Sonoco (SON) posted Q4 adjusted EPS of $1.05, beating the consensus estimate of $1.00 by 5%. Revenue surged 29.7% year-over-year to $1.77 billion, topping expectations by approximately $10 million, driven primarily by the Eviosys acquisition. Shares closed at $51.67 on the last trading day before the announcement (Feb 13), up ~18.4% year-to-date, with the earnings release arriving on Sunday, February 16, ahead of the company’s New York Investor Day on February 17.

About Sonoco Products Company

Sonoco Products Company (NYSE: SON) is a global leader in high-value sustainable metal and paper consumer and industrial packaging and the world’s largest producer of composite cans, tubes, and cores. Founded in 1899 as the Southern Novelty Company by James Lide Coker, the company is headquartered in Hartsville, South Carolina, and is the largest corporation in South Carolina by revenue.

With annualized net sales of approximately $7.5 billion in 2025 and roughly 22,000-23,400 employees operating across 265 facilities in 37 countries, Sonoco serves some of the world’s best-known brands.

As of late January 2026, the company carried a market capitalization of approximately $4.83 billion, with shares trading near $48-$52. Sonoco pays an annual dividend of $2.11 per share ($0.53/quarter) and was recently named one of the World’s Most Admired Companies by Fortune in 2026. The company is a member of the NYSE Century Index and the S&P 400.

Top Financial Highlights

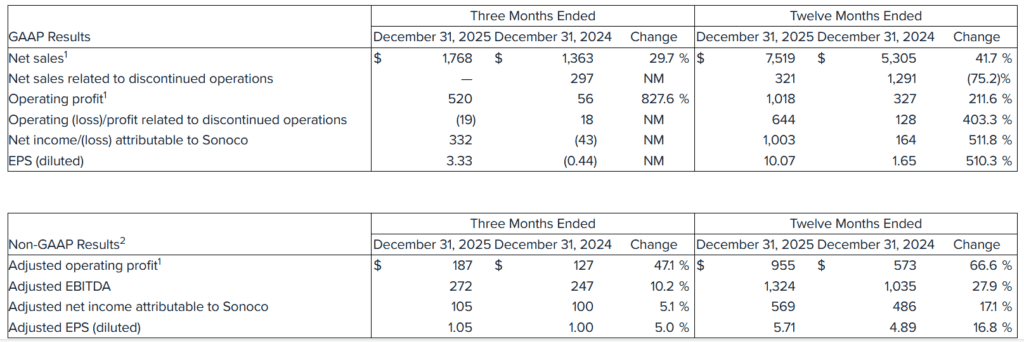

- Q4 Net Sales: $1.77 billion, up 29.7% year-over-year, driven primarily by the December 2024 Eviosys acquisition adding Metal Packaging EMEA revenue.

- Full-Year Net Sales: $7.52 billion, up 41.7% from $5.31 billion in 2024.

- Q4 GAAP Net Income: $332.2 million, a dramatic swing from a $(43.0) million loss in Q4 2024, primarily due to the gain on the sale of ThermoSafe.

- Q4 GAAP EPS (diluted): $3.33, compared to $(0.44) in Q4 2024.

- Q4 Adjusted EPS (diluted): $1.05, up 5.0% from $1.00 in Q4 2024.

- Q4 Adjusted Operating Profit: $187 million, up 47.1% from $127 million.

- Q4 Adjusted EBITDA: $272 million, up 10.2% from $247 million.

- Q4 Gross Profit: $347 million, up from $283 million in Q4 2024.

- Full-Year Adjusted EBITDA: $1.324 billion, up 27.9% from $1.035 billion.

- Full-Year Operating Cash Flow: $690 million (including $196 million in one-time divestiture-related taxes), down from $834 million in 2024.

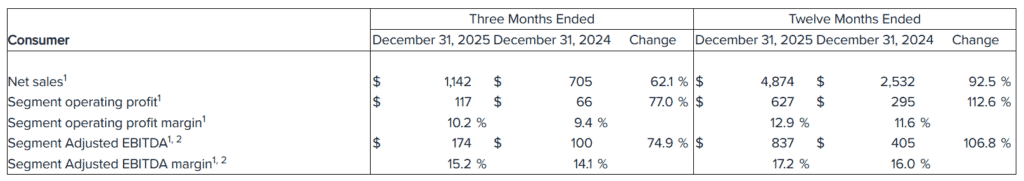

- Consumer Packaging Segment (Q4): Record sales of $1.14 billion (+62.1%), adjusted EBITDA of $174 million (+74.9%), with EBITDA margin expanding by 110 bps to 15.2%.

- Industrial Paper Packaging Segment (Q4): Sales of $568 million (flat YoY), adjusted EBITDA of $103 million (+1.3%), with EBITDA margin at 18.2% – ninth consecutive quarter of margin expansion.

- Cash on Hand: $378 million as of December 31, 2025, with total available liquidity of $1.6 billion.

- Net Debt Reduction: $2.7 billion reduced during full-year 2025, bringing net leverage to approximately 3.0x.

- 2026 Guidance: Revenue of $7.25B-$7.75B; Adjusted EPS of $5.80-$6.20; Adjusted EBITDA of $1.25B-$1.35B; Operating cash flow of $700M-$800M.

Fourth Quarter 2025 Consolidated Results

Note- NM = Not Meaningful

Fourth Quarter 2025 Segment Results

Beat or Miss?

| Metric | Reported | Consensus Estimate | Difference |

| Q4 Adjusted EPS | $1.05 | $1.00 | Beat by $0.05 (+5.0%) |

| Q4 Revenue | $1.77 billion | ~$1.76 billion | Beat by ~$10 million |

| Q4 Adjusted EBITDA | $272 million | – | +10.2% YoY |

| FY Adjusted EPS | $5.71 | – | +16.8% YoY |

| FY Revenue | $7.52 billion | – | +41.7% YoY |

Sonoco beat Wall Street’s Q4 EPS estimate by $0.05 and surpassed revenue expectations by approximately $10 million. The adjusted EPS beat of 5% was notable given that consensus had projected a 14.5% year-over-year EPS decline, but the company instead delivered a 5% increase.

What Leadership Is Saying?

Howard Coker stated that Sonoco delivered strong operating results despite macroeconomic pressure, reduced net debt by about 40% year over year, and lowered leverage to around 3.0x, while completing its portfolio transformation and streamlining its Consumer Packaging structure to improve efficiency and synergies.

Paul Joachimczyk added that the Consumer Packaging segment achieved record fourth quarter sales and profit with margin expansion, while Industrial Paper Packaging improved profitability for the ninth consecutive quarter, and the company is targeting a 20% increase in adjusted earnings in 2026 supported by cost savings and operational improvements.

Historical Performance

Q4 2025 vs. Q4 2024

| Category | Q4 2025 | Q4 2024 | Change (%) |

| Net Sales | $1,768M | $1,363M | +29.7% |

| Gross Profit | $347M | $283M | +22.6% |

| GAAP Operating Profit | $520M | $56M | +827.6% |

| Adjusted Operating Profit | $187M | $127M | +47.1% |

| GAAP Net Income | $332M | $(43)M | NM |

| Adjusted Net Income | $105M | $100M | +5.1% |

| GAAP EPS (diluted) | $3.33 | ($0.44) | NM |

| Adjusted EPS (diluted) | $1.05 | $1.00 | +5.0% |

| Adjusted EBITDA | $272M | $247M | +10.2% |

| SG&A Expenses | $213M | $220M | -3.2% |

Full Year 2025 vs. Full Year 2024

| Category | FY 2025 | FY 2024 | Change (%) |

| Net Sales | $7,519M | $5,305M | +41.7% |

| Gross Profit | $1,574M | $1,139M | +38.2% |

| GAAP Operating Profit | $1,018M | $327M | +211.6% |

| GAAP Net Income | $1,003M | $164M | +511.8% |

| GAAP EPS (diluted) | $10.07 | $1.65 | +510.3% |

| Adjusted EPS (diluted) | $5.71 | $4.89 | +16.8% |

| Adjusted EBITDA | $1,324M | $1,035M | +27.9% |

| Operating Cash Flow | $690M | $834M | -17.3% |

| SG&A Expenses | $862M | $724M | 19.10% |

Competitor YoY Comparison

Packaging Corporation of America (NYSE: PKG)

| Category | Q4 2025 | Q4 2024 | Change (%) |

| Net Sales | $2.4B | $2.1B | +14.3% |

| Net Income | $102M ($1.13/share) | N/A (see FY) | – |

| FY Net Sales | $9.0B | $8.4B | +7.1% |

| FY Net Income | $774M ($8.58/share) | $805M ($8.93/share) | -3.90% |

Graphic Packaging Holding Company (NYSE: GPK)

| Category | Q4 2025 | Q4 2024 | Change (%) |

| Net Income | $71M ($0.24/share) | $138M ($0.46/share) | -48.6% |

| Adjusted Net Income | $85M ($0.29/share) | $179M ($0.59/share) | -52.5% |

| FY Net Sales | $8.6B | $8.8B | -2.3% |

| FY Net Income | $444M ($1.48/share) | $658M ($2.16/share) | -32.5% |

| FY Adjusted EBITDA | $1.4B | N/A | – |

How the Market Reacted?

Sonoco reported its fourth quarter and full year 2025 results on February 16, 2026, ahead of an Investor Day held in New York on February 17. The stock closed at $51.67 on February 13, the last trading session before the announcement, reflecting an 18.4% year to date increase and a 29.9% gain over the prior three months.

Results exceeded expectations on both earnings per share and revenue, and 2026 guidance targets a 20% improvement in adjusted earnings excluding divested businesses. Following the completion of the ThermoSafe divestiture, a $2.7 billion reduction in net debt, and a leverage ratio of 3.0x, overall sentiment remained positive, although investors are expected to focus on execution of the three year profitability plan and potential tariff related risks.