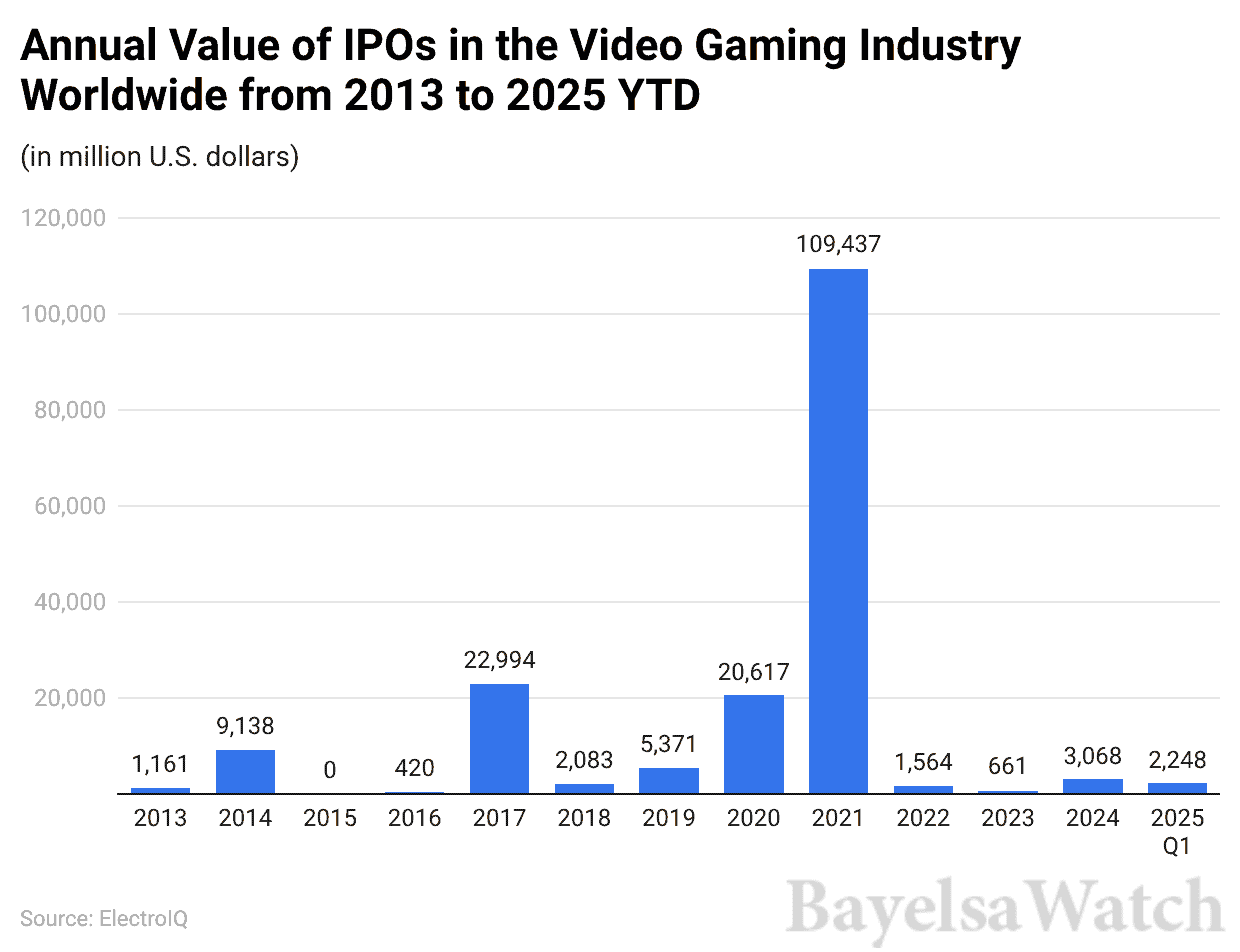

IPO Momentum In The Video Gaming Industry Worldwide

(Reference: statista.com)

- The annual IPO values shown here capture the cyclical capital market behavior of the video game industry, swinging sharply between exuberance and restraint.

- Between 2013 and 2019, the IPO market was relatively inactive, with annual volumes ranging from USD 1 billion to USD 9 billion, as investors still considered the sector a niche within public markets.

- In 2017, IPO values reached nearly USD 23 billion, driven by the expansion of mobile games and the initial excitement surrounding esports.

- The pandemic period marked the turning point in the situation. The total value of IPOs reached USD 20.6 billion in 2020, before reaching an all-time high of USD 109.4 billion in 2021.

- The increase occurred during a period when people stayed at home due to lockdowns, while banks offered low interest rates and investors showed interest in digital entertainment, which led to the video game industry reaching its highest market value.

- The IPO market declined to USD 1.56 billion in 2022 and USD 661 million in 2023, as investors reduced risk tolerance amid rising interest rates and falling asset values, while post-pandemic growth remained weak.

- In 2024, IPO activity reached a temporary equilibrium of USD 3.1 billion, while Q1 2025 already achieved USD 2.25 billion, indicating that the market is beginning to reopen but has not yet fully restored its previous state.

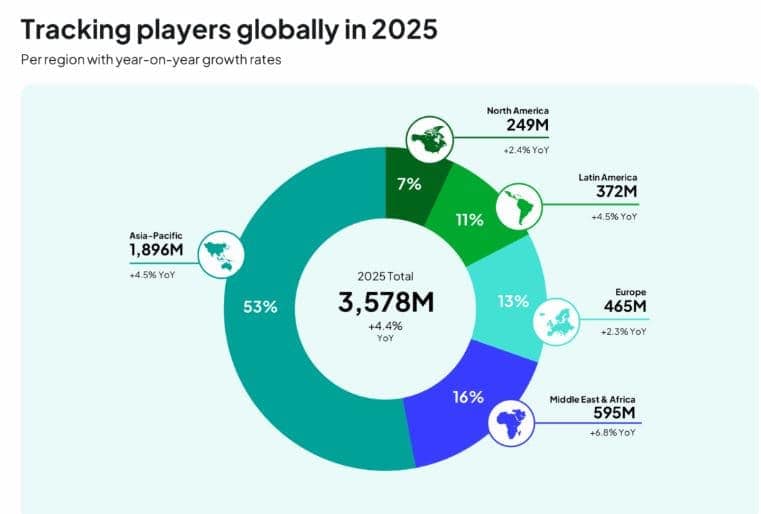

Video Game Industry Players

(Source: newzoo.com)

- The video game industry has reached a critical stage of development because its expansion no longer depends on increased operational capacity.

- The global gaming market will expand to 3.58 billion players by 2025, representing a 4.4% annual growth rate and accounting for more than 60% of the total online users worldwide.

- The industry has achieved extraordinary market penetration, indicating that its core markets have reached their maximum capacity, as internet user growth has stopped expanding.

- With 936 million players, PC gaming accounts for 26% of the market and is gaining traction among Asian players, who use platforms such as Steam.

- The console gaming market has 645 million players, representing 18% of the total market, and has reached a stable point; its younger player base now uses multiple devices to play games rather than expanding the user base.

- The Asia-Pacific region has 1.9 billion players, representing 53% of the global gaming population, whereas the Middle East and Africa experience the fastest growth, at 6.8% annually, owing to the adoption of mobile technology as the primary gaming platform.

- The video game industry will shift its focus from audience growth to creating deeper connections with existing players.

- The upcoming period will establish retention and cross-device experiences and long-tail monetization as essential factors for sustainable growth because Generation Alpha will enter multi-platform ecosystems while older generations will leave.

Key Forces Shaping The Video Game Industry

- The video game industry in 2025 is undergoing fundamental changes in its approach to game development and distribution, as well as in player experiences, which will replace its existing system for delivering incremental improvements.

- The gaming market is experiencing its most significant expansion through the growth of augmented reality and virtual reality technologies.

- The use of AR and VR systems has increased due to lower-cost headset models and improved hardware capabilities, which allow users to experience virtual environments during multiplayer games that require both social interaction and interactive gameplay.

- The gaming industry now merges with digital fitness programs to create a new market segment. Virtual reality fitness games have evolved from mobile applications and streaming services into standalone interactive gaming platforms.

- The crossover creates new monetization opportunities through interactive gaming, which connects to the global wellness market that generates trillions in revenue.

- The global esports market generated USD 2.1 billion in 2023 through its sponsorships, media rights, and live events, which attract audiences beyond the core gaming community.

- The studios apply AI technology to create customized gaming experiences, which generate dynamic story content while decreasing development expenses to achieve better player retention rates and faster production times.

- The gaming subscription market will generate USD 11 billion in revenue by 2025, driven by increasing demand for games that require fewer resources and provide instant access.

- The video game industry customizes user experiences, and it maintains constant online availability, which creates continuous growth for its global audience and its ability to create content.

Conclusion

The video game industry in 2025 stands at a powerful inflexion point. The era of explosive player acquisition is giving way to smarter monetization, deeper engagement, and service-led ecosystems. The market is expanding as mobile platforms, cloud technology, subscription services, and live gaming content have taken over the industry, with revenues projected to exceed USD 360 billion by 2027.

The current state of the industry reflects disciplined standards across capital markets, developer sentiment, and platform strategies. The winners ahead will be those who balance scale with retention, innovation with trust, and technology with player-centric design—turning gaming into a resilient, long-term digital economy.