BD opened fiscal 2026 with Q1 revenue of $5.25 billion, up 1.6% year over year, and GAAP and adjusted diluted EPS of $1.34 and $2.91, respectively. New BD revenue grew 2.5% FXN, and management reaffirmed full‑year fiscal 2026 revenue guidance while introducing adjusted EPS guidance for New BD, with sentiment skewing constructive despite lower adjusted EPS.

About Becton, Dickinson and Company

Becton, Dickinson and Company (BD) (NYSE: BDX) is a leading global medical technology company headquartered in Franklin Lakes, New Jersey. Founded in 1897, BD develops devices, instruments, reagents, and digital solutions that support medical discovery, diagnostics, and the delivery of care across hospitals, labs, and research settings. The company operates globally with a presence in virtually every country and employs more than 70,000 people.

BD’s portfolio spans medication delivery, medication management, biopharma systems, interventional products, diagnostics, and biosciences, with an increasing focus on biologics, GLP‑1 drug delivery, and connected care platforms. While the press release does not specify current market capitalization or P/E ratio, BD’s scale and balance sheet—with total assets of $54.84 billion and shareholders’ equity of $25.28 billion at December 31, 2025—underscore its position as one of the largest global medtech companies.

Top Financial Highlights

- Total revenue of $5.25 billion, up 1.6% as reported and 0.4% on a foreign‑currency‑neutral (FXN) basis versus Q1 fiscal 2025.

- New BD revenue (excluding the Biosciences and Diagnostic Solutions businesses) of $4.49 billion, up 3.5% as reported and 2.5% FXN.

- GAAP diluted EPS of $1.34, up 28.8% year over year, reflecting higher operating income and modestly lower interest expense.

- Adjusted diluted EPS of $2.91, down 15.2% as reported and 15.7% FXN, driven by lower adjusted contributions and specified items.

- Net income of $382 million, an increase of 26.1% versus $303 million a year ago.

- Operating income of $552 million, up 21.8% year over year, as total operating costs and expenses declined 0.3% despite higher selling and administrative expense and integration costs.

- Operating cash flow of $657 million in the quarter, compared with $693 million in the prior‑year period.

- Cash and equivalents plus restricted cash of $1.03 billion at December 31, 2025 (cash and equivalents $740 million, restricted cash $284 million), up from $851 million at the prior‑year opening balance cited in the cash flow table.

- Medical Essentials (Medication Delivery Solutions and Specimen Management) revenue of $1.60 billion, up 0.6%.

- Connected Care (Medication Management Solutions, Advanced Patient Monitoring, BioPharma Systems) revenue of $1.13 billion for MMS and $429 million for BioPharma Systems, with Connected Care internal components showing mid‑single‑ to high‑single‑digit growth.

- Interventional (Peripheral Intervention, Urology & Critical Care, Surgery) revenue of $1.33 billion, up 5.8% as reported and 5.1% FXN.

- Life Sciences (Diagnostic Solutions and Biosciences) revenue of $766 million, down 8.3% as reported and 10.5% FXN ahead of the planned separation.

- Total current assets of $9.19 billion and total debt (current plus long‑term) of $19.54 billion, supporting ongoing investment, integration, and the transaction with Waters Corporation.

- Full‑year fiscal 2026 revenue growth outlook for New BD reaffirmed at “low single‑digit plus” reported growth with “low single‑digit” FXN revenue growth, and adjusted diluted EPS guidance for New BD of $12.35 to $12.65.

Beat or Miss?

| Metric | Reported | Difference/Analysis |

| Revenue | $5.25 billion | Up 1.6% year over year; modest growth, in line with a “stronger‑than‑expected” internal view. |

| GAAP Diluted EPS | $1.34 | Up 28.8% YoY; reflects improved operating income and stable interest expense. |

| Adjusted Diluted EPS | $2.91 | Down 15.2% YoY; pressured by specified items and lower adjusted contributions. |

| Net Income | $382 million | Up 26.1% YoY; strong bottom‑line growth on modest revenue increase. |

| Operating Income | $552 million | Up 21.8% YoY as total operating costs and expenses declined 0.3%. |

| Analyst Revenue Consensus | N/A | No external consensus figures cited in the press release. |

| Analyst EPS Consensus | N/A | Not disclosed; management characterization suggests a better‑than‑internal‑plan quarter. |

What Leadership Is Saying

“We delivered stronger‑than‑expected first‑quarter performance which reflects our disciplined execution, including accelerated commercial initiatives and broad‑based growth across key end markets.” “With this significant milestone in our strategy to drive shareholder value, we fully pivot to New BD and the next chapter of the company’s growth—intensifying our focus on elevating commercial capabilities, advancing industry‑leading innovation, and applying BD Excellence to drive productivity and gross margin expansion.” — Tom Polen, chairman, CEO and president

Historical Performance

Year‑over‑year comparison: Q1 FY 2026 vs. Q1 FY 2025

| Category | Q1 FY 2026 (Current) | Q1 FY 2025 (Previous Year) | Change (%) |

| Revenue | $5.25 billion | $5.17 billion | +1.6% (reported), **+0.4% FXN). |

| Net Income | $382 million | $303 million | +26.1%. |

| Total Operating Costs and Expenses | $4.70 billion | $4.72 billion | −0.3% (slight decline, aiding operating leverage). |

BD also reported that GAAP diluted EPS increased from $1.04 to $1.34 (up 28.8%), while adjusted diluted EPS declined from $3.43 to $2.91 (down 15.2% on a reported basis).

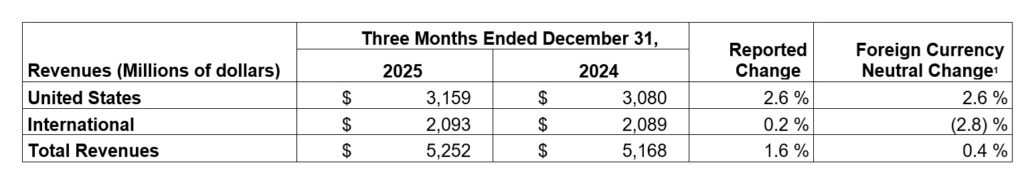

Geographic Results

- United States: For BD’s first quarter fiscal 2026 (three months ended December 31, 2025), revenues in the United States were $3,159 million, compared with $3,080 million in the prior year quarter, reflecting a 2.6% reported increase and a 2.6% foreign currency neutral increase.

- International: For BD’s first quarter fiscal 2026 (three months ended December 31, 2025), international revenues were $2,093 million, compared with $2,089 million in the prior year quarter, reflecting a 0.2% reported increase and a (2.8)% foreign currency neutral change.

- Total Revenues: For BD’s first quarter fiscal 2026 (three months ended December 31, 2025), total revenues were $5,252 million, compared with $5,168 million in the prior year quarter, reflecting a 1.6% reported increase and a 0.4% foreign currency neutral increase.

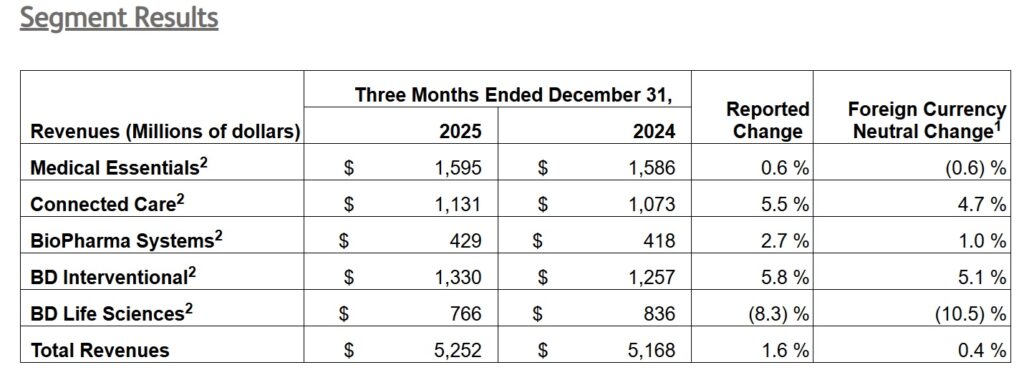

Segment Results

- Medical Essentials: For BD’s first quarter fiscal 2026 (three months ended December 31, 2025), Medical Essentials revenue was $1,595 million, compared with $1,586 million in the prior year quarter, reflecting a 0.6% reported increase and a (0.6)% foreign currency neutral change.

- Connected Care: For BD’s first quarter fiscal 2026 (three months ended December 31, 2025), Connected Care revenue was $1,131 million, compared with $1,073 million in the prior year quarter, reflecting a 5.5% reported increase and a 4.7% foreign currency neutral increase.

- BioPharma Systems: For BD’s first quarter fiscal 2026 (three months ended December 31, 2025), BioPharma Systems revenue was $429 million, compared with $418 million in the prior year quarter, reflecting a 2.7% reported increase and a 1.0% foreign currency neutral increase.

- BD Interventional: For BD’s first quarter fiscal 2026 (three months ended December 31, 2025), BD Interventional revenue was $1,330 million, compared with $1,257 million in the prior year quarter, reflecting a 5.8% reported increase and a 5.1% foreign currency neutral increase.

- BD Life Sciences: For BD’s first quarter fiscal 2026 (three months ended December 31, 2025), BD Life Sciences revenue was $766 million, compared with $836 million in the prior year quarter, reflecting a (8.3)% reported change and a (10.5)% foreign currency neutral change.

- Total Revenues: For BD’s first quarter fiscal 2026 (three months ended December 31, 2025), total revenue was $5,252 million, compared with $5,168 million in the prior year quarter, reflecting a 1.6% reported increase and a 0.4% foreign currency neutral increase.

Notes: The foreign currency neutral change is presented as a non GAAP measure, and effective October 1, 2025, BD reorganized into five separately managed segments with prior period amounts recast to reflect the reorganization.

How the Market Reacted?

The press release does not provide specific information on BD’s share price movement during regular trading or after hours on the earnings date. In lieu of explicit stock data, the tone of the release is constructive: management characterizes Q1 as “stronger‑than‑expected,” reaffirms full‑year revenue growth expectations for New BD, and introduces a solid adjusted EPS range for fiscal 2026. The completion of the combination of the Biosciences and Diagnostic Solutions business with Waters Corporation is framed as a key strategic milestone supporting long‑term revenue and earnings growth. Overall sentiment around the quarter appears bullish, despite the year‑over‑year decline in adjusted EPS, given improved GAAP profitability, stable cash generation, and clear guidance.