Kenvue (NYSE: KVUE) beat Wall Street estimates for Q4 2025, posting adjusted EPS of $0.27 vs. the consensus $0.22 – a 22.7% upside surprise. Revenue of $3.78 billion topped the $3.68 billion estimate, rising 3.2% year-over-year. Full-year adjusted EPS was $1.08, down from $1.14 in FY 2024, while net sales declined 2.1% to $15.12 billion. The company announced a 3.5% global workforce reduction (~770 jobs) ahead of its pending $48.7 billion acquisition by Kimberly-Clark, and will not provide forward-looking guidance.

About Kenvue

Kenvue Inc. (NYSE: KVUE) is the world’s largest pure-play consumer health company by revenue, built on more than a century of heritage from its former parent Johnson & Johnson. Headquartered in Summit, New Jersey (formerly Skillman, NJ), the company was incorporated in 2022 and began trading publicly on the NYSE in May 2023 following a $41 billion IPO. Kenvue operates through three segments – Self Care, Skin Health and Beauty, and Essential Health with iconic science-backed brands including Tylenol, Motrin, Listerine, Neutrogena, Aveeno, BAND-AID, Johnson’s, Zyrtec, and Nicorette.

As of February 17, 2026, Kenvue carries a market capitalization of approximately $35.3 billion, with approximately 1.92 billion shares outstanding. The stock trades at a P/E ratio of ~24.2 (trailing) and a forward P/E of ~16.5. The company pays an annualized dividend of $0.83 per share, yielding approximately 4.5%. Kenvue employed roughly 22,000 people as of the end of fiscal 2024, though the newly announced restructuring will reduce that by about 3.5%. In November 2025, Kimberly-Clark agreed to acquire Kenvue for approximately $48.7 billion ($21.01 per share in cash and stock), with the transaction expected to close in H2 2026.

Top Financial Highlights

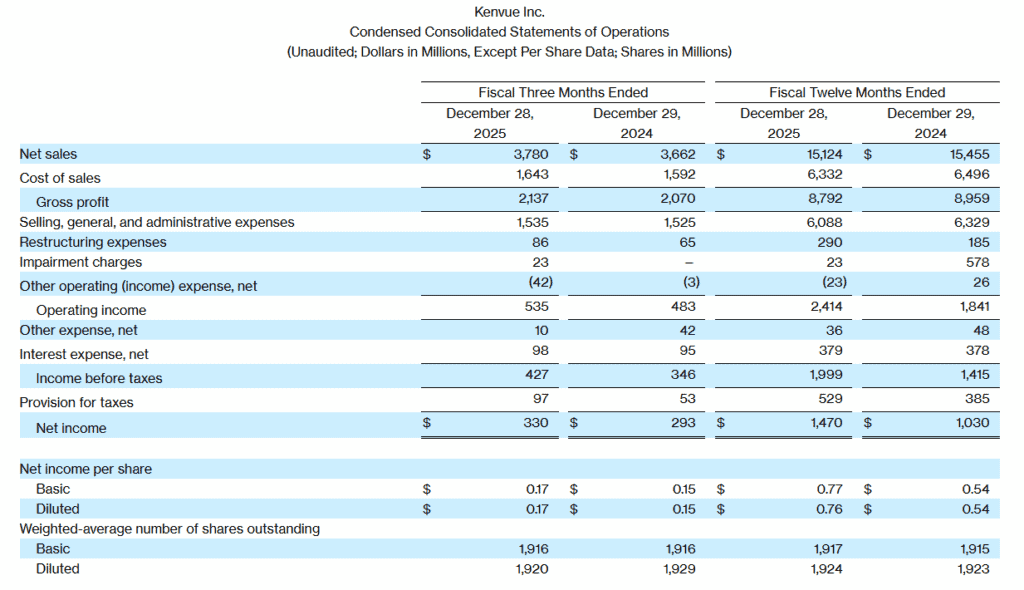

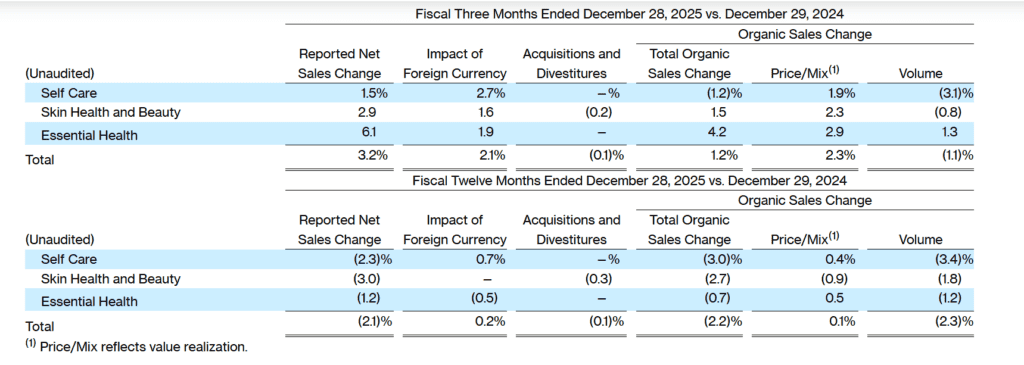

- Q4 Net Sales reached USD 3.78 billion, up 3.2% YoY. Growth included 1.2% organic expansion and a 2.1% foreign currency benefit.

- Q4 Organic Sales increased 1.2%, supported by 2.3% favorable price and mix realization. This was partially offset by a 1.1% decline in volume.

- Q4 Gross Profit was USD 2.137 billion reported and USD 2.224 billion adjusted. Reported gross margin remained at 56.5%, while adjusted margin improved to 58.8%, up 10 basis points YoY.

- Q4 Operating Income totaled USD 535 million reported and USD 751 million adjusted. Operating margin improved to 14.2%, compared to 13.2% last year, while adjusted operating margin rose to 19.9% from 19.2%.

- Q4 Net Income stood at USD 330 million reported and USD 513 million adjusted.

- Q4 Diluted EPS was USD 0.17 reported and USD 0.27 adjusted, exceeding consensus estimates of USD 0.22 by 22.7%.

- FY2025 Net Sales reached USD 15.124 billion, down 2.1% YoY. Organic sales declined 2.2% during the year.

- FY2025 Net Income increased to USD 1.47 billion reported, up 42.7% YoY, and USD 2.076 billion adjusted.

- FY2025 Diluted EPS rose to USD 0.76 reported, compared to USD 0.54 in the prior year. Adjusted diluted EPS was USD 1.08, compared to USD 1.14 previously.

- FY2025 Operating Cash Flow improved to USD 2.2 billion, compared to USD 1.8 billion in FY2024.

- FY2025 Free Cash Flow increased to USD 1.7 billion, up from USD 1.3 billion in the prior year.

- Cash on Hand stood at USD 1.1 billion as of December 28, 2025.

- Total Debt declined slightly to USD 8.5 billion, from USD 8.6 billion.

- In Q4, Essential Health led with 6.1% net sales growth. Skin Health and Beauty increased 2.9%, while Self Care rose 1.5%.

- The Board approved a 3.5% global workforce reduction. Approximately USD 250 million in pre tax restructuring charges are expected in 2026.

Condensed Consolidated Statements of Operations

Organic Sales Change

Beat or Miss?

| Metric | Reported | Analyst Estimate | Difference |

| Q4 Adjusted EPS | $0.27 | $0.22 | Beat by $0.05 (+22.7%) |

| Q4 Revenue | $3.78B | $3.68B | Beat by $100M (+2.7%) |

| FY Adjusted EPS | $1.08 | N/A | Down from $1.14 in FY 2024 |

| FY Revenue | $15.12B | N/A | Down 2.1% YoY from $15.46B |

| Q4 Gross Margin | 56.50% | N/A | Flat YoY |

| Q4 Adj. Operating Margin | 19.90% | N/A | Up 70 bps from 19.2% |

Kenvue delivered a decisive beat on both the top and bottom lines in Q4, outpacing consensus estimates comfortably. The adjusted EPS surprise of 22.7% was the largest quarterly beat in Kenvue’s history as a public company. However, the full-year picture remains mixed annual revenue declined 2.1% and adjusted EPS fell 5.3% vs. FY 2024, weighed down by volume headwinds, weak seasonal illness incidences in the U.S., and trade inventory reductions by certain customers.

What Leadership Is Saying?

Kirk Perry, Chief Executive Officer: “We ended 2025 with stronger top- and bottom-line performance in the fourth quarter, which reflected both disciplined execution against our strategic priorities, as well as a more favorable year-ago comparison on sales. As we look to 2026, we remain focused on continuing to enhance our performance, while progressing toward completion of our value-creating combination with Kimberly-Clark.”

Paul Ruh, Chief Financial Officer (from earlier 2025 commentary on the “Our Vue Forward” restructuring program): “These initiatives will structurally position Kenvue for success in the future and create long-term shareholder value. These initiatives will enable Kenvue to adjust its cost structure and ways of working to become more competitive.”

Historical Performance – Kenvue YoY Comparison

Q4 2025 vs. Q4 2024

| Category | Q4 2025 | Q4 2024 | Change (%) |

| Net Sales | $3,780M | $3,662M | +3.2% |

| Gross Profit | $2,137M | $2,070M | +3.2% |

| Gross Profit Margin | 56.50% | 56.50% | Flat |

| Operating Income | $535M | $483M | +10.8% |

| Operating Income Margin | 14.20% | 13.20% | +100 bps |

| Net Income | $330M | $293M | +12.6% |

FY 2025 vs. FY 2024

| Category | FY 2025 | FY 2024 | Change (%) |

| Net Sales | $15,124M | $15,455M | -2.1% |

| Gross Profit | $8,792M | $8,959M | -1.9% |

| Gross Profit Margin | 58.10% | 58.00% | +10 bps |

| Operating Income | $2,414M | $1,841M | +31.1% |

| Operating Income Margin | 16.00% | 11.90% | +410 bps |

| Net Income | $1,470M | $1,030M | +42.7% |

| Diluted EPS | $0.76 | $0.54 | +40.7% |

| Adjusted Diluted EPS | $1.08 | $1.14 | -5.3% |

| Operating Cash Flow | $2,200M | $1,800M | +22.2% |

| Free Cash Flow | $1,700M | $1,300M | +30.8% |

Q4 2025 Segment Breakdown

| Segment | Q4 2025 Net Sales | Q4 2024 Net Sales | Change (%) | Organic Sales Change |

| Self Care | $1,592M | $1,569M | 1.50% | -1.2% |

| Skin Health & Beauty | $1,040M | $1,011M | 2.90% | +1.5% |

| Essential Health | $1,148M | $1,082M | 6.10% | +4.2% |

| Total | $3,780M | $3,662M | 3.20% | +1.2% |

Competitor YoY Comparison

The table below compares Kenvue’s most recent quarterly and full-year results against key consumer health/consumer goods competitors. Note that fiscal year-end periods differ: Kenvue’s FY ends in late December; P&G’s FY ends June 30; Colgate-Palmolive’s FY ends December 31; and Unilever’s FY ends December 31. The most recently reported quarters are used for comparison.

Most Recent Quarterly Results (Latest Reported Quarter)

| Metric | Kenvue (Q4 FY2025) | P&G (Q4 FY2025, ended Jun ’25) | Colgate-Palmolive (Q4 CY2025) | Unilever (Q4 CY2025) |

| Revenue | $3.78B | $20.89B | $5.23B | ~$12.59B |

| Revenue YoY Change | +3.2% | +2% | +5.8% | ~-3.8% (turnover) |

| Organic Sales Growth | +1.2% | +2% | +2.2% | +4.2% |

| EPS (Adj.) | $0.27 | $1.48 (core) | $0.95 | €3.08 (underlying, FY) |

| EPS Beat/Miss | Beat by 22.7% | Beat by 4.2% | Beat by 4.4% | Modest beat |

| Operating Margin (Adj.) | 19.9% | Expanded 150 bps | ~21.7% | ~22.6% (underlying, FY) |

Full-Year Performance Comparison

| Metric | Kenvue (FY2025) | P&G (FY2025, ended Jun ’25) | Colgate-Palmolive (FY2025) | Unilever (FY2025) |

| Annual Revenue | $15.12B | $84.3B | $20.38B | €50.5B (~$55B) |

| Revenue YoY Change | -2.1% | Flat (0%) | +1.4% | -3.8% (turnover) |

| Organic Sales Growth | -2.2% | +2% | +1.4% | +3.5% |

| EPS (Adj.) | $1.08 | $6.83 (core) | $3.69 | €3.08 (underlying) |

| EPS YoY Change | -5.3% | +4% | +3% | +0.7% |

| Operating Cash Flow | $2.2B | $17.8B | $4.2B (record) | €5.9B (FCF) |

Kenvue was the weakest performer on an organic sales basis among its consumer goods peers in 2025, with a -2.2% decline compared to positive growth across P&G, Colgate-Palmolive, and Unilever. However, Kenvue’s Q4 turnaround with 1.2% organic growth and a significant EPS beat signals improving momentum heading into the Kimberly-Clark merger.

How the Market Reacted?

Kenvue shares traded within a narrow range on February 17, 2026 (the day results were released after market close), with the stock moving between $18.40 and $18.84 during the session, closing at approximately $18.42 – down $0.28 on the day. The muted same-day reaction reflects the fact that results were released after hours, and the stock is increasingly trading as a “deal stock” tied to the Kimberly-Clark acquisition price of $21.01 per share rather than standalone fundamentals.

The overall sentiment leaned cautiously bullish: the substantial Q4 EPS beat, improving segment trends (especially Essential Health’s 6.1% growth), and robust free cash flow generation of $1.7 billion were positive signals. However, the full-year revenue decline, announcement of ~770 job cuts (~3.5% of the workforce), and the absence of forward guidance kept investor enthusiasm in check. Analysts maintain a consensus “Hold” rating with a price target of approximately $19.46-$20.86, reflecting limited upside as the Kimberly-Clark deal dominates the investment thesis.