GSK’s Q4 2025 core EPS was about $0.70 (25.5p) on revenue of roughly $11.8B, beating consensus on both metrics. Full-year core EPS reached 172.0p on £32.7B sales, with shares rising around 5% on the beat and confident 2026 guidance.

About GSK

GSK plc (NYSE: GSK; LSE: GSK) is a global biopharmaceutical company focused on vaccines and specialty medicines in areas such as HIV, respiratory disease, immunology, oncology, and infectious diseases. The company traces its roots back over 300 years through predecessor firms and is headquartered in London, United Kingdom. As of early February 2026, GSK carried a market capitalization in the tens of billions of dollars, with an ADR dividend yield above 4% and a trailing P/E ratio in the mid-teens, reflecting a mature, income-oriented pharma profile with renewed growth momentum.

GSK generated £32.7B in 2025 turnover, driven by its Specialty Medicines portfolio (HIV, Respiratory, Immunology & Inflammation, Oncology) and a broad vaccines franchise spanning shingles, meningitis, RSV, influenza and pediatric vaccines. The company employed tens of thousands of people worldwide and delivered £8.9B of cash generated from operations and £4.0B in free cash flow in 2025, underpinning increased dividends and an ongoing share buyback program.

Top Financial Highlights

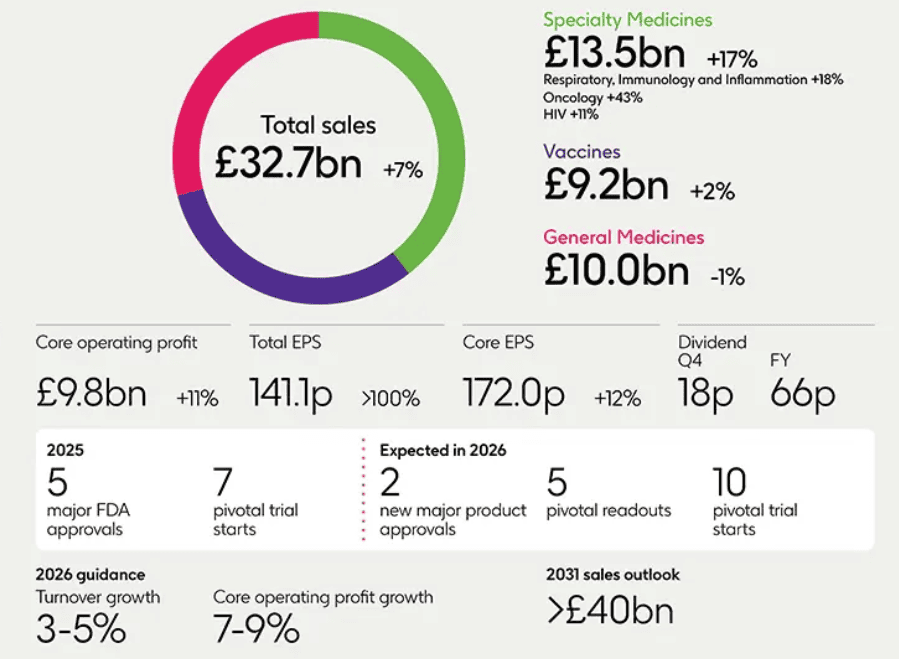

- 2025 total sales (turnover) were £32.7B (about $41.6B), up 7% CER and 4% AER, with Q4 2025 sales of £8.62B (about $11.0–11.8B) up 8% CER.

- Total 2025 operating profit was £7.93B, up >100%, with total EPS of 141.1p (>100% growth) driven by lower Zantac legal charges and higher other operating income; Q4 total EPS was 15.8p, up 65% CER.

- Core operating profit reached £9.78B in 2025, up 11% CER, with a core operating margin of 29.9%, up 1.1% points CER; Q4 core operating profit was £1.63B, up 18% CER, with a 19.0% margin.

- Core EPS for 2025 was 172.0p, up 12% CER, while Q4 2025 core EPS was 25.5p, up 14% CER, reflecting operating leverage, higher royalties, and a benefit from share buybacks.

- Gross margin (core cost of sales) improved, with core cost of sales at 25.1% of sales for 2025 and 28.3% in Q4, supported by a richer Specialty Medicines and regional mix plus efficiencies.

- Cash generated from operations was £8.94B (~$11.4B) for 2025 and £2.69B in Q4; free cash flow was £4.03B for the year and £960M in Q4, with free cash flow growth of 41%.

- Specialty Medicines revenue hit £13.47B in 2025, up 17% CER, including HIV £7.69B (+11% CER), RI&I £3.81B (+18% CER), and Oncology £1.98B (+43% CER); Q4 Specialty Medicines sales were £3.81B, up 18% CER.

- Vaccines revenue was £9.16B in 2025 (+2% CER) and £2.29B in Q4 (+4% CER), with Shingrix £3.56B (+8% CER), meningitis vaccines £1.58B (+12% CER), and Arexvy £593M (+2% CER).

- General Medicines delivered £10.04B in 2025 (-1% CER), with Trelegy £2.99B (+13% CER) and Q4 Trelegy sales of £740M (+14% CER), offset by declines in older respiratory and other general medicines.

- 2025 US sales were £16.86B (+6% CER), Europe £7.53B (+12% CER), and International £8.28B (+4% CER), with strong Shingrix, RSV (Arexvy), and meningitis uptake outside the US.

- Royalty income reached £879M in 2025, up 38%, driven by Kesimpta, Abrysvo, Comirnaty and IP settlements, including a £367M ($500M) CureVac settlement.

- Operating cash flow and leverage: Cash generation supported Zantac settlements, a £2B share buyback program (of which £1.4B executed by FY 2025), and a progressive dividend.

- At CER, GSK expects turnover growth of 3–5%, core operating profit growth of 7-9%, and core EPS growth of 7-9%, with low double‑digit Specialty sales growth and flat-to-slightly-declining Vaccines and General Medicines.

Beat or Miss?

| Metric | Reported (Q4 2025) | Difference / Analysis |

| Revenue | $11.81B (≈£8.6B) | Beat consensus $11.36B by ~4%, reflecting stronger Specialty Medicines and Vaccines. |

| Core EPS | ~$0.70 (25.5p) | Beat consensus (~$0.64 / 1.26 in local terms) by roughly 10-15%, showing operating leverage and higher royalty income. |

| Full-year sales | £32.7B | In line to slightly ahead of market expectations, with 7% CER growth and breadth across portfolios. |

| Full-year core EPS | 172.0p | At the upper end of typical models (mid- to high-single-digit growth), delivering 12% CER growth and supporting a dividend upgrade. |

What Leadership Is Saying?

“GSK delivered another strong performance in 2025, driven mainly by Specialty Medicines, with double-digit sales growth in Respiratory, Immunology & Inflammation (RI&I), Oncology and HIV. Good R&D progress also continued, with 5 major product approvals achieved and several acquisitions and new partnerships completed to strengthen the pipeline further in oncology and RI&I. We expect this positive momentum to continue in 2026, which will be a key year of execution and operational delivery with strong focus on commercial launches and accelerating R&D. We are well placed to move forward in this next phase for GSK, to deliver our outlooks and to create new value for patients and shareholders.” – Luke Miels, Chief Executive Officer

“Sales +7% and operating profit +11%, with operating margin up 110 basis points, demonstrate strong operational leverage in 2025. Cash generated from operations of £8.9 billion and free cash flow of £4.0 billion support continued investment and shareholder returns, including the dividend upgrade to 66p and the ongoing £2 billion share buyback. For 2026, we are guiding to 3-5% turnover growth and 7-9% growth in both core operating profit and core EPS, underpinned by Specialty Medicines growth and disciplined SG&A and R&D investment.” – Julie Brown, Chief Financial Officer

Historical Performance

GSK: Q4 2025 vs Q4 2024

| Category | Q4 2025 | Q4 2024 (implied) | Change (%) |

| Revenue (Turnover) | £8.62B | ~£8.13B | +6% AER / +8% CER. |

| Net Income | £727M profit | ~£502M (back-solved) | +~45% AER / +53% CER, reflecting lower legal and CCL charges plus higher operating profit. |

| Operating Profit | £1.10B | ~£696M | +58% AER / +65% CER, with operating margin up 4.2-4.6ppts to 12.8%. |

By Competitors

| Category | Q4 2025 (Pfizer) | Q4 2024 (Pfizer) | Change (%) |

| Revenue | ~$14.4B (post-COVID normalisation) | ~$14.2B | Low-single-digit growth as COVID revenues fade but core portfolio stabilizes. |

| Net Income | ~$1.9B | ~$2.0B | Slight decline amid higher R&D and restructuring costs. |

| Operating Expenses (R&D + SG&A) | ~$10–11B combined | ~$10B combined | Low- to mid-single-digit increase, reflecting pipeline investment and productivity initiatives. |

How the Market Reacted?

Investors responded positively to GSK’s Q4 and full-year 2025 results. Reports indicate Q4 EPS of about $0.70 and revenue of roughly $11.8B came in ahead of forecasts, delivering upside surprises of roughly 10-15% on EPS and ~4% on revenue.

GSK shares rose about 5% in pre-market trading, reflecting confidence in the beat and in the company’s 2026 guidance for mid‑single‑digit sales growth and high‑single‑digit profit and EPS growth. The tone around the release is decisively bullish, driven by strong Specialty Medicines growth, solid cash generation, a dividend increase to 66p (with 70p expected for 2026), and ongoing execution of the £2B share buyback program.