SAP delivered Q4 2025 non-IFRS EPS of €1.62 (up 16% YoY) on revenue of €9.68 billion, growing 9% at constant currencies. Cloud revenue surged 26% at constant currencies, but stock fell ~15% in pre-market as current cloud backlog growth and 2026 guidance disappointed investor expectations. Full-year free cash flow reached a record €8.2 billion.

About SAP SE

SAP SE (NYSE: SAP) is the world’s largest enterprise application software company, headquartered in Walldorf, Germany. Founded in 1972, SAP provides end-to-end ERP, cloud, analytics, and AI solutions that power mission-critical operations for over 400,000 customers in more than 180 countries. The company’s flagship products include S/4HANA Cloud, SuccessFactors, Ariba, and Concur, spanning supply chain, finance, HR, and procurement.

As of February 2026, SAP trades at a market capitalization of approximately $239 billion with a P/E ratio of 27.69 and a dividend yield of approximately 1%. The company employs over 100,000 people worldwide. SAP’s predictable revenue now accounts for 86% of total revenue, reflecting its successful transition to a recurring cloud-based business model.

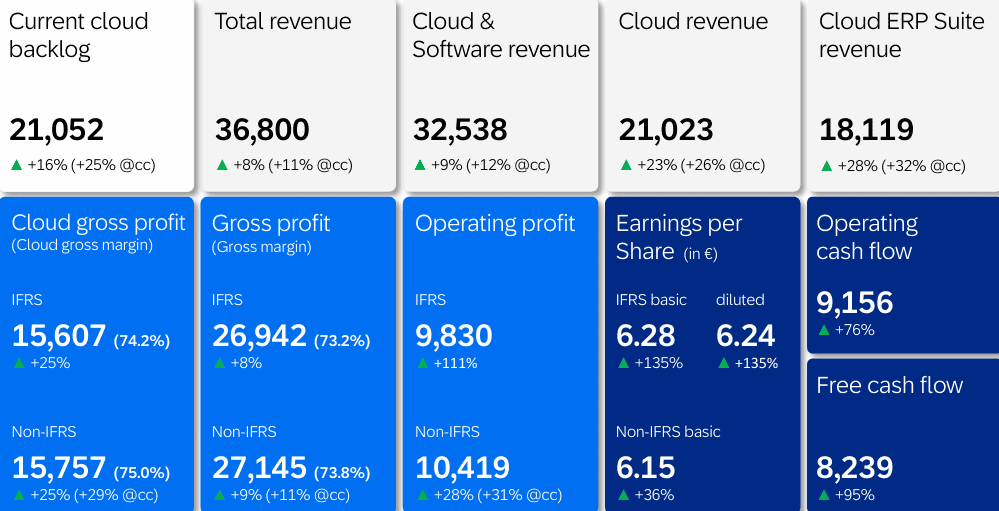

Top Financial Highlights

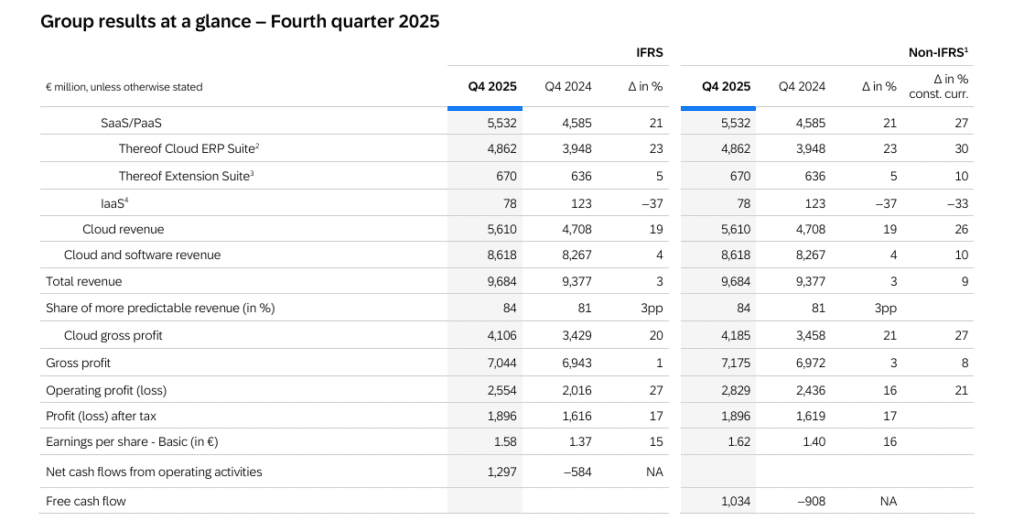

- Q4 Revenue reached €9.68 billion, up 3% YoY and 9% at constant currencies.

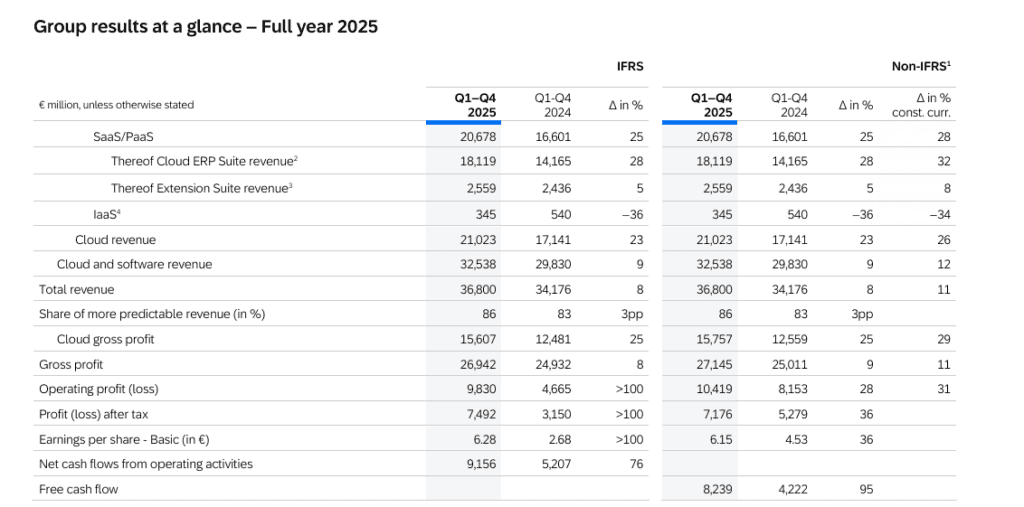

- Full Year 2025 Revenue totaled approximately €36.8 billion, increasing 8% YoY and 11% at constant currencies.

- Q4 Non IFRS EPS was €1.62, up 16% YoY. Full Year Non IFRS EPS reached €6.15, rising 36% YoY.

- Q4 Net Income under IFRS stood at €1.83 billion, up 14.2% from €1.60 billion in Q4 2024.

- Q4 Gross Profit totaled €7.00 billion, with a 73.0% gross margin.

- Q4 IFRS Operating Profit reached €2.55 billion, up 27% YoY. Non IFRS operating profit increased 21% YoY.

- Full Year Non IFRS Operating Profit was €10.42 billion, up 28% YoY and 31% at constant currencies.

Cloud Performance and Backlog

- Q4 Cloud Revenue reached €5.61 billion, rising 19% YoY and 26% at constant currencies.

- Cloud ERP Suite Revenue in Q4 totaled €4.86 billion, up 23% YoY and 30% at constant currencies.

- Total Cloud Backlog reached a record €77.3 billion, increasing 22% YoY and 30% at constant currencies.

- Current Cloud Backlog stood at €21.05 billion, up 16% YoY and 25% at constant currencies.

Cash Flow and Capital Allocation

- Full Year Free Cash Flow reached €8.2 billion, at the high end of company outlook.

- Cash on Hand was €8.22 billion as of December 31, 2025.

- 2026 Guidance projects Non IFRS operating profit between €11.9 billion and €12.3 billion, reflecting 14% to 18% growth at constant currencies. Free cash flow is expected to reach approximately €10 billion.

- A new share repurchase program of up to €10 billion has been approved for execution over two years, beginning February 2026.

FY 2025 | in € millions, unless otherwise stated

SAP – Financial Outlook 2026

- Cloud Revenue is expected between €25.8 billion and €26.2 billion at constant currencies. This compares to €21.02 billion in 2025, reflecting 23% to 25% growth at constant currencies.

- Cloud and Software Revenue is projected at €36.3 billion to €36.8 billion at constant currencies. This represents 12% to 13% growth, compared to €32.54 billion in 2025.

- Non IFRS Operating Profit is forecast between €11.9 billion and €12.3 billion at constant currencies. This implies 14% to 18% growth, up from €10.42 billion in 2025.

- Free Cash Flow is expected to reach approximately €10 billion at actual currencies, compared to €8.24 billion in 2025.

- The Non IFRS Effective Tax Rate is estimated at approximately 29%, compared to 30.4% in 2025.

- Current Cloud Backlog Growth at constant currencies is expected to slightly decelerate in 2026, following 25% growth recorded in 2025.

Beat or Miss?

SAP met its full-year 2025 revenue outlook and exceeded expectations on non-IFRS operating profit and free cash flow. However, Q4 results missed Wall Street’s per-share and revenue forecasts in USD terms.

| Metric | Reported | Analyst Estimate | Difference |

| Q4 EPS (USD, non-IFRS) | $1.62 | $1.76 | -7.95% miss |

| Q4 Revenue (USD) | $9.68B | $11.35B | -14.71% miss |

| Q4 Cloud Revenue Growth (cc) | 26% | ~26% consensus | In line |

| Current Cloud Backlog Growth (cc) | 25% | ≥26% expected | Slightly below |

| FY Non-IFRS Operating Profit | €10.42B | €10.3-10.6B outlook | Exceeded |

| FY Free Cash Flow | €8.2B | €7.9-8.4B outlook | High end |

What Leadership Is Saying?

Christian Klein, CEO: “Q4 was a strong cloud quarter, with bookings resulting in 30% Total Cloud Backlog growth to a record 77 billion Euros. The significant Current Cloud Backlog growth in Q4 has laid a strong foundation for accelerating Total Revenue growth through 2027. SAP Business AI has become a main driver for growth as it was included in two thirds of our Q4 cloud order entry, combined with strong AI adoption across the ERP Suite.”

Dominik Asam, CFO: “We closed 2025 on a high note, delivering strong operating profit and free cash flow ahead of our expectations. This performance reflects focused execution, financial discipline, and the continued trust our customers place in us as the North Star for their digital transformation. As evidenced by continued strong growth well ahead of the market in SaaS and PaaS, and our ability to bring such growth down to the bottom line and Free Cash Flow, we are confident that our strategy and operational discipline will continue to drive long-term value creation.”

Historical Performance

SAP Q4 2025 vs Q4 2024

| Category | Q4 2025 | Q4 2024 | Change (%) |

| Total Revenue | €9.59B | €9.38B | +2.3% (9% cc) |

| Net Income (IFRS) | €1.83B | €1.60B | 14.20% |

| Operating Expenses | €4.35B | €4.93B | -11.60% |

| EPS (IFRS) | €1.57 | €1.37 | 14.60% |

| IFRS Operating Profit | €2.55B | €2.02B | +27% |

| Free Cash Flow | €1.09B | -€0.82B | Turnaround |

Enterprise Software Competitors YoY

| Category | SAP Q4 CY2025 | Oracle Q4 FY2025 | Salesforce Q4 FY2025 |

| Revenue | €9.68B (~$10.6B) | $15.9B (+11% YoY) | $10.0B (+8% YoY) |

| Net Income (non-GAAP/non-IFRS) | ~€1.83B | $4.9B (+6% YoY) | N/A (GAAP NI reported) |

| EPS (non-GAAP/non-IFRS) | €1.62 (+16% YoY) | $1.70 (+4% YoY) | ~$2.55 (guided) |

| Cloud Revenue Growth (YoY) | +26% (cc) | +27% | +9% (cc) |

| Operating Cash Flow (FY) | €9.1B | $20.8B | $13.0B |

How the Market Reacted?

Despite strong full-year operational results, SAP’s stock sold off sharply following the Q4 2025 earnings announcement on January 29, 2026. Shares fell approximately 15% in pre-market trading, dropping from a previous close of $236.11 to around $201, as the current cloud backlog growth of 25% (cc) came in below the 26%+ level investors had anticipated and 2026 cloud revenue guidance fell short of bullish expectations.

The selloff reflected disappointment over forward-looking metrics rather than the quarter’s actual financial results, which showed record profitability and free cash flow. As of February 19, 2026, SAP shares trade around $205, well below their 52-week high of $313.28, suggesting the market is still digesting the deceleration narrative despite the company’s announced €10 billion share buyback program.