Chemours posted Q4 2025 adjusted EPS of $0.05 (beating the $0.00 consensus estimate) on revenue of $1.33 billion, flat versus estimates but down 2.2% year-over-year. Full-year net sales held at $5.8 billion while adjusted EBITDA declined to $742 million. The stock plunged ~16.5% following the report as the GAAP net loss of $0.31 per share and weak segment margins rattled investors.

About Chemours (NYSE: CC)

The Chemours Company (NYSE: CC) is a global chemistry company headquartered in Wilmington, Delaware, founded on July 1, 2015, as a spin-off from DuPont. The company holds leading market positions across three operating segments: Thermal & Specialized Solutions (TSS), Titanium Technologies (TT), and Advanced Performance Materials (APM). Chemours manufactures well-known brands including Teflon™, Opteon™ refrigerants, Ti-Pure™ titanium dioxide, and Viton™ fluoroelastomers.

The company employs approximately 6,000 people across 29 manufacturing sites, serving roughly 2,900 customers in 120 countries. As of February 20, 2026, Chemours trades at a market capitalization of approximately $2.55 billion, with a trailing EPS of –$2.13 and a dividend yield of roughly 3.0%. The current P/E ratio is negative given the full-year net loss, and the stock last closed at $17.04 well within its 52-week range of $9.13 to $21.85.

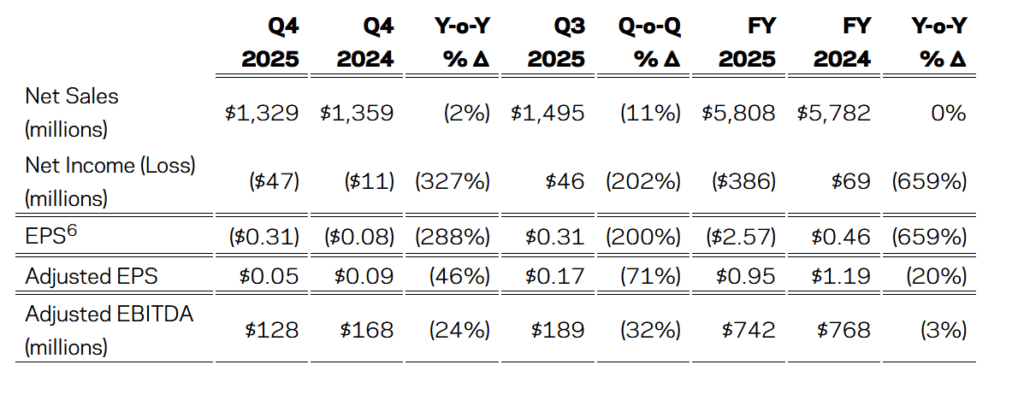

Top Financial Highlights

- Q4 2025 net sales totaled USD 1.33 billion, reflecting a 2.2% year over year decline.

- Full year 2025 net sales reached USD 5.8 billion, remaining broadly flat compared to the prior year.

- Q4 2025 GAAP net loss amounted to USD 47 million, or negative USD 0.31 per diluted share, compared to a net loss of USD 11 million or negative USD 0.08 per share in Q4 2024.

- Q4 2025 adjusted net income stood at USD 7 million, or USD 0.05 per diluted share, compared to USD 14 million or USD 0.09 per share in the prior year quarter.

- Q4 2025 adjusted EBITDA declined to USD 128 million, representing a 24% decrease from USD 168 million in Q4 2024.

- Full year 2025 adjusted EBITDA totaled USD 742 million, compared to USD 768 million in 2024.

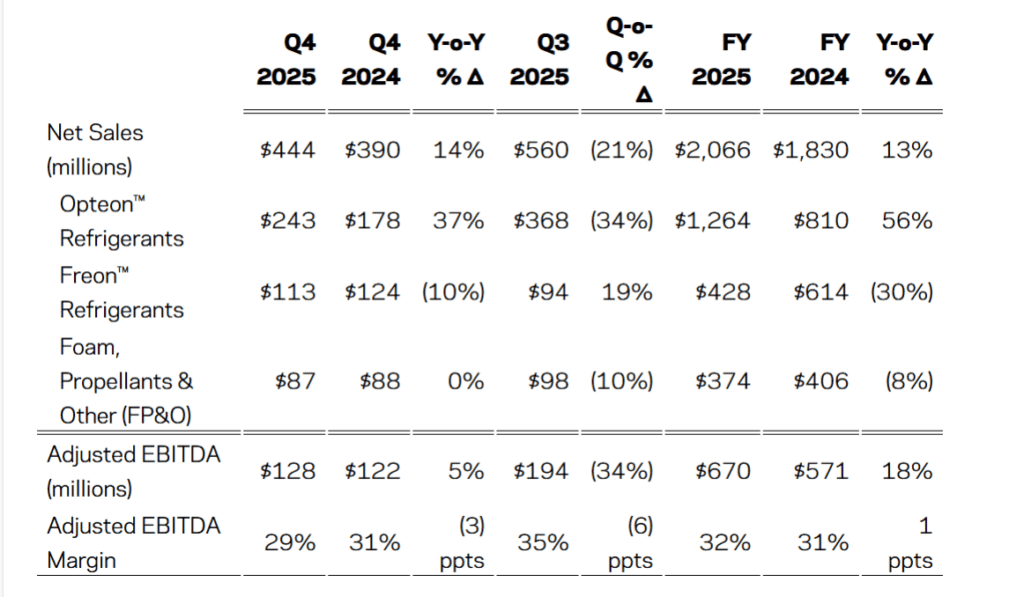

- Q4 net sales in the TSS segment reached USD 444 million, increasing 14% year over year, supported by a 37% surge in Opteon refrigerants.

- Q4 net sales in the TT segment amounted to USD 561 million, declining 11% year over year due to weaker titanium dioxide pricing.

- Full year net sales in the APM segment totaled USD 1.3 billion, reflecting a 5% year over year decline.

- Q4 operating cash flow generated USD 137 million, remaining broadly in line with USD 138 million in Q4 2024.

- Q4 capital expenditures declined to USD 45 million, compared to USD 109 million in the prior year quarter.

- Full year 2025 free cash flow remained positive at USD 51 million.

- Full year adjusted earnings per share were USD 0.95, compared to USD 1.19 in the previous year.

- For 2026, the company expects net sales growth of 3% to 5%, adjusted EBITDA in the range of USD 800 million to USD 900 million, capital expenditures between USD 275 million and USD 325 million, and free cash flow conversion above 25%.

Total Chemours

Thermal & Specialized Solutions

Beat or Miss?

| Metric | Reported | Consensus Estimate | Difference |

| Q4 EPS (Adjusted) | $0.05 | $0.00 | Beat by $0.05 (+2,400% surprise) |

| Q4 Revenue | $1.33B | $1.33B | In line (0% surprise) |

| TSS Adj. EBITDA | $128M | $135.12M | Missed by ~$7M |

| APM Adj. EBITDA | $12M | $34.36M | Missed by ~$22M |

| TT Adj. EBITDA | $23M | $17.47M | Beat by ~$5.5M |

| Full Year Adj. EPS | $0.95 | $0.96 | Slight miss of $0.01 |

Revenue matched Wall Street expectations while adjusted EPS technically exceeded the consensus estimate of $0.00, though the full-year adjusted EPS of $0.95 came in marginally below the $0.96 estimate. The significant GAAP net loss of $0.31/share driven by non-cash charges and weak cost absorption was the primary source of investor concern.

What Leadership Is Saying?

CEO Denise Dignam – on strategy and 2026 outlook:

“As we look ahead to 2026, it is important to build upon the substantial strategic progress achieved in 2025. Our Pathway to Thrive strategy remains central to how we make decisions, allocate capital, and conduct our business operations… We fulfilled our commitments for 2025, delivering at least $125 million of gross controllable cost savings.”

CFO Shane Hostetter – on segment performance and cash flow:

“We are pleased with the robust cash flow generated and the ability to drive sales performance within our expectations. Net sales met expectations largely due to TSS achieving record sales, driven by continued strong Opteon adoption and consistent commercial performance across all divisions… We’re really proud of both the execution on the Opteon side and Freon side in 2025, and we’ll continue to execute and grow in both next year.”

Historical Performance

Chemours YoY

| Category | Q4 2025 | Q4 2024 | Change (%) |

| Net Sales | $1.33B | $1.36B | -2.2% |

| Net Income (Loss) | -$47M | -$11M | -327% |

| Adjusted EBITDA | $128M | $168M | -24% |

| Adjusted EPS | $0.05 | $0.09 | -44% |

| Operating Cash Flow | $137M | $138M | -0.7% |

| Capital Expenditures | $45M | $109M | -59% |

The full-year comparison paints a similar picture: net sales held flat at $5.8 billion, but adjusted EBITDA declined from $768 million to $742 million, and the company swung from a $69 million full-year profit to a $386 million net loss, largely due to impairment charges, lower TT pricing, and reduced production absorption.

Competitor Comparison

| Category | Chemours (CC) Q4 2025 | Tronox (TROX) Q4 2025 | Notes |

| Revenue | $1.33B | $730M | Tronox up 8% YoY; Chemours down 2.2% |

| Net Income (Loss) | -$47M | -$176M | Both posted net losses; Tronox’s was deeper |

| GAAP Diluted EPS | ($0.31) | ($1.11) | Chemours fared better on a per-share basis |

| Adjusted EBITDA | $128M | $57M | Tronox saw a 56% decline in Adj. EBITDA |

| Adj. EBITDA Margin | ~9.6% | 7.80% | Chemours maintained higher margins |

Both TiO₂ producers faced significant pricing headwinds in Q4 2025, but Chemours’ diversified portfolio particularly the strong Opteon™ refrigerant business in TSS provided a meaningful cushion compared to Tronox’s more concentrated TiO₂ exposure. Kronos Worldwide (NYSE: KRO), another major TiO₂ competitor, has not yet reported Q4 2025 results; its earnings release is expected on March 9, 2026.

How the Market Reacted?

Shares of Chemours fell sharply following the earnings release, dropping approximately 16.5% to close at $17.04 on February 20, 2026, their steepest single-day decline in recent memory. The sell-off was triggered by the deeper-than-expected GAAP net loss, continued margin compression in the TT and APM segments, and a full-year adjusted EPS that marginally missed analyst expectations.

Trading volume spiked to over 10.8 million shares, nearly four times the average daily volume of ~2.8 million, reflecting intense investor concern about near-term profitability. Despite the negative reaction, some analysts noted that Chemours’ 2026 guidance of $800M-$900M in adjusted EBITDA implies a meaningful recovery, with consensus still pointing to a fair value near $16 per share.