Introduction

Columbia Sportswear Statistics: The Columbia Sportswear Company, which operates as a premier global brand for apparel and outdoor products, dedicated its resources to operating in a challenging market environment during 2025. Columbia experienced its most important year of company development during 2025 when its sales reached nearly 34 billion dollars, and its quarterly profits showed inconsistent results. The company’s operational results mirror the overall market developments in outdoor and activewear products, yet they show the difficulties that traditional companies face when they try to develop their business while maintaining operational effectiveness and creating new products.

This article will show the Columbia Sportswear statistics, which include the complete company performance through its 2025 financial documents, revenue numbers, profitability assessments, market behavior patterns, strategic business plans, and essential quarterly report findings.

Editor’s Choice

- Columbia Sportswear reported USD 3.40 billion in full-year 2025 revenue, reflecting 1% year-over-year growth despite macroeconomic headwinds.

- Q4 CY2025 revenue reached USD 1.07 billion, beating analyst estimates by 3.6%, although sales declined 2% year over year.

- The United States generated USD 1.98 billion, accounting for nearly 58% of total revenue, but declined 4% YoY.

- International markets contributed approximately 42% of total sales, with EMEA growing 13% reported (10% constant currency) to USD 576.9 million.

- The Latin America and Asia Pacific regions combined to achieve 9% actual growth, which converted to 10% growth in constant currency terms, to reach USD 618 million, as the main factor driving business growth.

- The company generated 2.71 billion dollars from its clothing, accessories, and equipment sales, which accounted for almost 80% of its total revenue while generating 1% annual revenue growth.

- The flagship Columbia brand generated USD 2.97 billion, which contributed around 87% of the company’s revenue, while secondary brands experienced revenue declines between 1% and 8%.

- Wholesale revenue increased 3% to USD 1.78 billion, comprising 52% of total sales, while DTC declined 1% to USD 1.62 billion.

- Full-year gross profit rose to USD 1.72 billion, with gross margin improving to 50.5%, up from the prior year.

- Net income declined 21% to USD 177.2 million, with diluted EPS falling to USD 3.24, despite a 5–6% reduction in diluted shares outstanding.

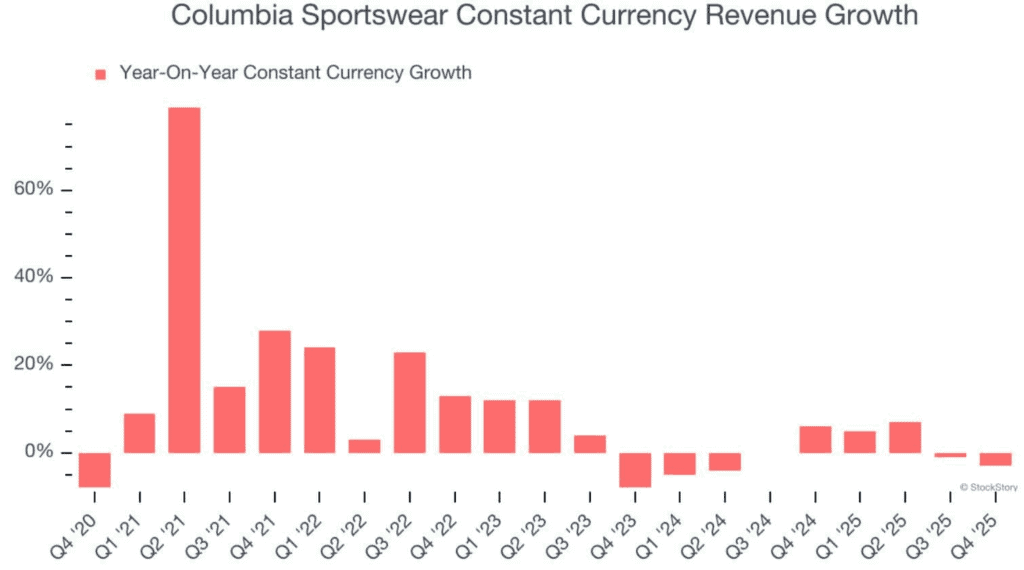

Columbia Sportswear Revenue Growth

(Source: financialcontent.com)

- Columbia Sportswear achieved USD 1.07 billion in revenue during Q4 CY2025, which surpassed analyst predictions of USD 1.03 billion by 3.6%, even though the company experienced a 2.4% revenue decrease compared to the previous year.

- The holiday performance exceeds expectations because demand stays strong, which helps Columbia Sportswear succeed against industry challenges and current cautious spending behavior from consumers.

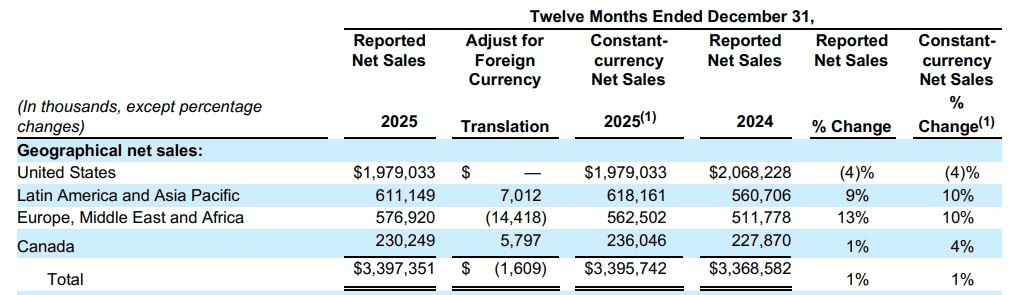

Columbia Sportswear Geographical Net Sales

(Source: cloudfront.net)

- Columbia Sportswear achieved USD 1.07 billion in revenue during Q4 CY2025, which surpassed analyst predictions of USD 1.03 billion by 3.6%, even though the company experienced a 2.4% revenue decrease compared to the previous year.

- The holiday performance exceeds expectations because demand stays strong, which helps Columbia Sportswear succeed against industry challenges and current cautious spending behavior from consumers.

- The table presents regional net sales performance data for the twelve-month period ending December 31 2025, which demonstrates both reported growth and constant-currency growth patterns.

- From an analyst’s standpoint, Columbia Sportswear displays geographical growth that remains constant between its different operational areas.

- The United States generated approximately USD 1.98 billion in revenue, which accounted for almost 58% of total sales.

- However, the region experienced a 4% decline compared to the previous year, which indicated a decrease in domestic demand or a change in marketing strategies.

- In contrast, Latin America and the Asia Pacific experienced strong growth, which increased their revenue by 9% according to reported figures and 10% based on constant currency to reach USD 618 million.

- Europe, the Middle East, and Africa achieved 13% reported growth, which brought their revenue to USD 576.9 million, while constant currency growth reached 10%.

- Canada experienced 1% reported growth, while constant currency results showed 4% growth. This difference occurred because foreign exchange difficulties obscured the true strength of business operations.

- Total net sales increased 1% to USD 3.40 billion, with foreign currency translation reducing revenue by USD 1.6 million.

- Notably, nearly 42% of Columbia Sportswear’s revenue now originates outside the United States, reinforcing international expansion as a strategic pillar.

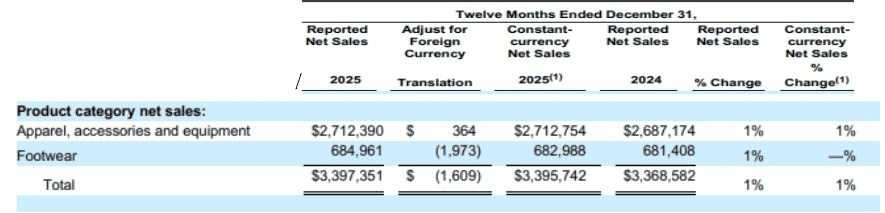

Columbia Sportswear Product Category Net Sales

(Source: cloudfront.net)

- The table presents product category net sales for the twelve months ended December 31, 2025, highlighting performance across core segments.

- Columbia Sportswear maintains stable performance across all product categories, according to the analyst assessment, because both apparel and footwear lines contribute equal sales despite current economic conditions.

- Apparel, accessories, and equipment generated approximately USD 2.71 billion in reported net sales, reflecting 1% year-over-year growth. This category accounts for nearly 80% of total revenue, which establishes it as the main driver of Columbia Sportswear’s business expansion.

- The company experienced 1% constant-currency growth, which showed that foreign exchange effects had little impact on customer demand performance.

- Footwear delivered USD 685 million in reported sales, which also experienced a 1% year-over-year increase.

- The constant-currency analysis showed a slight decline in footwear sales because demand decreased when companies eliminated currency advantages.

- The foreign exchange impact reduced total company revenue by USD 1.6 million, which showed that the company had limited exposure to currency fluctuations.

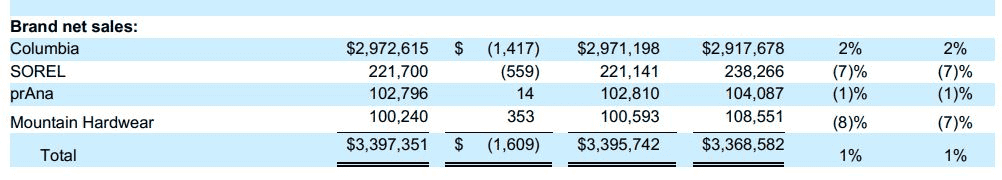

Columbia Sportswear Brand Net Sales

(Source: cloudfront.net)

- The table presents a comparative analysis of brand net sales for the twelve months ended December 31, 2025, highlighting reported figures, currency adjustments, and year-over-year change.

- The Columbia company reported net sales of USD 2.97 billion, which showed a 2% increase from the previous year and demonstrated continuous brand growth despite facing USD 1.4 million in currency-related losses.

- SOREL showed a 7% decrease, which brought its value to USD 221.1 million, while prAna experienced a 1% decrease, resulting in a total of USD 102.8 million.

- The Mountain Hardwear brand exhibited an 8% decline, which showed a decrease in demand for specialized outdoor equipment.

- Total reported net sales showed a slight increase of 1%, which brought the total to USD 3.40 billion, showing brand strength but also revealing increasing costs for multiple brands.

- The company experienced constant-currency growth that matched its reported growth at 1%, which indicated foreign exchange rates had minimal impact on its operations.

- The core demand for Columbia Sportswear products remains strong because these items generate approximately 87% of the company’s revenue.

- Columbia Sportswear supports its portfolio through strong operational stability, which results in High revenue generation from its core businesses.

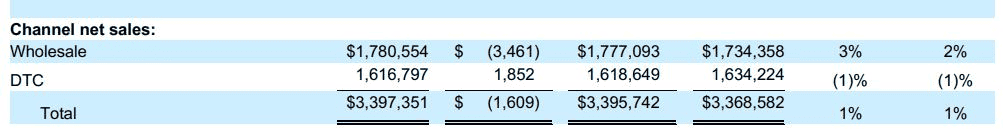

Columbia Sportswear Channel Net Sales

(Source: cloudfront.net)

- The above table displays net sales results for each channel during the twelve months ending December 31 2025, which helps understand the company’s distribution methods and revenue sources.

- Columbia Sportswear maintains a well-distributed retail network, according to the analyst who found that wholesale sales remained the main revenue source while direct-to-consumer sales reached a steady state.

- The company achieved wholesale sales of about USD 1.78 billion, which represented a 3% increase from the previous year and a 2% rise when measured in constant currency.

- The segment accounts for approximately 52% of total company revenue, which demonstrates Columbia Sportswear’s ability to establish strong retail partnerships and operate its global distribution system.

- The business experienced only a minor foreign currency impact of USD 3.5 million because it faced minimal risks concerning wholesale channel translation.

- The company reported DTC sales of USD 1.62 billion, which showed a 1% decrease in both reported and constant currency metrics. This softness may indicate cautious consumer spending or normalization following prior digital growth surges.

- DTC sales represent approximately 48% of overall revenue, which demonstrates how Columbia Sportswear operates its multiple sales channels.

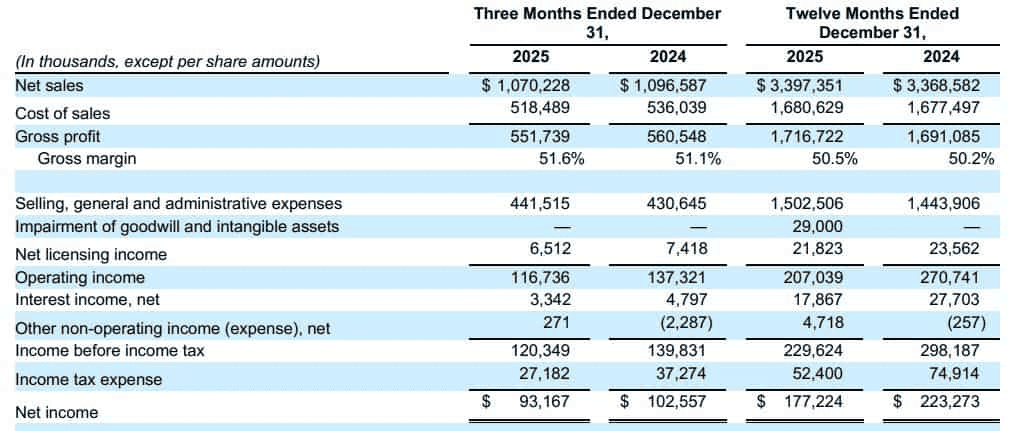

Columbia Sportswear Gross Profit And Net Income

(Source: cloudfront.net)

- The table provides a detailed view of quarterly and full-year financial performance, which shows revenue trends, operating efficiency, and bottom-line results.

- Columbia Sportswear demonstrates operational resilience through its modest top-line growth and its selective cost pressures.

- Net sales for the fourth quarter of 2025 reached USD 1.07 billion, which represented a 2% decline from the previous year’s sales of USD 1.10 billion.

- The cost of sales decreased by approximately 3% to USD 518.5 million, which resulted in gross margin expansion to 51.6% because of a 50 basis points increase from the previous year.

- The margin improvement shows that the company maintains strict control over its inventory while its pricing remains stable.

- The company achieved a gross profit of USD 551.7 million during the quarter because it managed its expenses effectively.

- The organization spent USD 441.5 million on selling, general, and administrative expenses during Q4, which represents an increase of approximately 3% because the company chose to continue building its brand and developing its operational systems.

- The company experienced a decrease in operating income, which fell from USD 137.3 million to USD 116.7 million.

- The company achieved net income of USD 93.2 million for the quarter, which fell short of the USD 102.6 million amount for 2024, while diluted earnings per share dropped from USD 1.80 to USD 1.73.

- Columbia Sportswear gained USD 3.40 billion in revenue during the full year, which represents a 1% increase compared to the previous year.

- The gross profit increased to USD 1.72 billion while gross margin reached 50.5%.

- The company faced a decrease in operating income, which fell to USD 207.0 million from USD 270.7 million because of an impairment charge of USD 29 million that the company recorded throughout the fiscal year.

- The company achieved an annual net income of USD 177.2 million, which decreased from the previous year when net income reached USD 223.3 million, representing a 21% decline.

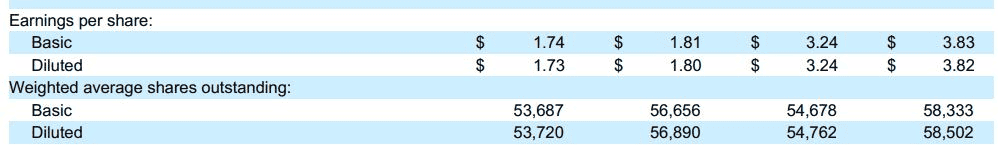

Columbia Sportswear Earnings Per Share

(Source: cloudfront.net)

The table presents quarterly and annual earnings per share (EPS) data, which shows weighted average shares outstanding to measure shareholder value. Columbia Sportswear experienced moderate earnings compression despite maintaining disciplined capital management.

- The basic EPS for the fourth quarter of 2025 dropped to USD 1.74 from USD 1.8,1 which represented a 4% decrease from the previous year.

- The diluted EPS demonstrated the same pattern as it decreased to USD 1.73 from its prior value of USD 1.80. The company experienced a slight revenue decline because its operating income decreased due to rising costs and ongoing strategic investments.

- The company achieved 5.6% share dilution reduction because the weighted average diluted shares outstanding decreased from 56.9 million to 53.7 million, which indicates that the company carried out share buybacks or used capital for better asset management.

- Columbia Sportswear achieved basic and diluted EPS of USD 3.24 for the full year, while 2024 results showed basic EPS of USD 3.83 and diluted EPS of USD 3.82, which represents a 15% decrease from the previous year.

- The average diluted shares outstanding decreased from 58.5 million to 54.8 million, which demonstrates that the company implemented a capital allocation strategy that benefits shareholders.

- Columbia Sportswear maintains effective balance sheet control with its share management practices, even though its earnings face challenges.

- The company uses its share buyback program to decrease outstanding shares, which results in an increase in per-share value.

Conclusion

Columbia Sportswear Statistics: Columbia Sportswear maintains its profitability despite facing significant earnings challenges during 2025. The company achieved 1% revenue growth but proved its strategic capabilities through international market expansion and gross margin growth to 50.5%, and the successful execution of stock buyback programs. The company’s international business operations compensated for weakened US performance, which established geographic diversity as a permanent asset for business expansion.

The company experienced a 21% decrease in net income, but its core operational capabilities remained stable through effective cost management and strong brand identity maintenance. The Columbia brand generates 87% of total income, which serves as the primary driver for corporate success. The year 2025 serves as a transition period during which the company adjusts its operations to establish patterns that will drive future development.

FAQ

Columbia Sportswear reported USD 3.40 billion in full-year 2025 revenue, which represented a 1% increase from the previous year.

U.S. revenue declined 4% year over year to USD 1.98 billion.

EMEA achieved a 13% increase in reported results, which converted to a 10% rise at constant exchange rates, while both Latin America and Asia Pacific recorded 9% growth.

Apparel, accessories, and equipment, which produced USD 2.71 billion in revenue, account for approximately 80% of the company’s overall income.

The flagship brand generated USD 2.97 billion in revenue, which increased by 2%, while it accounted for 87% of total portfolio revenue.

Net income reached USD 177.2 million, which represented a 21% decrease compared to the previous year.

The diluted EPS for the complete year reached USD 3.24, which showed a 15% decrease from the 2024 figure.