Introduction

Ralph Lauren Statistics: The Ralph Lauren Corporation serves as an American fashion icon that combines everlasting design elements with modern design elements to create its fashion collections. The brand started in 1967 as a business that sold polo shirts but evolved into a global lifestyle brand that sells products in multiple categories, including clothing, fashion items, household goods, and perfumes. The company proved its ability to endure, which was developed through its operational changes and strong economic performance during the year 2025 when consumer habits started to change, and economic challenges intensified.

The article analyzes Ralph Lauren’s statistics, which will show business performance in 2025 through revenue growth data, profit results, business operations, market research, and audited financial reports, which provide accurate and reliable information.

Editor’s Choice

- Ralph Lauren generated USD 7.08 billion in revenue in FY2025, which shows that the company experienced a strong recovery after the pandemic ended.

- The company’s largest market for FY2025 revenue came from North America, which contributed 43.1% of total sales.

- Europe generated USD 2.17 billion in revenue during FY2025, which established itself as a vital driving force for business expansion.

- The Direct-to-Consumer (DTC) retail segment achieved a revenue increase to USD 4.77 billion during 2025, which exceeded the 9% compound annual growth rate of wholesale operations.

- The retail sector now contributes almost 70% of total revenue, which represents an increase from 63% during the previous five years.

- The company achieved its highest gross profit of USD 4.85 billion during FY2025, which represents a 33% increase over the FY2021 lowest point.

- The company achieved its highest operating income of USD 932 million during fiscal year 2025.

- The adjusted operating margin for the fiscal year 2025 reached 14.0%, which represents a 150 basis points increase compared to the previous year.

- The operating margin for Asia reached 30.7% during the first quarter of fiscal year 2026, which marked the highest margin across all territories.

- The company achieved a net income of USD 743 million for fiscal year 2025, which resulted in an adjusted earnings per share of USD 12.33.

- The company’s total debt decreased to USD 2.67 billion in 2024, which represents a 26% reduction from its highest point in 2020.

- The effective interest rate averaged 1.49%, keeping financing costs manageable.

- The company operates 312 outlet stores globally, with 55% located in North America.

- Asia dominates concession-based shop-in-shops with 671 locations, representing over 95% of the total network.

- Global workforce stabilized at approximately 23,400 employees in 2025, reflecting a leaner operating model.

History Of Ralph Lauren Corporation

- Ralph Lauren Corporation stands as one of the oldest American fashion brands that continues to succeed.

- The company started its operations in 1967 by selling creatively designed neckties, but it has developed into a worldwide lifestyle brand that generates more than USD 4 billion in yearly revenue.

- The brand maintains its position as a luxury brand through its collection, which includes premium men’s and women’s apparel, accessories, footwear, fragrances, and home products.

- Ralph Lauren statistics reveal that the company operates three business segments, which provide equal value to its operations through Wholesale and Retail and Licensing.

- The company achieves global brand visibility through its wholesale distribution network, which supplies major department stores and specialty stores in North America, Europe, Asia, and Latin America.

- The company uses direct-to-consumer retail through flagship stores and shop-in-shops and e-commerce platforms to improve its profit margins while it gains ownership of customer data, which has become a crucial resource in the luxury retail sector.

- Ralph Lauren statistics show that the brand maintains its global presence through multiple revenue sources, which help it withstand economic downturns in specific regions.

- The company demonstrates how heritage branding and controlled distribution, together with strategic licensing, enable luxury brands to achieve sustained growth in their competitive market.

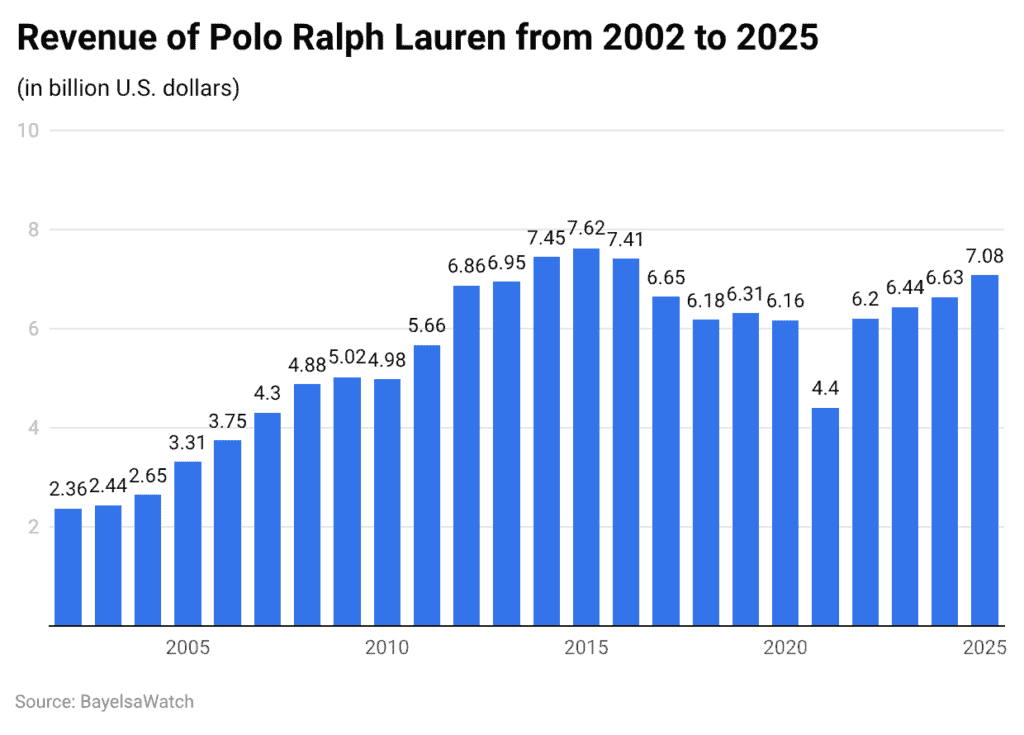

Ralph Lauren Revenue

(Reference: statista.com)

- The latest Ralph Lauren statistics highlight a notable financial rebound. Polo Ralph Lauren achieved USD 7.08 billion in worldwide revenue for the fiscal year ending March 2025, which shows a strong recovery from the pandemic years that caused most fashion companies to experience business declines.

- Between 2020 and 2022, global apparel sales declined sharply because of store closures and supply chain disruptions.

- Ralph Lauren achieved growth through its premium market strategy and direct sales business model.

- The Ralph Lauren statistics demonstrate that the brand maintains its strength to set prices while it meets the renewed demand for luxury and lifestyle products, which currently exists in international markets.

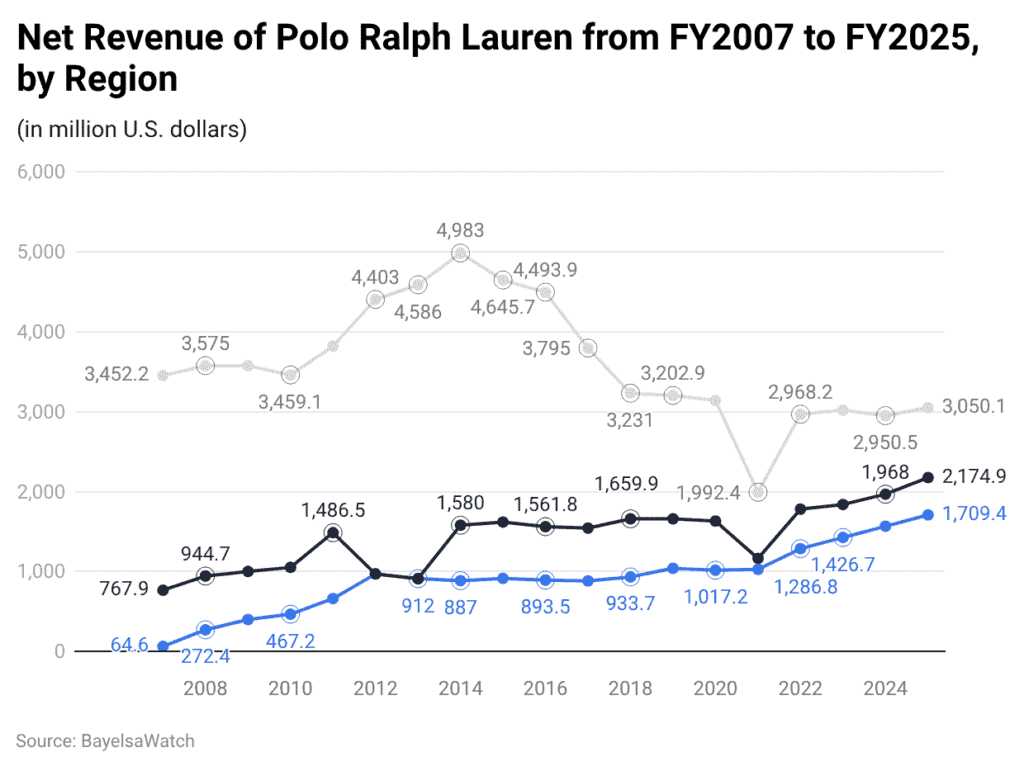

Ralph Lauren Revenue By Region

(Reference: statista.com)

- The latest Ralph Lauren statistics reveal Europe as a critical growth engine for the brand.

- Ralph Lauren achieved nearly USD 2.17 billion in European net revenue during fiscal year 2025, which demonstrates the region’s strong demand for premium lifestyle fashion.

- North America, Europe, and Asia regional expansion since 2007 has enabled better control of currency fluctuations and changes in consumer purchasing patterns.

- European markets show strong luxury demand, which benefits from tourism recovery and planned store openings.

- These Ralph Lauren statistics demonstrate how geographic diversification supports stable long-term growth for the global lifestyle powerhouse.

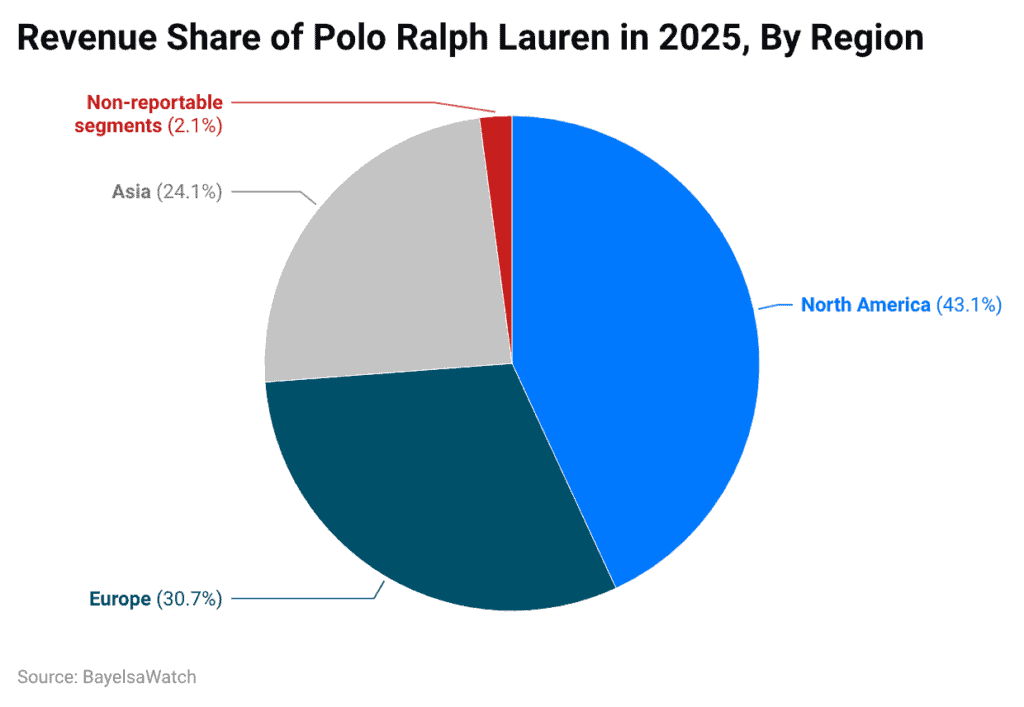

Ralph Lauren Revenue Share By Region

(Reference: statista.com)

- The latest Ralph Lauren statistics show that North America serves as the primary financial foundation for the company.

- The region accounted for 43.1 % of total worldwide net revenue during fiscal year 2025, making it the company’s largest market.

- The U.S. and Canada market concentration exists because of strong brand recognition, established retail systems, and affluent consumers who spend on luxury items.

- North America remains the main source of revenue, although Europe and Asia continue their

expansion. - The Ralph Lauren statistics demonstrate that regional balance matters for the company, but its ongoing home market dependence drives both profitability and expansion.

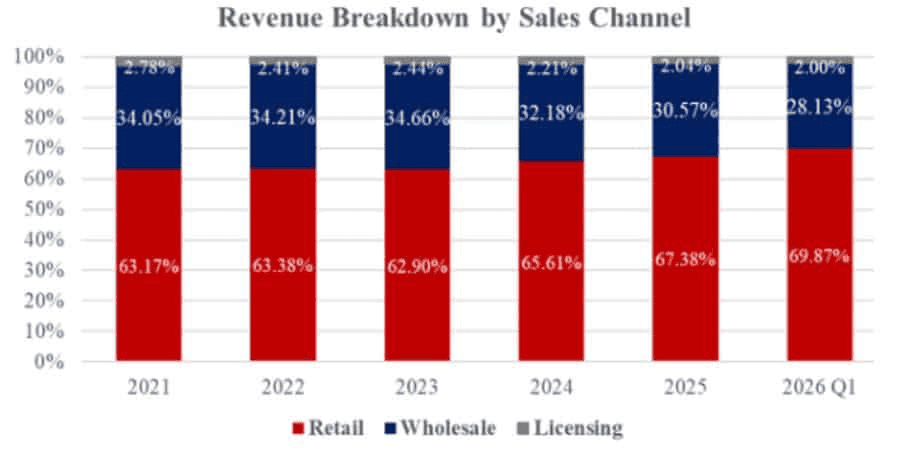

Ralph Lauren Revenue Share By Sales Channel

(Source: seekingalpha.com)

- Ralph Lauren’s current business analysis shows that the company now plans to focus on selling directly to customers.

- The company has achieved revenue growth, which started at USD 6.22 billion in 2022 and reached USD 7.08 billion in 2025 with an average annual growth rate of 6.7% over five years.

- The retail segment of the business delivers the strongest growth because it operates at 9% annual growth, while both wholesale and licensing show lower performance with 2.6% and -0.5% growth rates.

- Retail revenue climbed from USD 3.94 billion in 2022 to USD 4.77 billion in 2025, including a strong 16% surge in 2025 alone.

- The share of total revenue from retail operations increased to almost 70% today from 63% five years ago, which shows that the brand concentrates its efforts on its own retail locations and online sales channels.

- Wholesale revenue has experienced unpredictable changes, including a -4% drop in 2024, while licensing revenue has maintained stability.

- The Ralph Lauren company uses its statistics to show that it focuses on high-margin sales through its own brand-controlled distribution channels.

- The luxury market competition forces Ralph Lauren to build its DTC operations, which will boost its pricing control, customer data access, and future profit growth.

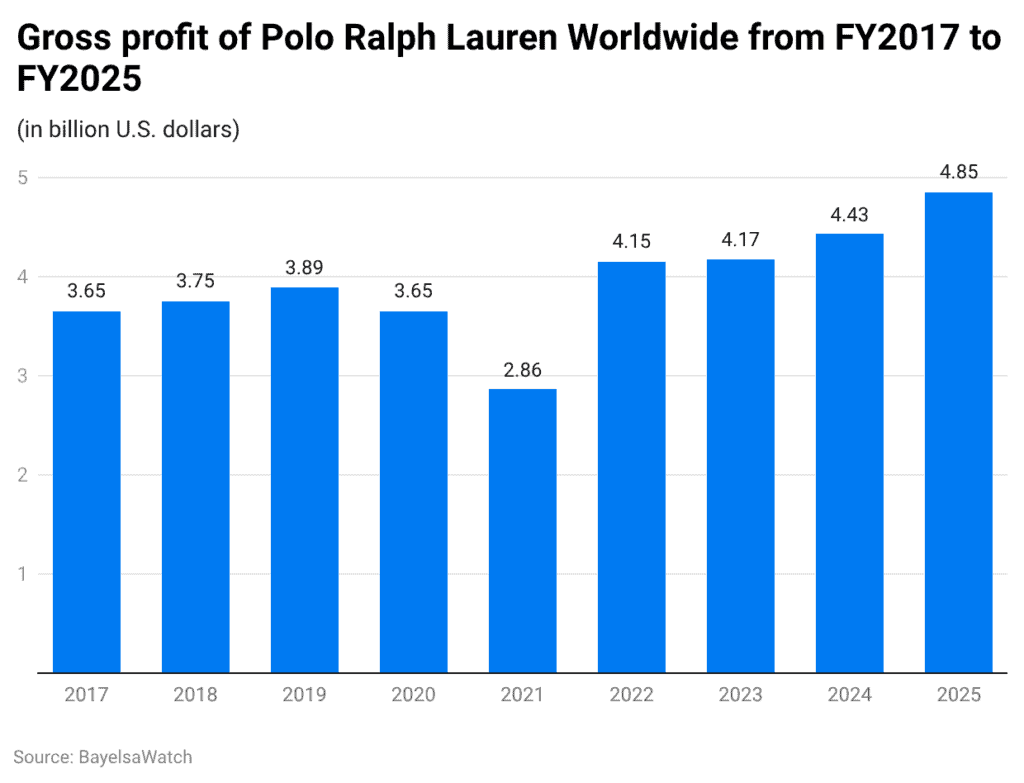

Ralph Lauren Gross Profit

(Reference: statista.com)

- The provided Statista chart demonstrates Ralph Lauren’s financial data, which shows sustained profitability growth throughout the company’s history.

- The company recorded its highest gross profit of USD 3.89 billion during FY2019 after starting with USD 3.65 billion in FY2017 and experiencing a drop to USD 2.86 billion during FY2021 because of pandemic-related interruptions.

- The company reported a profit of USD 4.15 billion for FY2022, which increased to USD 4.17 billion in FY2023 and reached USD 4.43 billion in FY2024 before achieving a record profit of USD 4.85 billion in FY2025.

- The current figure shows a 33% increase, which started from the low point of FY2021. The earnings growth of Ralph Lauren results from enhanced pricing methods, better direct-to-consumer profit margins and effective expense control.

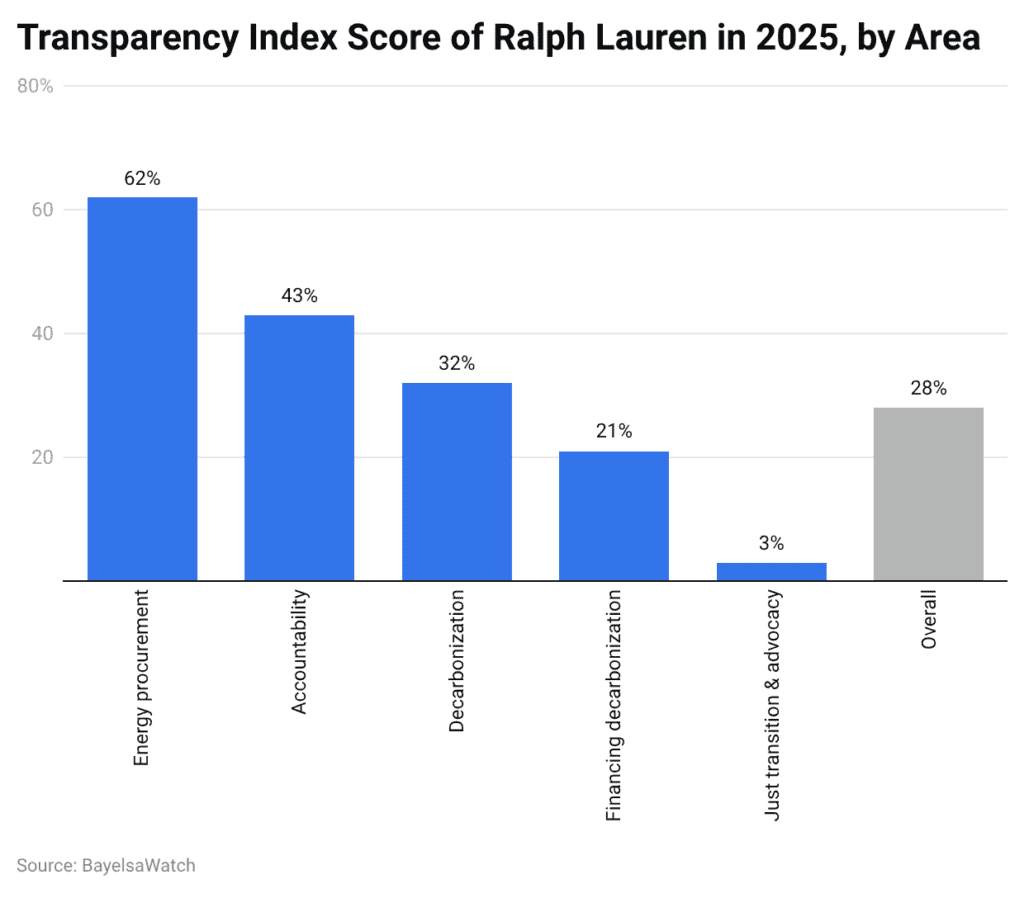

Ralph Lauren Transparency Index Score

(Reference: statista.com)

- The most recent Ralph Lauren transparency data shows sustainability results that demonstrate both positive and negative aspects.

- The company achieves its highest performance level through energy procurement practices, which reach 62% because they disclose details about their renewable energy sources and energy management methods.

- The organization shows 43% accountability, together with 32% progress in decarbonization efforts, which shows they need better emissions targets and measurable outcomes.

- The organization has allocated only 21% of its resources for decarbonization research, whereas the funding for “just transition & advocacy” activities exists at a low level of 3%.

- The organization has reached the initial transparency level because its total transparency score stands at 28%.

- The Ralph Lauren statistics indicate that the company needs to enhance its climate governance and sustainability disclosure practices for its long-term operations.

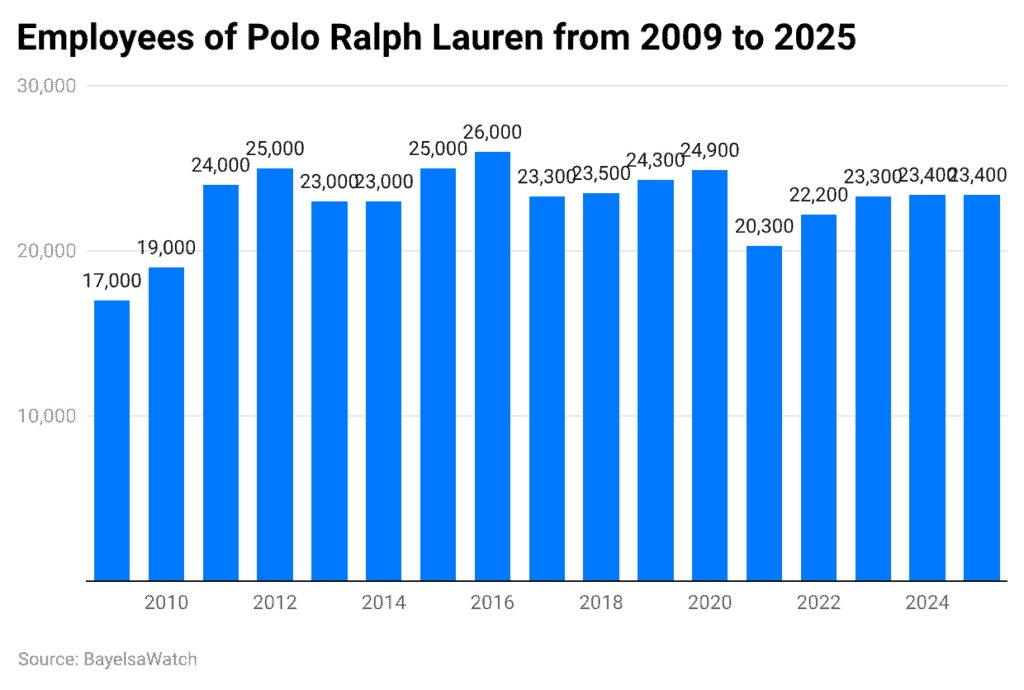

Ralph Lauren Employees

(Reference: statista.com)

- The latest Ralph Lauren statistics demonstrate that their workforce has experienced three different stages, which included periods of expansion and contraction and a time of stable employment, which matched their strategic business goals.

- The employee numbers increased from 17000 in 2009 to 26000 in 2016 because the company pursued aggressive international business expansion.

- The staff numbers reached a peak of 23000 to 25000 before they experienced a steep decline, which brought them down to 20300 in 2021 because of pandemic-related organizational changes.

- The organization has been increasing its workforce until 2025, when it achieved a staffing level of about 23400 employees.

- The operating system of Ralph Lauren operates with a more efficient model, which provides cost savings while supporting the company’s efforts to expand its retail business and direct-to-consumer operations.

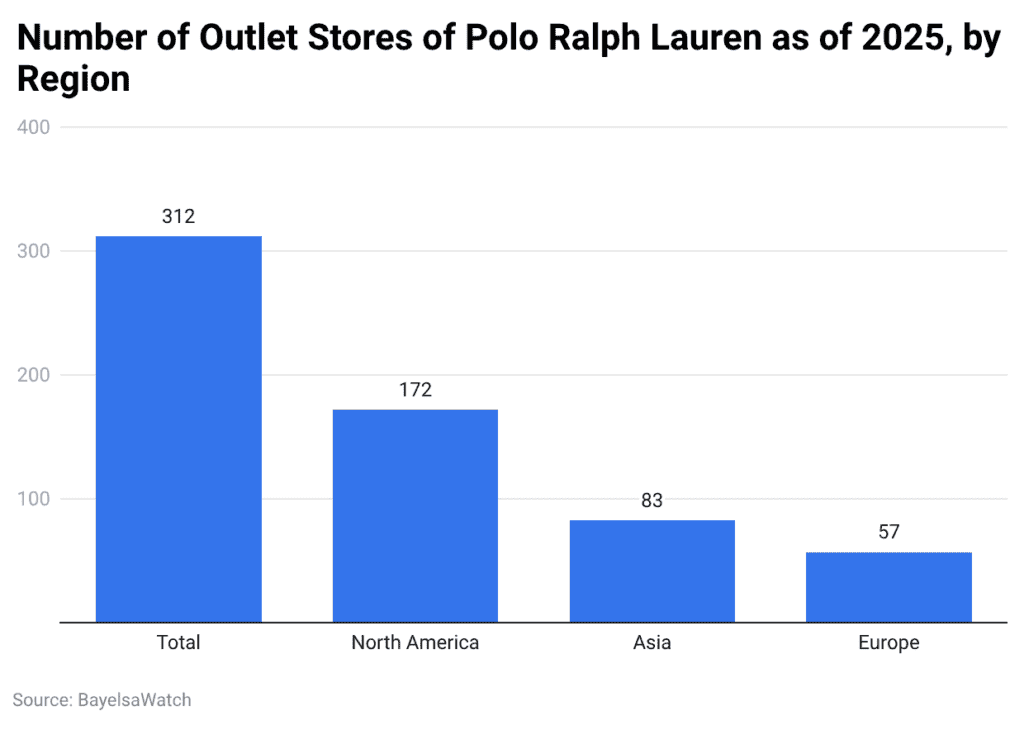

Number Of Ralph Lauren Outlet Stores By Region

(Reference: statista.com)

- The latest Ralph Lauren statistics demonstrate that the company operates outlets that extend across multiple regions but maintain a North American focus as their primary market.

- The company runs 312 outlet stores worldwide as of 2025, with 172 stores located in North America, which represent approximately 55 % of their total store count.

- Asia has 83 locations, which account for 27 % of the total, while Europe operates 57 stores, which represent 18 % of the total.

- The United States market shows a greater level of brand development and outlet store presence, which demonstrates that discount luxury products have a secure customer demand.

- The global analysis of Ralph Lauren statistics demonstrates that outlet stores serve as an important method for businesses to manage their inventory while protecting their profit margins and gaining new customers.

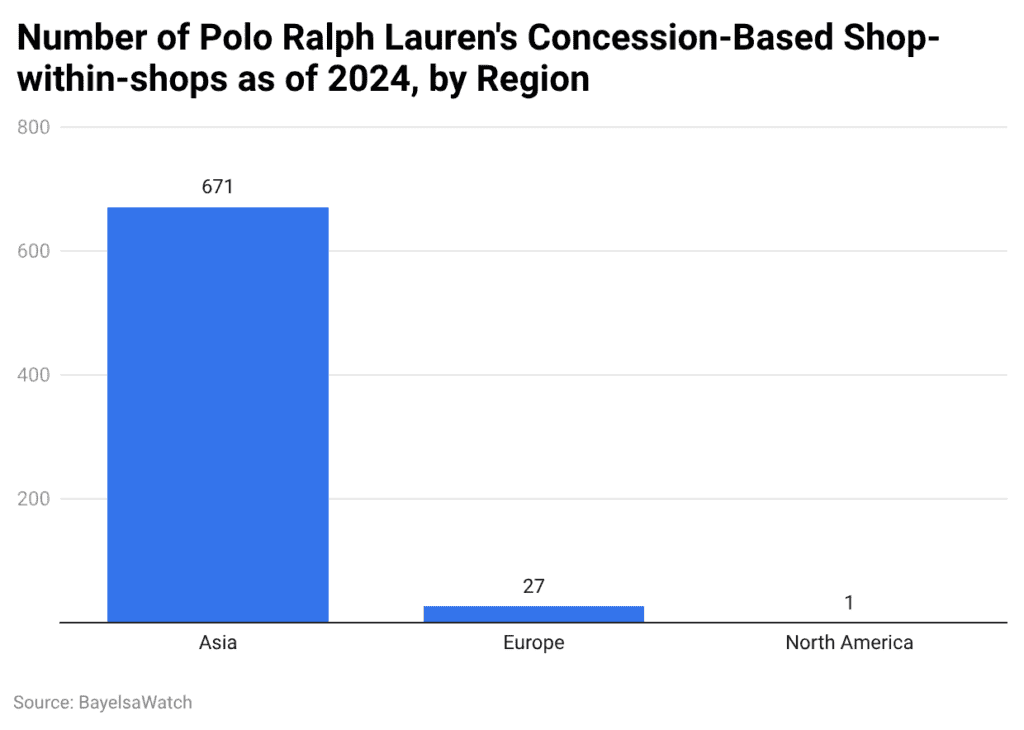

Ralph Lauren’s Number Of Concession Based Shop Within Shops By Region

(Reference: statista.com)

- The Ralph Lauren statistics show that concession-based shop-in-shops have been distributed unevenly across different regions.

- Asia operates 671 units, which constitute more than 95 % of the global footprint from the total network of 699 locations.

- Europe follows distantly with 27 locations, while North America has just 1 concession-based shop-in-shop.

- The distribution demonstrates that department store partnerships and premium mall formats hold essential value for Asian markets.

- The Ralph Lauren statistics show that the brand uses concession models to develop its presence across Asian markets, which experience rapid growth while achieving financial efficiency and developing retail operations that suit local conditions.

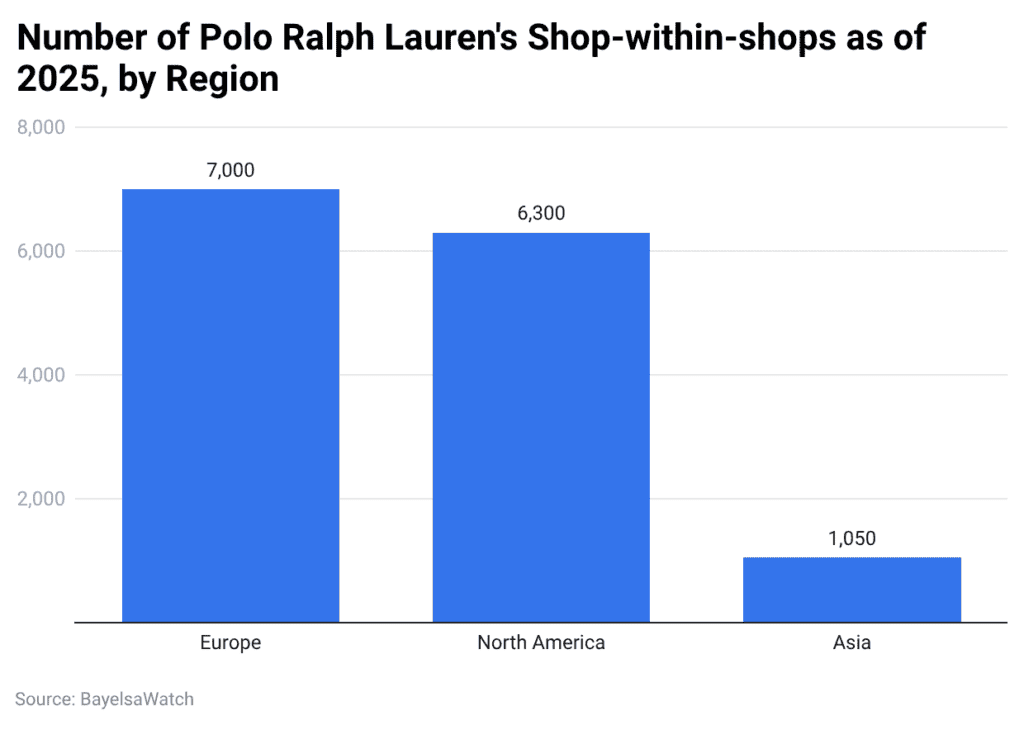

Ralph Lauren’s Number Of Shops Within Shops By Region

(Reference: statista.com)

- The current Ralph Lauren statistics demonstrate that the shop-within-shop model functions as a critical business operation for the company.

- The company operated approximately 6,300 shop-within-shops across North America as of March 2025, which demonstrates its deep operational connections with department store networks.

- Ralph Lauren uses this format to manage all aspects of merchandise display and customer service while avoiding the expenses of operating an independent retail outlet.

- The company uses its licensing partners together with its internal business operations to achieve better market visibility and cost-effective business operations.

- Ralph Lauren statistics demonstrate that the shop-within-shop method helps the company maintain its premium market status while building stronger relationships with wholesale partners and maintaining a unique brand identity throughout different retail markets.

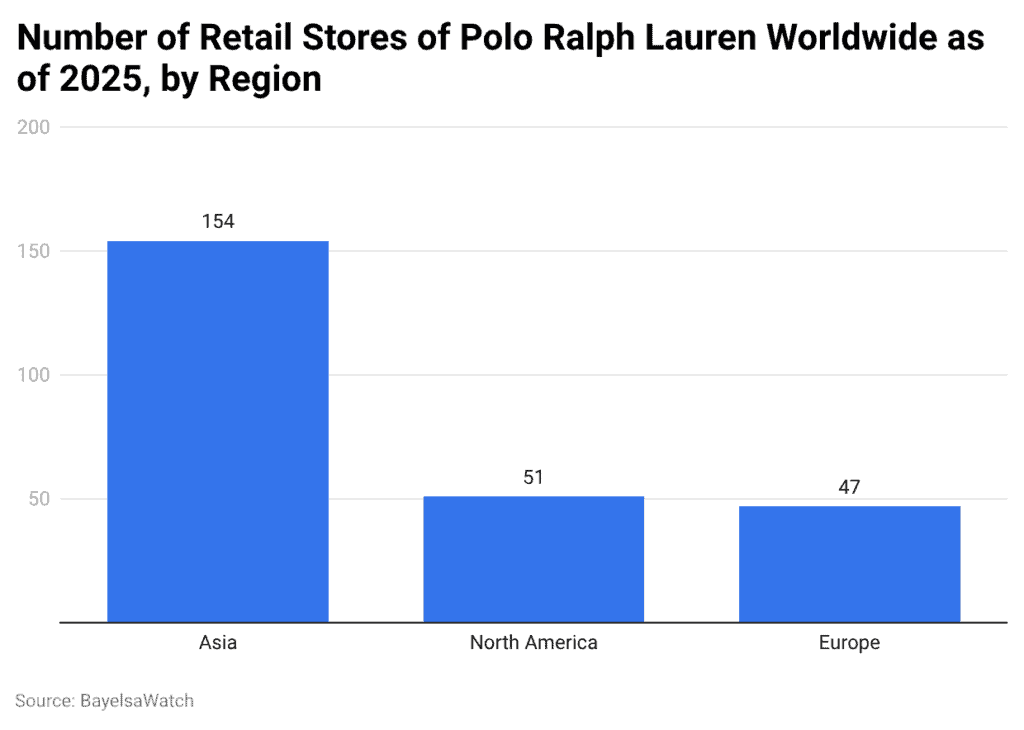

Ralph Lauren Retail Outlets By Region

(Reference: statista.com)

- The retail presence in Asia currently leads all three regions with 154 stores, accounting for 61% of the total. North America follows with 51 stores, while Europe operates 47 locations.

- The business strategy focuses on Asia, which includes emerging luxury markets, a growing middle-class consumer base, and well-established shopping mall systems.

- The Ralph Lauren statistics show that the company focuses on direct control of its brand and premium market presence in Asia, while it operates a limited and efficiency-based approach to Western market expansion.

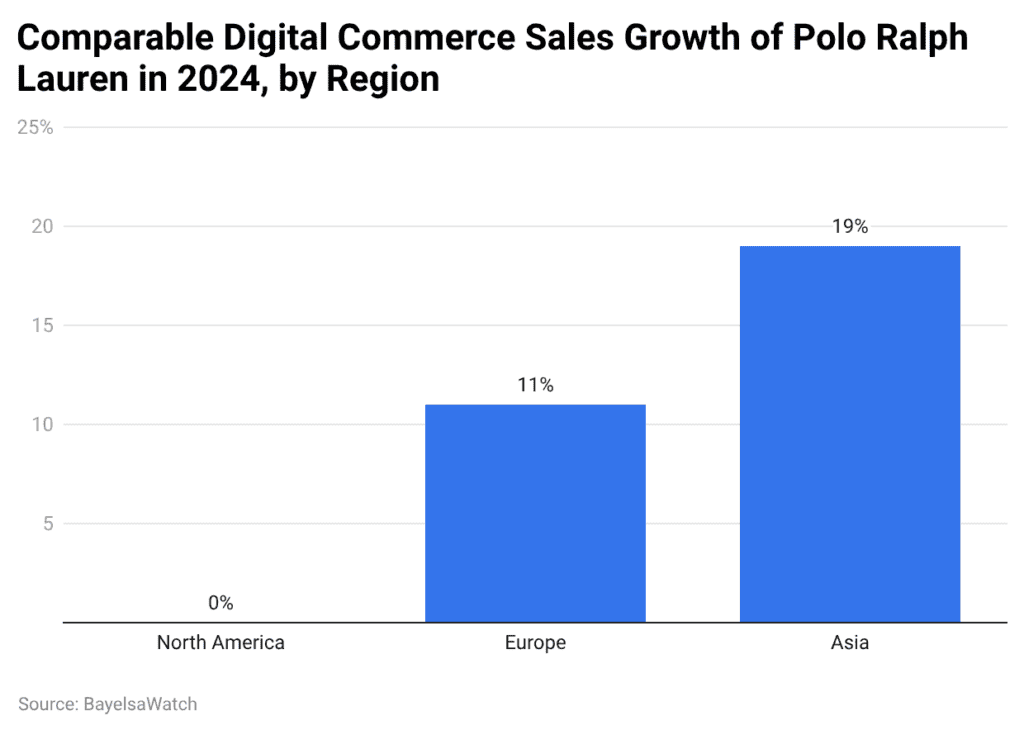

Ralph Lauren E-Commerce Sales By Region

(Reference: statista.com)

- The Asian market showed strong digital growth in 2024 with a 19 % year-over-year increase, which indicates that more customers are shopping online through their mobile devices to purchase luxury goods in China and Southeast Asian markets.

- The digital growth of North America remained unchanged because the market had reached maturity, and the year-over-year comparisons became more challenging.

- The Ralph Lauren statistics show that Asia serves as the main force driving online growth, while North America focuses on optimizing its business processes, retaining customers, and safeguarding its profit margins.

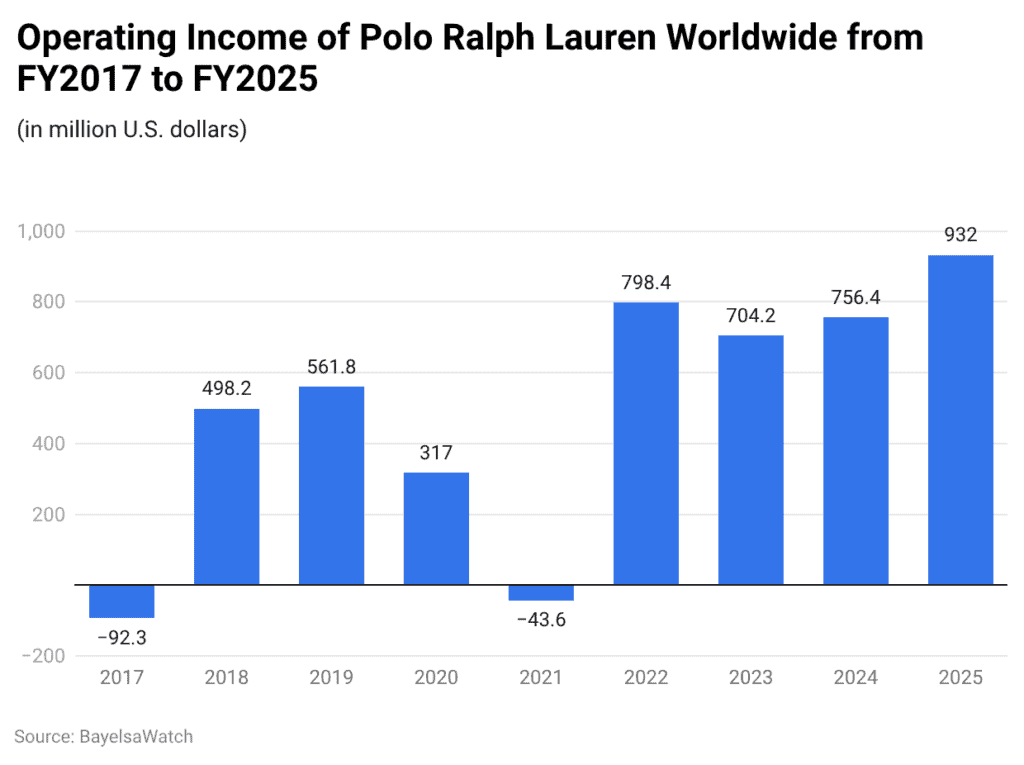

Ralph Luren Operating Profit

(Reference: statista.com)

- Ralph Lauren statistics show that the company achieved a complete turnaround of its operational profits.

- The company reported operating losses of USD 92.3 million in FY2017 and USD 43.6 million in FY2021 because of the financial impact from its restructuring efforts and the business interruptions caused by the pandemic.

- The performance showed strong recovery to reach USD 798.4 million in FY2022 before it decreased to USD 704.2 million in FY2023 and then increased to USD 932 million in FY2025, which represented the highest total during that time frame.

- The period from FY2022 to FY2025 shows a more than 30 % increase.

- Ralph Lauren’s statistics state that the company improved its cost management abilities, maintained its ability to charge higher prices, and developed better operational efficiencies across its worldwide business operations.

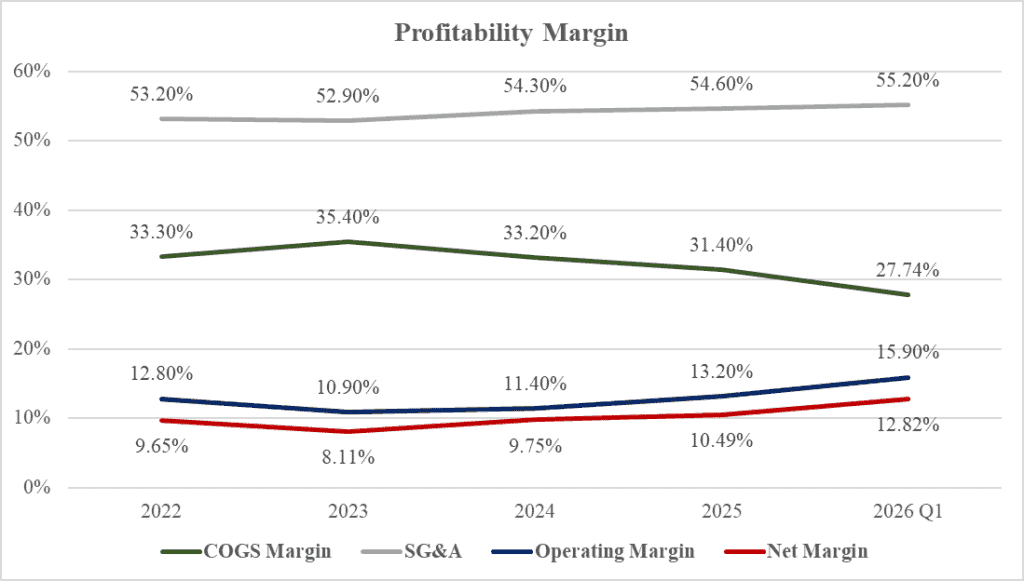

Ralph Lauren Margin Performance

(Source: seekingalpha.com)

- Ralph Lauren’s recent statistics indicate that the company has begun its transition into a period of better profitability.

- The company’s operating margin increased by 2.1 % when comparing Q1 FY2026 results to the same period from the previous year, while net margin experienced a 1.67 % increase, which showed the company’s success in maintaining its cost structure and pricing power.

- The most significant change occurs through the cost of goods sold (COGS), which dropped from 33% of revenue in 2022 to 27.74% in the latest quarter, a major improvement in operational structure.

- The efficiency improvement has completely balanced out the small increase in SG&A costs, which occurred because of marketing activities and newly opened retail locations.

- The Asian market exhibits strong margin growth because its operating margin increased to 30.7% in 2026 Q1 after starting at 17.8% in 2022, which created the highest profit level across all markets.

- European economic conditions showed consistent improvements until they reached 26.4%, whereas North America maintained a constant rate of 20.6% after experiencing business disruptions during the pandemic.

- Ralph Lauren statistics provide evidence for a company’s operational growth and its ability to enhance supply chain operations and maintain a high-value brand.

- The margin path establishes that the company will maintain its long-term profit stability while its worldwide market expansion will create more profit opportunities.

Ralph Lauren Debt Collections

| Debt Calculations | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

| Short-Term Borrowings | 475 | – | – | – | – | – |

| Current Portion of LT Debt | 300 | – | 500 | – | – | 400 |

| Current Portion of Lease Obligations | 298 | 323 | 282 | 287 | 265 | 246 |

| Long-Term Debt | 396 | 1,633 | 1,137 | 1,139 | 1,141 | 743 |

| Capital Leases | 1,758 | 1,665 | 1,474 | 1,456 | 1,270 | 1,280 |

| Total Debt | 3,227 | 3621 | 3,392 | 2,882 | 2,675 | 2,668 |

(Source: seekingalpha.com)

- The financial performance of Ralph Lauren shows evidence that the company handles its debt more effectively, while its financial management practices show better results.

- The company’s total debt reached its highest point of USD 3.62 billion in 2020 because the company had to manage USD 1.63 billion in long-term debt and USD 1.67 billion in capital leases during the pandemic.

- The company has maintained its process of decreasing debt until now by achieving a debt reduction that brings its total debt to around USD 2.67 billion in 2024.

- The company holds capital leases worth USD 1.28 billion as a major financial obligation in 2024, while its long-term debt obligation decreased to USD 743 million, which shows better management of liquidity resources.

- The organization can sustain its current debt level of USD 2.67 billion because its interest expenses will stay under control with a 1.49% interest rate against operating income, which exceeded USD 900 million during the previous years.

- The Ralph Lauren statistics show a stronger capital structure, reduced refinancing risk, and improved balance sheet strength.

Ralph Lauren’s Operating Income And Net Income Growth

- Ralph Lauren statistics highlight a year of meaningful profitability acceleration. The company reported its operating income for Fiscal 2025 as USD 932 million.

- Adjusted operating income increased to USD 990 million, which resulted in a 14.0% profit margin, after the company achieved a 150-basis-point profit margin increase compared to the previous year.

- The company achieved margin expansion because it now controls its expenses better while gaining better product pricing power through its improved product selection.

- North America produced USD 640 million in operating income, which resulted in a margin increase to 21.0% that surpassed the previous year by 240 basis points.

- Europe achieved USD 566 million in revenue at a 26.0% profit margin, which increased 240 basis points despite facing a 30-basis-point foreign currency challenge.

- Asia achieved USD 413 million in operating income with a 24.2% profit margin, which grew 280 basis points from the previous year despite a 50-basis-point currency effect.

- The company shows operational strength through its worldwide operations and growing brand recognition.

- The company netted USD 743 million in net income, which equals USD 11.61 per diluted share, but this result shows a rise from the previous fiscal year when the company reported USD 646 million in profit that equated to USD 9.71 per share.

- The adjusted EPS for the company increased to USD 12.33 from USD 10.31 because the company experienced earnings growth that reached double-digit percentages.

- The effective tax rate increased to 22%, compared with 17% reported in the prior year, largely due to the absence of discrete tax benefits.

Government Policies Shape Ralph Lauren’s Global Operating Environment

- Ralph Lauren’s international business operations depend on government regulations, which determine its operational framework.

- The political landscape plays a significant role in determining the performance data that Ralph Lauren uses to evaluate its business results.

- Ralph Lauren operates as a worldwide clothing manufacturer that faces different employment regulations and taxation systems and international trade regulations throughout its operations in North America.

- America, Europe, and Asia. Stricter labor regulations that require higher minimum wages and better workplace safety standards will drive up production and sourcing expenses, which will decrease gross margins.

- A minor increase of 1 to 2 % in operating costs will have a major effect on profit margins for any business that generates more than 7 billion dollars in yearly revenue.

- Pro-business tax reforms and corporate tax rate reductions enhance net income and earnings per share growth based on previous years, which showed effective tax rates that ranged from 17% to 22%.

- The importance of trade policies matches their economic implications.

- Lower tariffs create better import/export operations, which help maintain supply chain flexibility, while protectionist actions lead to higher input expenses, which reduce profit margins.

- Ralph Lauren’s long-term data shows how external factors impact its operating margins and expense patterns across different regions.

- The ongoing political leadership, together with the established policy direction, creates a direct impact on multiple areas, which include sourcing strategies, pricing models, and geographic investment decisions.

- Companies must maintain operational flexibility to compete successfully in international brand markets.

Conclusion

Ralph Lauren Statistics: Ralph Lauren has achieved its 2025 performance target because the brand successfully moved from its recovery phase to a period of controlled development. The company presents its ability to set prices and manage operations through its financial performance, which includes USD 7.08 billion in revenue and USD 4.85 billion in gross profit, growing operating margin,s and a stronger balance sheet position. The company uses its capital allocation model to drive future growth through its direct-to-consumer business model and expansion into Asia, and its plans for margin optimization.

Ralph Lauren maintains its long-term earnings capacity through three elements, which include its global presence in multiple regions, its continuous debt reduction, and its status as a high-end brand. The data indicate that the global luxury enterprise has developed into a more robust and resilient organization that operates at a higher structural capacity.