Introduction

Drone Taxi Statistics: Drone taxis (air taxis) are small electric flying vehicles that can take off and land straight up like a helicopter. They are designed to carry people over short city routes and to avoid road traffic. You can imagine booking one like a cab, but it flies from a vertiport near offices, malls, metro stations, or airports. These taxis may reduce travel time, alleviate congestion, and lower pollution if they operate on clean electricity.

However, they also present new challenges: safety regulations, air traffic control, noise, costs, and public trust. As test flights expand and approvals progress, drone taxis could soon change how we travel in busy cities.

Editor’s Choice

- In 2026, the global drone taxi market is projected to reach USD 325.8 million.

- Faster regulatory pilot programs drive 45% of global adoption.

- Market share in 2025 indicates North America leads at 35%, followed by Asia-Pacific at 30%.

- Advances in battery technology are enabling drone taxis to fly farther, which is estimated to increase the forecast CAGR by 4.2%.

- Piloted drone taxis accounted for 60.72% of the market, while autonomous drone taxis are expected to grow the fastest, increasing at a 24.10% CAGR from 2026 to 2031.

- Drone taxis are projected to reduce corridor travel times by about 50%.

- Today’s lithium-ion packs deliver 250-300Wh/kg, which can limit many city trips to about 30 km.

- The company reports more than 700 trial flights in Guangzhou and Hefei since Q2 2025.

- Joby Aviation states that its Joby air taxi can reach a maximum speed of 200 mph.

- On January 21, 2026, Reuters reported that Serbia could purchase up to 25 Archer Midnight eVTOLs, the official provider for EXPO 2027 Belgrade.

Key Takeaways

- According to Global Growth Insights, 45% of global adoption is driven by faster regulatory pilot programs.

- Approximately 30% of the total investment is allocated to vertiports and charging infrastructure.

- Around 25% of cities are running early test programs for aerial transport services.

- The industry has achieved about 60% progress in autonomy development.

- Battery density and energy-storage performance have improved by roughly 50%.

- Vertiport construction has increased by approximately 40% across major metropolitan areas worldwide.

- In 2025, North America accounts for 35% of the market, followed by Asia-Pacific at 30%, Europe at 25%, and the Middle East & Africa at 10%.

- The biggest barrier is urban airspace regulation, which accounts for around 40% of the challenge.

- Funding gaps and public safety concerns each account for about 30% of the challenge.

- From 2024 to 2025, pilot corridors increased by approximately 45%, vertiport partnerships by approximately 35%, and certification programs by approximately 20% globally.

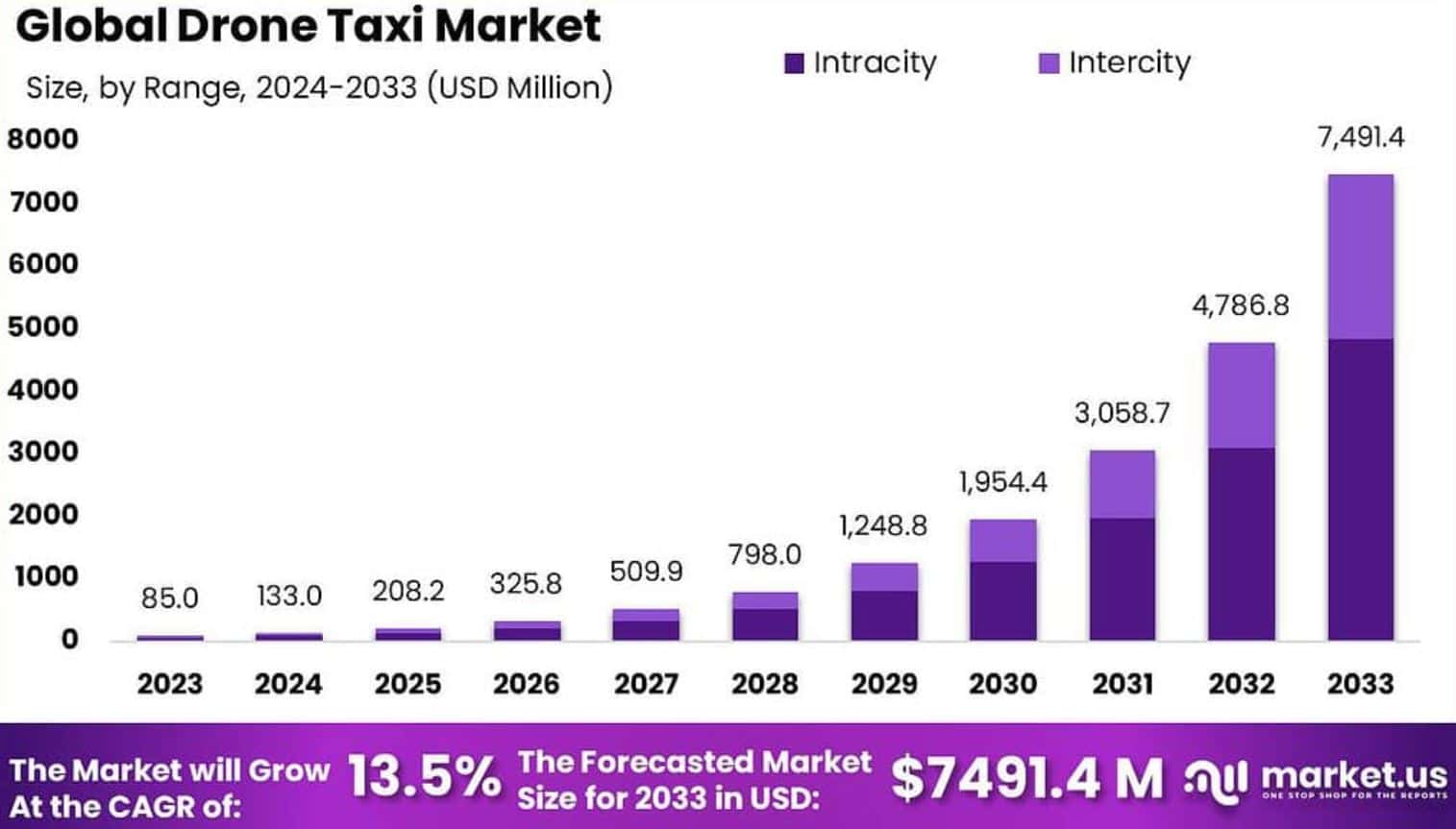

Drone Taxi Market Size

(Source: market.us)

- In 2026, the global drone taxi market is projected to reach USD 325.8 million.

- By 2033, the market is forecast to reach USD 7,491.4 million.

- Moreover, the global market is expected to expand at a 13.5% CAGR from 2026 to 2033.

Key Growth Drivers And Impacts

- Improved batteries enable drone taxis to fly farther, which is expected to raise the forecast CAGR by 4.2%.

- Public and private partners are building vertiports faster, which could increase growth by 3.8%.

- Airlines and airports are integrating drone taxis into trips, which may lift premium first- and last-mile demand by 3.5%.

- Quieter drone taxi designs are making certification easier and faster, which could add 2.9% to growth.

- Remote and hybrid work is increasing regional travel needs, while ESG goals are boosting interest in zero-emission drone taxis, adding 2.7% and 2.1%.

Segment Breakdown Analyses

- According to Mordor Intelligence, in 2025, piloted drone taxis accounted for 60.72% of the market, while autonomous drone taxis are expected to grow the fastest, increasing at a 24.10% CAGR from 2026 to 2031.

| Segment | Market Share, 2025 | Fastest-Growing Segment (CAGR from 2026 to 2031) |

| Propulsion type | Battery-electric drone taxis (54.88%) | Hydrogen fuel-cell drone taxis (20.85%) |

| Passenger capacity | 3-4 seat drone taxis (42.30%) | 5-6 seat drone taxis (19.05%) |

| Range | Sub-50 km intracity trips (44.10%) | 150-300 km regional trips (19.95%) |

| End-use | Airport shuttle services (44.70%) | Corporate shuttle services (21.15%) |

| Lift technology | Multicopter drone taxis (45.20%) | Lift-plus-cruise drone taxis (22.40%) |

| Geography | North America (45.10%) | Asia-Pacific (25.20%) |

Drone Taxi Statistics By Implementation

China (Guangzhou & Hefei)-EHang EH216-S + certified operators

- This program has transitioned to operator-certified trial commercial operations with pilotless, passenger-carrying aircraft.

- According to sec.gov, the company reports more than 700 trial flights in Guangzhou and Hefei since Q2 2025.

- The company also reports more than 10,000 autonomous eVTOL flights across 40+ operational sites (reported for H1 2025 in company/regulatory materials).

- Ehang’s official report further stated that the key regulatory milestones reported include a Type Certificate (Oct 13, 2023), a Standard Airworthiness Certificate (Dec 21, 2023), and a Production Certificate (Apr 7, 2024).

- The first batch of operator certificates reportedly covered two operators: Guangdong EHang General Aviation and Hefei HeYi Aviation.

UAE (Dubai)-Joby Aviation + Dubai RTA/Skyports

- Dubai is being positioned as a government-backed commercial launch market supported by in-country flight testing.

- According to Joby Aviation, exclusive operating rights for 6 years in Dubai.

- The plan includes 4 vertiports, with locations commonly described as the DXB area, Dubai Mall, Palm Jumeirah, and an Atlantis/American University area (site wording varies by source).

- Joby reported a 17-minute piloted point-to-point flight landing at DWC in Nov 2025.

- Launch timing has been reported differently over time, with Joby previously signalling early 2026, while later reports indicated ethe nd of 2026.

Europe (France): Paris Olympics Showcasing Volocopter VoloCity Air Taxi

- Volocopter has completed test flights, but passenger service has not launched.

- The company states the vehicle program has completed 2,000+ test flights (across prototypes).

- Planned Paris 2024 passenger flights were cancelled, with certification timing cited as the key constraint in reporting.

- As of Jan 2026, the company expects to obtain EASA certification in 2027.

United States Autonomous Air Taxi Candidate Wisk Generation 6

- A report published by Wisk. Aero stated that Wisk is in a prototype + certification pathway phase rather than commercial operations.

- Wisk reported the first flight of Gen 6 on Dec 16, 2025.

- Published target specifications include 4 seats, approximately 90 miles of range (with reserves), and a cruise speed of 120 knots.

USA (piloted eVTOL taxi pathway) + network planning-Archer Midnight

- Archer is developing an aircraft program in parallel with route-network planning, but it has not yet commenced eVTOL passenger service.

- Archer’s published operating concept focuses on 20-50 mile segments with rapid turnaround and up to 150 mph performance.

- United’s commitment has been described as up to 200 aircraft, and includes a USD 10 million pre-delivery payment tied to 100 aircraft.

- A proposed NYC network concept claims potential airport-commute trip times of 5-15 minutes, subject to certification and operational approvals.

Top Drone Taxi Companies

| Company | Type | Seats/pilot | Range | Speed (cruise/max) |

| Joby Aviation | Joby air taxi (tilt-prop eVTOL) | 1 pilot + 4 passengers | Up to approximately 100 mi (urban target); up to 150 mi (max stated in releases) | Up to 200 mph |

| Archer Aviation | Midnight (multi-rotor eVTOL) | 1 pilot + 4 passengers | Built for 20-50 mi short hops (some materials cite up to 100 mi target) | Up to 150 mph |

| Wisk (Boeing) | Generation 6 (autonomous eVTOL) | 4 seats, autonomous (human oversight) | 90 mi (with reserves) | 120 knots (cruise) |

| Volocopter | VoloCity (multicopter eVTOL) | 2 seats | 20 km | 90 km/h cruise; 100 km/h max |

| EHang | EH216-S (autonomous multicopter) | 2 passengers, unpiloted | 30 km | 130 km/h (max design speed) |

| Vertical Aerospace | VX4 / “Valo” (piloted eVTOL) | 1 pilot + 4 passengers | 100 mi | 150 mph (cruise) |

| BETA Technologies | ALIA (VTOL + CTOL family) | 1 pilot + 5 passengers | 336 nm (max demonstrated range shown for CTOL) | 153 kts (max) |

| Eve Air Mobility (Embraer) | Eve eVTOL (lift + cruise) | 4 passengers + pilot; up to 6 when uncrewed is certified | 60 mi (100 km) | – |

| Lilium | Lilium Jet (ducted-fan “jet”-style eVTOL) | Up to 6 passenger seats (configured) + pilot concept | 250+ km (projected, incl. reserves) | 280 km/h |

Key Factors Accelerating The Urban Drone Taxi Market

- Battery improvements can increase the range of drone taxis. Today’s lithium-ion packs deliver 250-300 Wh/kg, which can limit many city trips to about 30 km. New options such as CATL’s 500 Wh/kg Qilin cell and lithium-sulfur chemistries could roughly double usable range by 2027 and reduce energy cost per seat-kilometre.

- Lighter structures can improve efficiency. Structural battery modules used in Joby’s S4 can reduce structural weight by 15-20% by integrating energy storage with the airframe. Solid-state battery prototypes also better manage the risk of thermal runaway, thereby facilitating faster certification.

- Vertiport partnerships can speed infrastructure buildout. More than 1,500 vertiports are in development, and Manhattan’s EB 105A pilot suggests that co-funded public-private models can reduce build time to 3-5 years for pads and charging. Similar approaches in Dubai and Osaka appear scalable.

- Airline integration can drive early demand. United and Archer plan 10-minute hops from Newark to lower Manhattan priced at USD 200-300 per seat, with tickets integrated into the airline booking process. This can reduce customer acquisition cost by roughly two-thirds and generate USD 15-25 in incremental airport fee income per passenger.

- Lower noise can improve community acceptance and approvals. NASA tests show noise levels 26-36 dB lower than those of helicopters, supporting compliance with the FAA 62 dB residential overflight ceiling. German pilot surveys improved from 2.6 to 3.8 on a 5-point scale, and regulators may shorten flight-test plans if aircraft beat helicopters by 10 dB or more.

Recent Developments

| Date | Developments |

| March 31, 2025 | China’s CAAC issued the world’s first Air Operator Certificates for passenger eVTOL flights for operators using the EHang EH216-S. |

| June 25, 2025 | EHang stated that the CAAC issued the first AOCs for civil, human-carrying, pilotless operations conducted by EH216-S operators. |

| June 30, 2025 | Joby reported that it delivered its first production eVTOL aircraft to Dubai and began local testing to support an early 2026 launch. |

| August 26, 2025 | EHang reported it delivered 68 EH216-series aircraft in Q2 2025 to 13 enterprise customers in China and Japan. |

| August 26, 2025 | EHang also reported receiving more than 150 new orders for the EH216 series. |

| September 12, 2025 | The FAA announced the eVTOL Integration Pilot Program to accelerate the rollout of advanced air mobility through public-private partnerships. |

| November 13, 2025 | Archer announced the initiation of an in-country flight-test campaign for its Midnight eVTOL in the UAE as part of its launch plan. |

| December 15, 2025 | Joby reported flying over 9,000 miles and completing more than 4,900 test points in 2025 to support FAA certification progress. |

| January 8, 2026 | At CES 2026, Archer announced plans to develop aviation AI technology using NVIDIA IGX Thor. |

| January 12-21, 2026 | eIPP selections may occur around March 2026, with trials approximately 90 days later, and Reuters reported that Serbia may purchase up to 25 Midnight aircraft for EXPO 2027. |

Conclusion

After completing the article, it is evident that drone taxis can transform urban travel by flying over traffic, saving time, and reducing local pollution. However, success requires more than new technology. They must be demonstrated to be safe, approved by the relevant authorities, and controlled by air traffic control. Cities also need vertiports, fast chargers, and clear routes.

Prices should be affordable, not only for the rich. Most importantly, people must trust them. With appropriate regulations and planning, air taxis may begin operating on busy routes as a premium service and then expand incrementally.