Harley-Davidson posted a Q4 2025 GAAP loss of -$2.44 per share on $496M in consolidated revenue, with full-year EPS of $2.78 and revenue of $4.47B. Results highlight deep losses in the core motorcycle segment offset by record financial services profit. Shares fell roughly 8% as cautious 2026 guidance and margin pressure weighed on investor sentiment.

About Harley-Davidson, Inc.

Harley-Davidson, Inc. (NYSE: HOG) is one of the most recognizable motorcycle brands globally, founded in 1903 and headquartered in Milwaukee, Wisconsin. The company designs, manufactures and sells heavyweight motorcycles, related parts & accessories, apparel, and licensed products through its Harley-Davidson Motor Company (HDMC) segment. It also provides financing and insurance services via Harley-Davidson Financial Services (HDFS), and holds a majority stake in electric motorcycle maker LiveWire.

Around the time of the Q4 2025 release, Harley-Davidson’s equity market capitalization was approximately $2.38B, with a trailing P/E ratio near 4.9 and a dividend yield around 3.6%, underscoring a low-valuation, income-paying profile relative to earnings power. The company generated meaningful cash from operations and maintains a multi-billion-dollar cash balance, which helps support ongoing restructuring, tariff headwinds, and shareholder returns even as the legacy motorcycle business cycles through a demand slowdown and margin reset.

Top Financial Highlights

- Full-year 2025 consolidated revenue was $4.47B, down 14% versus 2024, reflecting weaker motorcycle shipments and lower HDFS revenue after the portfolio reshaping.

- Q4 2025 consolidated revenue came in around $496M, down 28% year over year from $688M in Q4 2024, as motorcycle volumes, mix, and tariffs pressured the top line.

- Harley-Davidson reported a Q4 2025 net loss of $279M, or -$2.44 diluted EPS, versus a $117M net loss and -$0.93 EPS in Q4 2024, meaning the quarterly loss more than doubled year over year.

- For full-year 2025, net income attributable to Harley-Davidson was roughly $339M, translating into diluted EPS of $2.78, down from $3.44 in 2024 as HDMC swung from profit to loss.

- The core HDMC segment delivered 2025 revenue of about $3.58B, down 13% year over year, and moved from $278M operating income in 2024 to an operating loss of $29M in 2025, reflecting lower shipments, negative operating leverage and higher tariffs.

- In Q4 2025, HDMC revenue was $379M, down 10% versus Q4 2024; HDMC gross margin was -8.0%, versus -0.8% a year earlier, and operating loss widened to $260M from $214M.

- HDFS full-year 2025 revenue was $869M, down 16%, but operating income surged to a record $490M (up from $248M in 2024) due to the capital-light transaction with KKR and PIMCO and favorable credit loss provisions.

- LiveWire generated $25.7M in 2025 revenue and an operating loss of $75M, narrowing losses in line with prior expectations as the EV business remains in investment mode.

- Operating cash flow for 2025 was $569M, down sharply from $1.064B in 2024, driven by weaker HDMC profitability and working-capital normalization.

- Harley-Davidson ended 2025 with roughly $3.1B in cash, significantly de-risking the balance sheet following the HDFS asset sale and associated debt reduction, and providing ample liquidity to fund the reset.

- The company returned $434M to shareholders during 2025, including $347M in discretionary share repurchases and $86M in dividends, signaling continued commitment to capital returns despite cyclical headwinds.

- Full-year global retail motorcycle sales were 132,535 units, down 12% year over year, while HDMC global shipments fell 16% to 124,477 units; new motorcycle dealer inventory ended the year 17% lower than Q4 2024.

- In Q4 2025, HDMC shipped 13,515 motorcycles, down 4% year over year, with global retail motorcycle sales down 1% but North America up 5%, highlighting ongoing mixed demand across regions.

- 2026 guidance: HDMC expects 130,000–135,000 global retail sales and wholesale shipments, HDMC operating results in a range of a $40M loss to $10M profit, HDFS operating income of $45M–$60M, and a LiveWire operating loss of $70M–$80M, framing 2026 as a deliberate “transition year.”

Beat or Miss?

| Metric | Reported (Q4 2025) | Difference / Analysis |

| GAAP diluted EPS | -$2.44 | Missed consensus of about -$0.92 by roughly -$1.52, indicating a much deeper loss than analysts expected. |

| Motorcycle & related revenue (analyst basis) | ~$390.6M | Came in well below Zacks consensus of about $527.3M, a revenue miss of roughly -26%, highlighting softer-than-modeled core demand. |

| Consolidated revenue | ~$496.2M | Slightly above one set of Street estimates around $482M, but still down ~28% YoY, underscoring a severe top-line contraction despite a small headline “beat.” |

Analyst frameworks differ on whether they track motorcycle-only or fully consolidated revenue. On a consolidated basis, revenue modestly beat some expectations; on the motorcycle segment basis commonly used in models, Harley-Davidson delivered a material revenue shortfall alongside a large EPS miss.

What Leadership Is Saying?

“Going forward you can expect an intensified focus on the key drivers of sustainable growth: strong and profitable dealerships, growing the powerful connection riders have with our brand, locally relevant marketing, and capital-efficient growth.” – Artie Starrs, President and CEO

This earlier Q3 2025 remark frames how management is approaching the reset: pulling back on volume-at-any-cost strategies, tightening dealer economics, and emphasizing profitable growth and brand equity rather than pure unit expansion.

“With that in mind, we view 2026 as a transition year as we reset the business and finalize our new strategy.” – Jonathan Root, Chief Financial Officer

CFO Jonathan Root’s comment captures the financial stance: investors should expect suppressed margins and lower HDFS earnings in 2026 as Harley digests tariff costs, absorbs the effects of the HDFS transaction, and rebalances its motorcycle distribution and pricing architecture.

Historical Performance

Harley-Davidson YoY: Q4 2025 vs Q4 2024

| Category | Q4 2025 | Q4 2024 | Change (%) / Commentary |

| Consolidated Revenue | $496M | $688M | -28% – steep decline driven by lower HDMC revenue and HDFS downsizing. |

| Net Income Attributable to HDI | -$279M | -$117M | Loss widened ~139% as motorcycle margins deteriorated further. |

| Operating Income (Loss) | -$361M (consolidated) | -$193M (consolidated) | Operating loss increased ~87%, reflecting deeper HDMC losses and a Q4 HDFS loss tied to transaction and debt-management costs. |

Despite record HDFS earnings for the full year, Q4 2025 shows the full force of tariff inflation, weaker demand, and promotional activity in the motorcycle segment, compounded by discrete HDFS debt-retirement charges.

Historical Performance

Competitor YoY: Polaris Inc. (PII) – Q4 2025 vs Q4 2024

| Category | Q4 2025 | Q4 2024 | Change (%) / Commentary |

| Revenue | $1.92B | $1.76B | +9–10% – solid top-line growth driven by Off-Road vehicles. |

| Net Income | -$303.3M (net loss) | $10.8M (net profit) | Swing of roughly -$314M, turning modest profit into a large loss amid tariff and cost pressures. |

| Operating Margin | -16.70% | 3.70% | Down about 20.4% points, reflecting significant margin compression despite higher sales. |

This comparison underlines that Harley-Davidson is not alone in facing intense margin pressure. Polaris grew revenue but also swung to a large Q4 loss, suggesting broader challenges across powersports from tariffs, input costs, and promotional intensity—though Harley’s motorcycle-heavy mix and strategic reset amplify the impact.

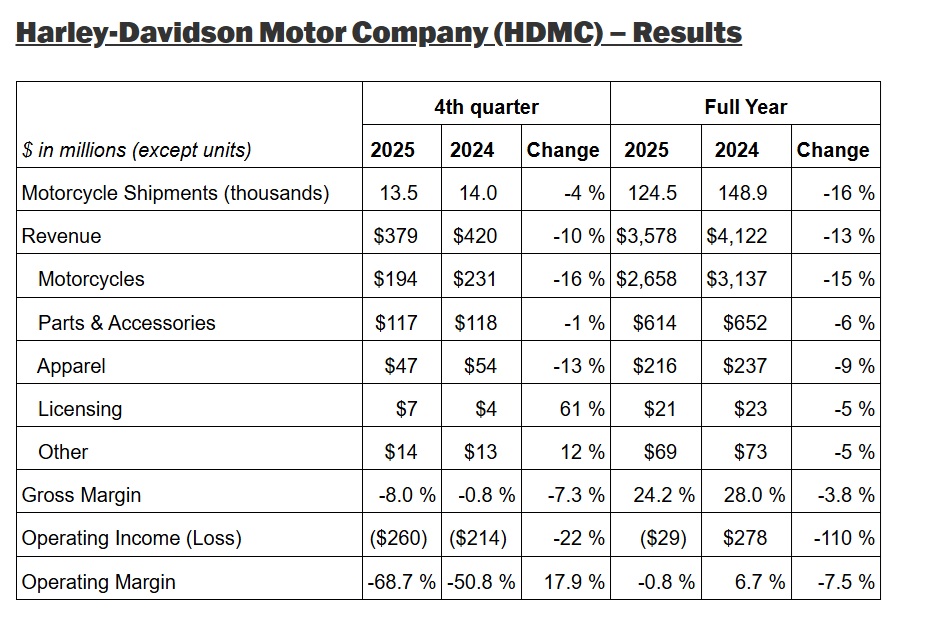

Harley-Davidson (HDMC) Sales Overview

- HDMC total revenue: In Q4 2025, Harley-Davidson Motor Company revenue was $379 million, down from $420 million in Q4 2024, a change of -10%; for full year 2025, revenue was $3,578 million, down from $4,122 million in 2024, a change of -13%.

- Motorcycles revenue: In Q4 2025, motorcycle revenue was $194 million, down from $231 million in Q4 2024, a change of -16%; for full year 2025, motorcycle revenue was $2,658 million, down from $3,137 million in 2024, a change of -15%.

- Parts and Accessories revenue: In Q4 2025, Parts and Accessories revenue was $117 million, down from $118 million in Q4 2024, a change of -1%; for full year 2025, Parts and Accessories revenue was $614 million, down from $652 million in 2024, a change of -6%.

- Apparel revenue: In Q4 2025, apparel revenue was $47 million, down from $54 million in Q4 2024, a change of -13%; for full year 2025, apparel revenue was $216 million, down from $237 million in 2024, a change of -9%.

- Licensing revenue: In Q4 2025, licensing revenue was $7 million, up from $4 million in Q4 2024, a change of 61%; for full year 2025, licensing revenue was $21 million, down from $23 million in 2024, a change of -5%.

- Other revenue: In Q4 2025, other revenue was $14 million, up from $13 million in Q4 2024, a change of 12%; for full year 2025, other revenue was $69 million, down from $73 million in 2024, a change of -5%.

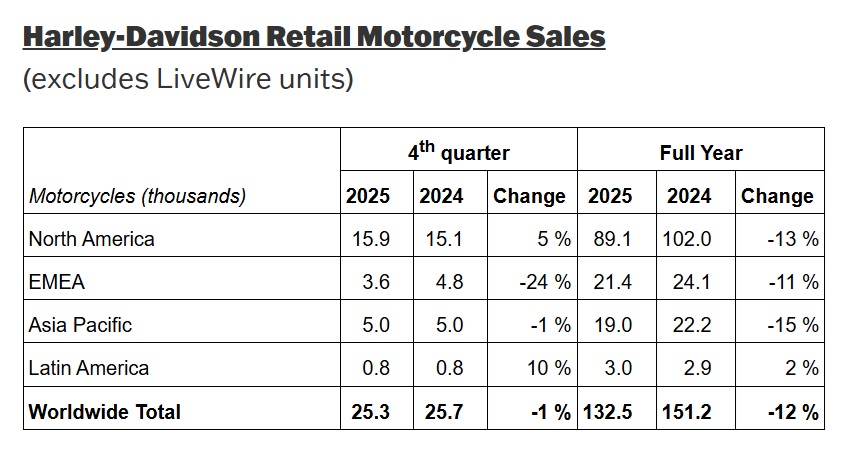

Harley-Davidson Retail Motorcycle Sales By Region

- North America: In Q4 2025, Harley-Davidson retail motorcycle sales were 15.9 thousand units, up from 15.1 thousand units in Q4 2024, a change of +5%; for full year 2025, sales were 89.1 thousand units, down from 102.0 thousand units in 2024, a change of -13%.

- EMEA: In Q4 2025, retail motorcycle sales were 3.6 thousand units, down from 4.8 thousand units in Q4 2024, a change of -24%; for full year 2025, sales were 21.4 thousand units, down from 24.1 thousand units in 2024, a change of -11%.

- Asia Pacific: In Q4 2025, retail motorcycle sales were 5.0 thousand units, compared with 5.0 thousand units in Q4 2024, a change of -1%; for full year 2025, sales were 19.0 thousand units, down from 22.2 thousand units in 2024, a change of -15%.

- Latin America: In Q4 2025, retail motorcycle sales were 0.8 thousand units, compared with 0.8 thousand units in Q4 2024, a change of +10%; for full year 2025, sales were 3.0 thousand units, up from 2.9 thousand units in 2024, a change of +2%.

- Worldwide Total: In Q4 2025, global retail motorcycle sales were 25.3 thousand units, down from 25.7 thousand units in Q4 2024, a change of -1%; for full year 2025, sales were 132.5 thousand units, down from 151.2 thousand units in 2024, a change of -12%.

How the Market Reacted?

Equity markets reacted negatively to Harley-Davidson’s Q4 2025 release and 2026 outlook. Multiple reports noted that HOG shares fell around 8% following the announcement, as investors focused less on the record HDFS earnings and more on the deeper-than-expected motorcycle losses and sharply lower HDFS guidance for 2026. At roughly $20 per share and a mid-single-digit P/E, the stock is being priced as a turnaround story rather than a growth franchise.

Overall sentiment around this report leans bearish-to-cautiously neutral: the balance sheet and cash generation are strong, but near-term earnings, margins, and unit trends are under pressure as 2026 is framed explicitly as a “transition year” rather than a recovery year.