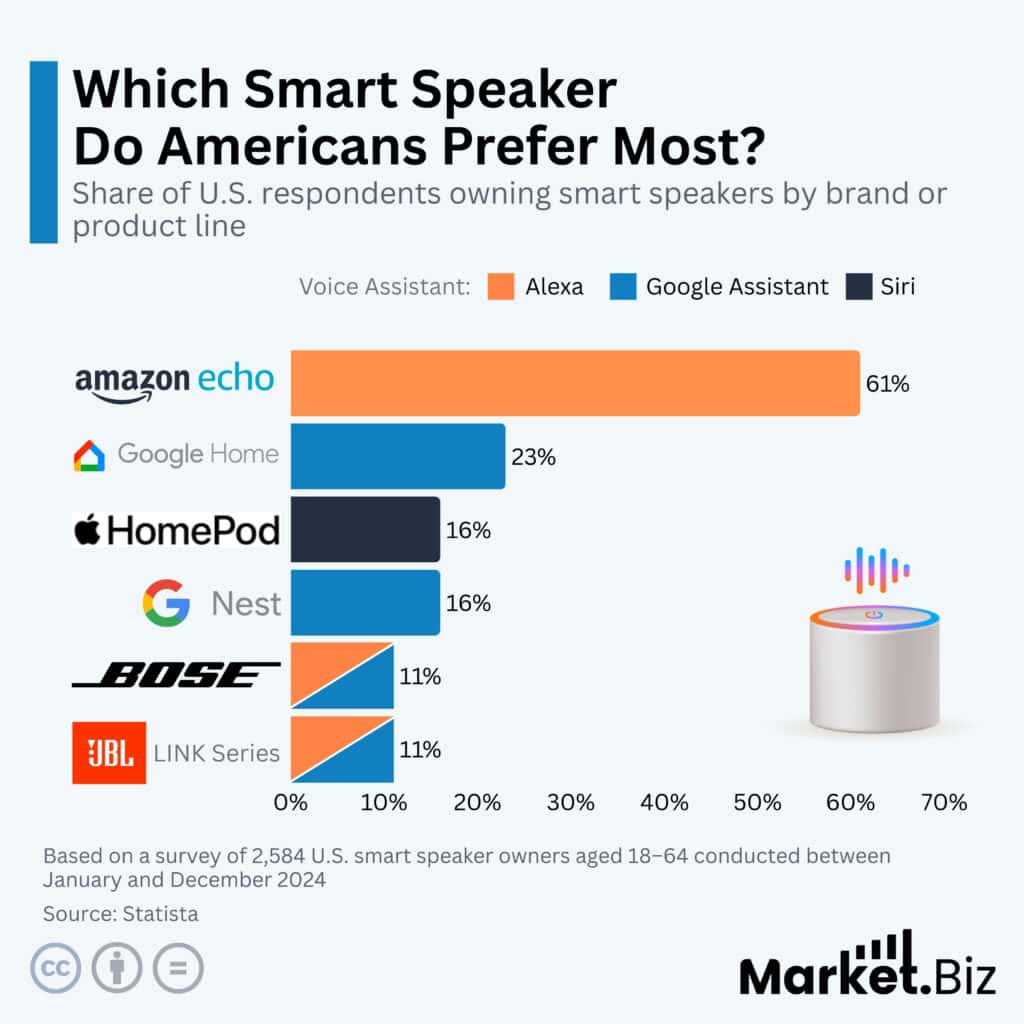

Amazon Echo remains the clear market leader in the U.S. smart speaker landscape. From late 2024 through early 2026, Amazon Echo devices accounted for 65-67% of total smart speaker ownership, with an estimated 101 million American users aged 12 and above. Household penetration has remained stable at approximately 35% since 2022, reflecting a mature yet resilient adoption base.

Amazon’s leadership is primarily driven by early market entry, competitive pricing such as the Echo Dot at $49.99, and deep Alexa integration across more than 100 million connected devices. This scale continues to place Amazon well ahead of Google Nest, which holds roughly 17 to 27%, and Apple HomePod, at 15 to 21%. Industry surveys consistently indicate higher single- and multi-device ownership rates for Alexa-powered speakers.

Recent product updates from major brands indicate ongoing innovation, while the U.S. smart speaker market continues to expand alongside smart home adoption in more than 103 million households. Despite rising competition, independent surveys confirm Amazon’s preference advantage remains structurally strong, reinforcing its position as the most trusted and widely used smart speaker brand in the United States.

Key Takeaways

- Around 35% of the U.S. population aged 12+ owns at least one smart speaker, which is commonly summarized as roughly 101 million people.

- Amazon Echo is most often reported as the leading smart speaker brand in the U.S., with ownership share commonly cited in the 65% to 67% range among smart speaker owners.

- Google Home and Google Nest are typically reported as the next-largest ecosystems, with figures commonly shown at around 24% for Google Home and 17% for Google Nest in brand-ownership snapshots, while some summaries cite Google Home at nearly 27%.

- Apple HomePod ownership is often shown in the high teens to low 20% range, such as 18%, 19%, or 21%, depending on the survey and measurement approach.

- A commonly cited ownership split for U.S. adults reports that about 23% own an Amazon Alexa device, about 11% own a Google Nest device, and about 2% own an Apple HomePod. It is also noted that multi-brand ownership can occur.

- U.S. smart speaker ownership by age has been reported to peak at 24% for ages 45–54 and at around 22% for ages 55+, in a widely cited smart audio study.

- Estimated U.S. Alexa user counts vary by source; one widely cited forecast projected approximately 75.6 million U.S. Alexa users in 2024.

- One U.S. market estimate valued the smart speaker market at $5.987B in 2024 and projected $28.19B by 2033, implying a 20.77% CAGR over that period.

- One forecast projected that the number of U.S. smart home users could reach 103.15 million by 2028, representing about a 65% increase over the prior year referenced in that report.

- Global smart speaker shipments are projected at approximately 156 million units in 2025, representing about 4% year-over-year growth.

- Smart speaker use is often driven by audio: one study reports that 58% of owners use smart speakers to listen to music, and another reports 66% use them to listen to news.

- Common U.S. pricing references list the Echo Dot (5th Gen) at $49.99 and the Echo Studio at $199.99 (prices may vary by retailer and promotions).

Source: Market.Biz (Which Smart Speaker Do Americans Prefer Most?)

Current Market Dominance

Recent research indicates that Amazon Echo remains the dominant choice among American smart speaker users. From 2024 to 2026, surveys indicate that 65% of U.S. households own an Echo device, amounting to approximately 67 million active devices. This figure demonstrates Amazon’s growing lead, particularly compared with previous years, when its market share hovered around 70% between 2019 and 2021.

One reason for Amazon’s continued success is its broad product range, which caters to diverse budgets. For example, the Echo Dot is priced at $49.99, while the high-end Echo Studio costs $199.99. The Alexa ecosystem is also robust, supporting 71.4 million users and 100 million connected devices as of March 2024.

Google Nest smart speakers hold a smaller market share, with 17–27% of US households using them (split as 24% for Google Home and 17% for Nest). Users are drawn to Google Assistant’s advanced natural language processing features. Apple’s HomePod has a 15–21% share, mainly among iOS users, and is known for its high-quality audio, including spatial sound in the second-generation model, which sells for $299.

Smart speaker adoption in the US reached 35% of people aged 12 and above in 2025, representing 101 million users. This rate has remained steady since 2022, even as the number of smart homes grew to over 103 million. Recent product improvements include Amazon’s Echo Pop ($60, featuring a faster AZ2 processor), Apple’s second-generation HomePod Mini (now with temperature and humidity sensors), and Google’s updates to Nest Audio for improved AI-powered sound.

Product reviews from sources like RTings and CNET consistently rank Echo Studio as the top overall smart speaker. The JBL Authentics 500 is notable for supporting both Alexa and Google Assistant, whereas Sonos Era models are praised for their high-fidelity sound. However, Amazon Echo remains the most popular choice among the general public.

Multi-device ownership is increasingly common, with 41% of users owning two or more smart speakers at home. Daily usage is high, particularly for music: 58% of owners (approximately 72 million households) use their speakers daily. North America accounts for 41.3% of the global smart speaker market, with the US leading thanks to a wide range of Alexa-compatible devices and strong growth in voice-activated shopping, which is growing at 22.7% per year.

Competitive Comparison

| Feature/Metric | Amazon Echo | Google Nest | Apple HomePod |

| Context Window | 1M tokens (Alexa LLM) | 1M tokens (Gemini) | 200K tokens (Siri) |

| Pricing per 1M Tokens | $0.0025 input/$0.003 output | $0.0001 input/$0.0005 output | N/A (ecosystem-locked) |

| Multimodal Support | Voice + limited vision (Echo Show) | Voice + video (Nest Hub) | Voice + spatial audio |

| Agentic Capabilities | Routines, skills, smart home hub | Adaptive routines, Matter | HomeKit automation |

Amazon Echo wins in market penetration and affordability for high-volume users, while Google Nest leads cost-effectiveness and multimodal integration; HomePod excels in audio premium but lags in openness.

Reasons Behind Amazon’s Market Leadership

Amazon’s continued dominance in the US smart speaker market can be traced back to its early entry, as the Echo was first released in 2014. This early start enabled Amazon to quickly capture more than 70% of the market. The company’s focus on affordability also played a major role—nearly half (48%) of smart speaker owners use the budget-friendly Echo Dot. Alexa, Amazon’s voice assistant, is now available on over 100 million devices, reinforcing the brand’s presence in households.

The Amazon ecosystem encourages users to remain loyal to its products. At present, 23% of U.S. adults own an Echo, compared with 11% with Google Nest and 2% with Apple HomePod. One major reason is that 27% of buyers say integration with other smart home devices is important, and Alexa supports more brands and products than its competitors.

Amazon also leads in several key metrics: 65% of US smart speaker owners use Echo devices, and there are 71.4 million Alexa users. In comparison, Google reached a peak market share of 31% in shipments, which has declined since 2021.

Other factors that help Amazon retain its users include strong privacy features, support for multiple languages, and a large set of Alexa “skills” (over 60,000). These features contribute to high engagement: 52% of Echo owners use their device daily, and listening time has increased by 400% in recent years.

Future Outlook

Looking ahead, Amazon is expected to remain the leader in the US smart speaker market through 2030. The market itself is projected to reach $28 billion by 2033, growing at an annual rate of 20.77%. However, Google could become a stronger competitor by enhancing its artificial intelligence through Gemini AI and by offering more affordable devices. If new standards such as Matter help unify smart home systems, Google’s market share could rise to 30%.

Apple’s HomePod may also experience growth, potentially reaching a 25% market share if Apple’s new multimodal intelligence features are successful. However, Apple’s closed ecosystem may limit this growth. Overall, the percentage of Americans with smart speakers may decrease slightly to 30.8% as the market becomes saturated and more people focus on upgrading their current devices rather than purchasing new ones. Advanced features like AI agents with 95% accuracy are expected to drive these upgrades.

By 2025, global shipments of smart speakers are projected to reach 156 million units. Growth in voice-based shopping is likely to continue at an annual rate of 22.7%, and improvements in privacy will be important in shaping consumer preferences. Amazon is likely to maintain its lead if Alexa continues to add new features, but Google and Apple could gain ground if they focus on better audio quality and advanced technology.

Conclusion

As a market analyst, Amazon Echo remains the clear US preference at 65%+ share, but intensifying AI/multimodal competition from Google Nest signals potential share erosion by 2027—track Matter adoption and pricing for investment cues.